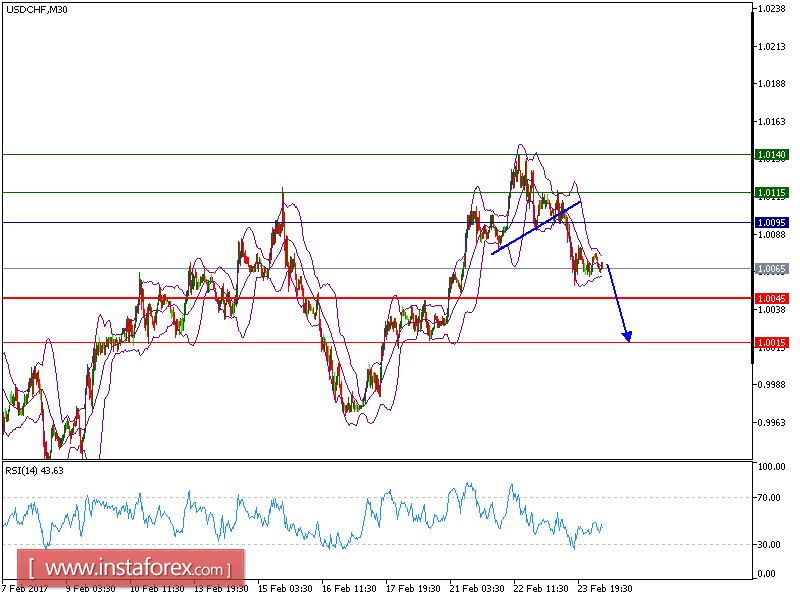

Downside movements are expected to prevail the USD/CHF dynamic. The pair broke below a rising trend line and consolidated on the downside. The declining 20-period and 50-period moving averages are playing resistance roles and maintain the downside bias. The relative strength index is below its neutrality level at 50 and lacks upward momentum.

The US dollar weakened against most major currencies for a second day after the latest Fed minutes appeared to be less hawkish than expected. The currency was also weighed down by comments from US Treasury Secretary Steven Mnuchin, who pointed out that policies by the Trump administration would have limited impact this year.

The US Labor Department reported 244,000 initial jobless claims for the week ended February 18 (vs. 240,000 expected, 238,000 a week earlier). The Chicago Federal National Activity Index dropped to -0.05 in January (vs. +0.00 expected) from +0.18 in December. Separately, the FHFA House Price Index improved 0.4% on month in December (vs. +0.5% expected, +0.7% in November).

As long as 1.0090 holds on the upside, look for a further drop towards 1.0045 and even 1.0015 in extension.

Resistance levels: 1.0115, 1.0140, and 1.0160

Support levels: 1.0045, 1.0015, and 0.9975

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română