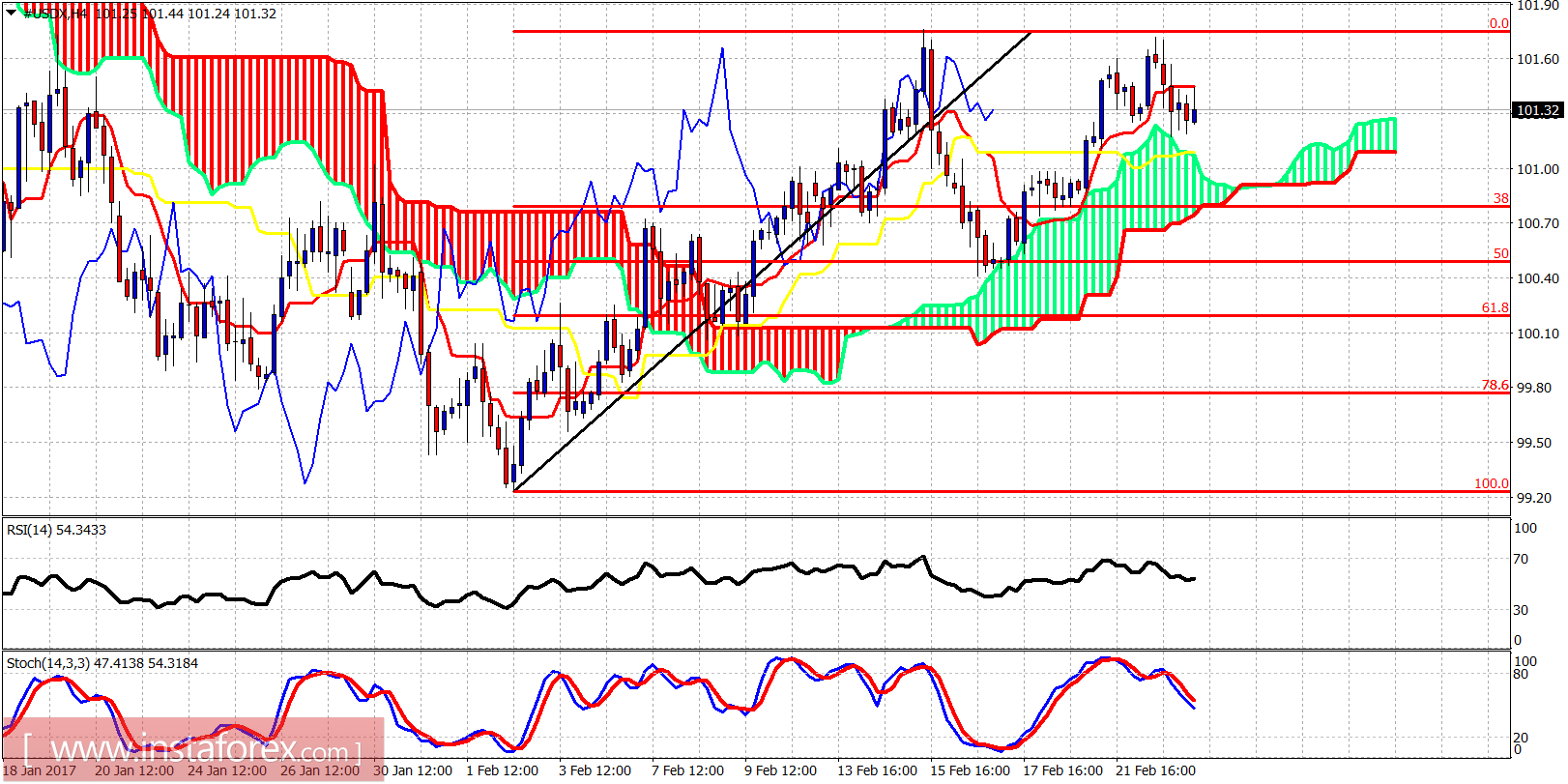

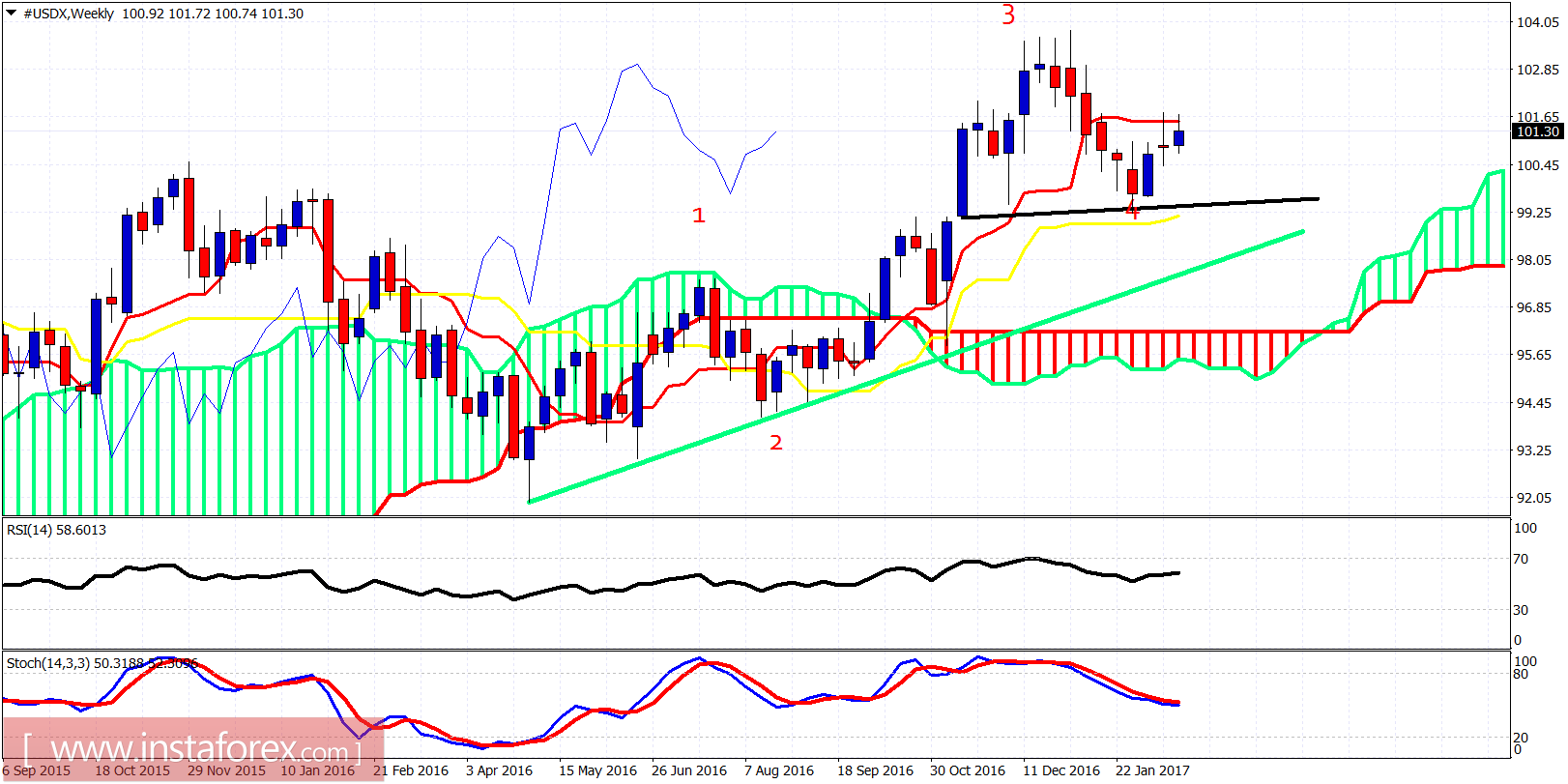

The Dollar index reached important resistance yesterday at 101.70 but got rejected and pulled back towards 101.40 short-term support. The bearish scenario of the Head-and-Shoulders pattern is still applicable but only a break below 99.25 will confirm it.

Green line - long-term trend line support

The Dollar index is trading between the kijun- and tenkan-sen indicators (yellow and red line indicators). On a weekly basis, trend remains bullish but a possible double top at 101.80 and rejection by the tenkan-sen will be bad news for bulls. Don't forget that we could be forming the right hand shoulder in the bearish Head-and-Shoulders pattern.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română