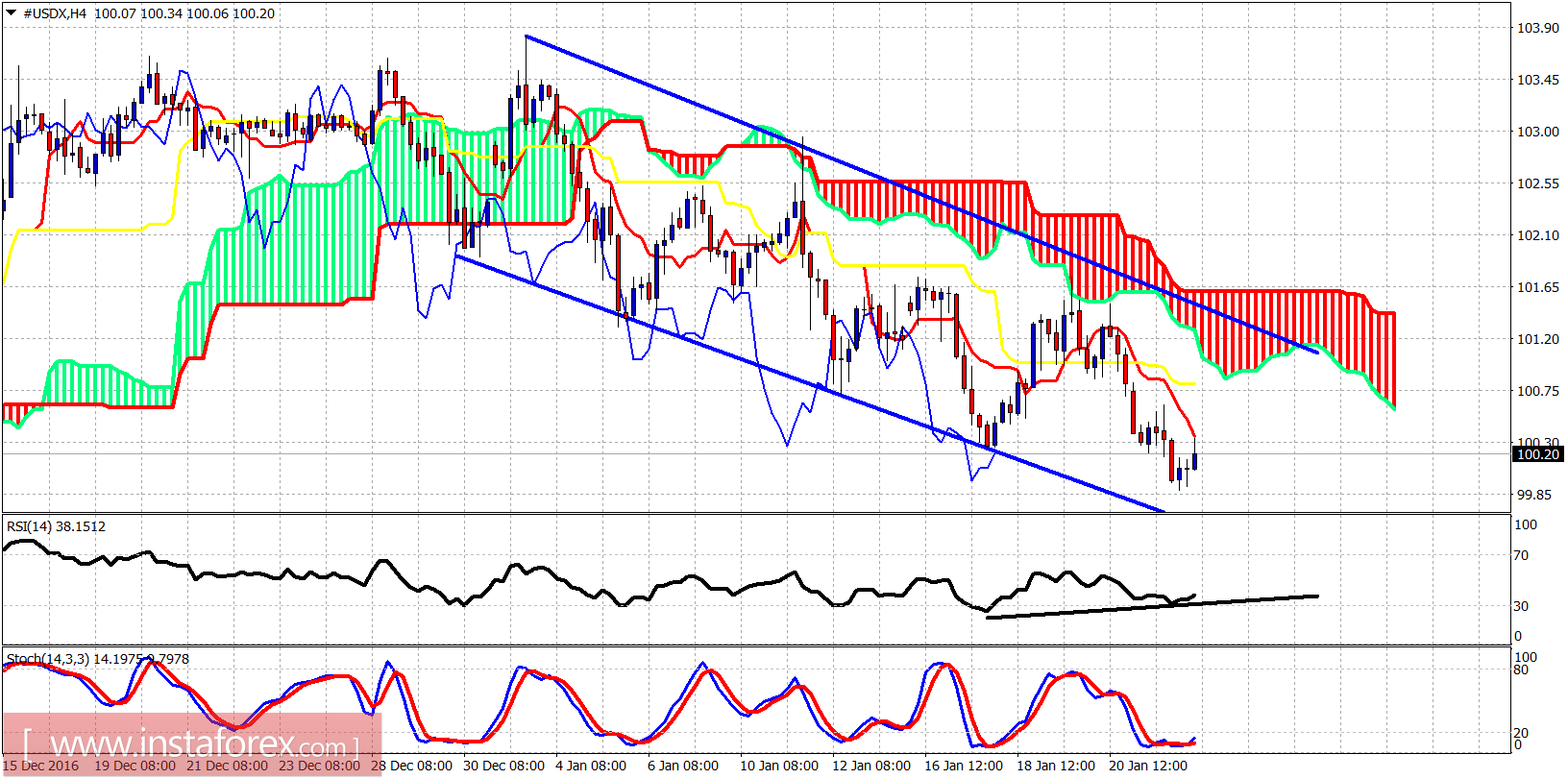

The Dollar index has started providing bullish divergence signs in the 4-hour RSI. This is the first non-confirmed low in the Dollar index. Yesterday I supported the view that the new low was expected to be weak and soon we should see a strong upward bounce.

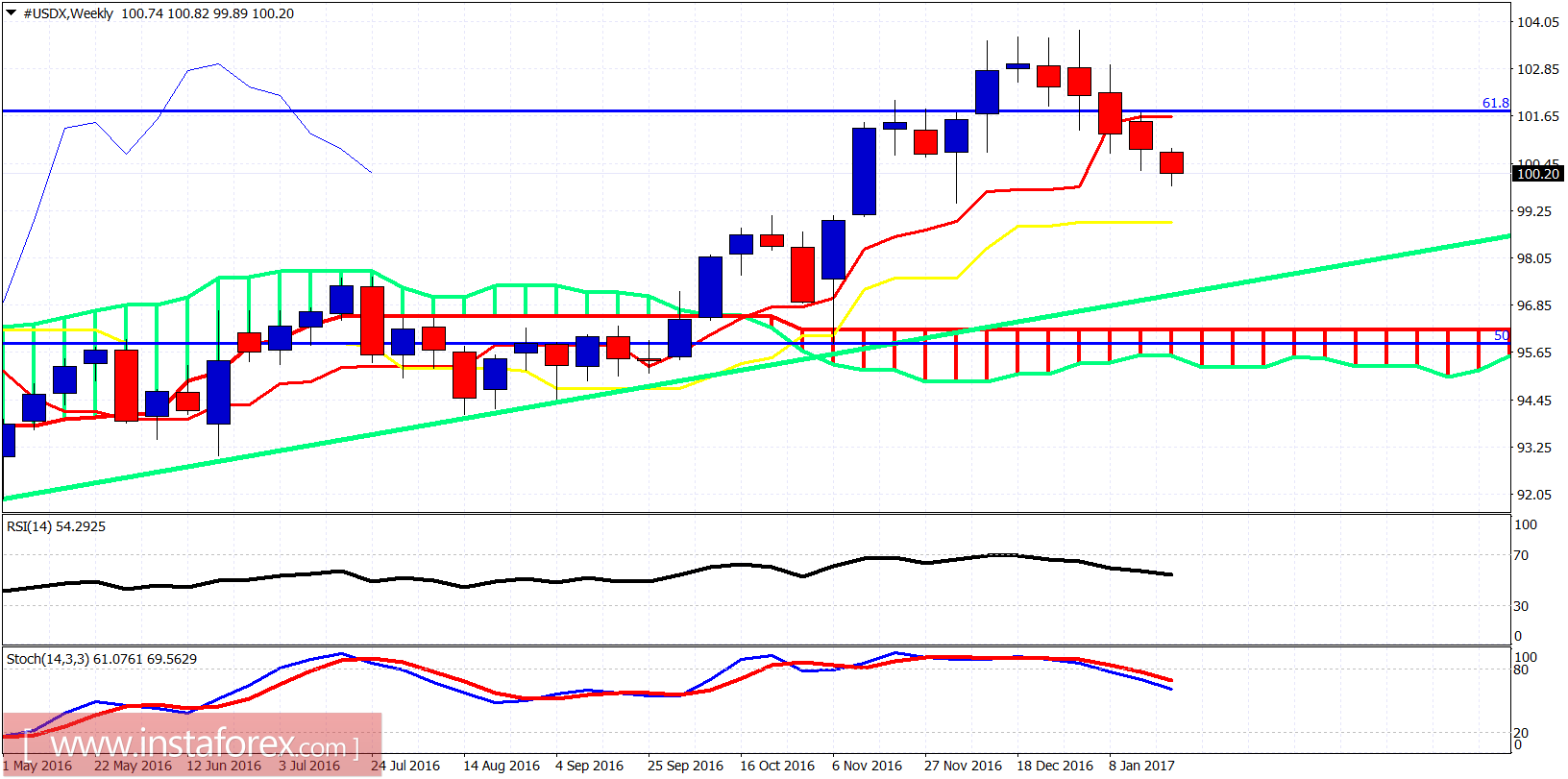

The early bounce towards 100.60 was weak and price reversed and provided a new lower low at 99.87 which was closer to our target. The new low was not confirmed by the RSI. The Dollar index remains inside the bearish channel and below the Ichimoku cloud. Trend remains bearish. Resistance is at 101. We could see a test of that area today.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română