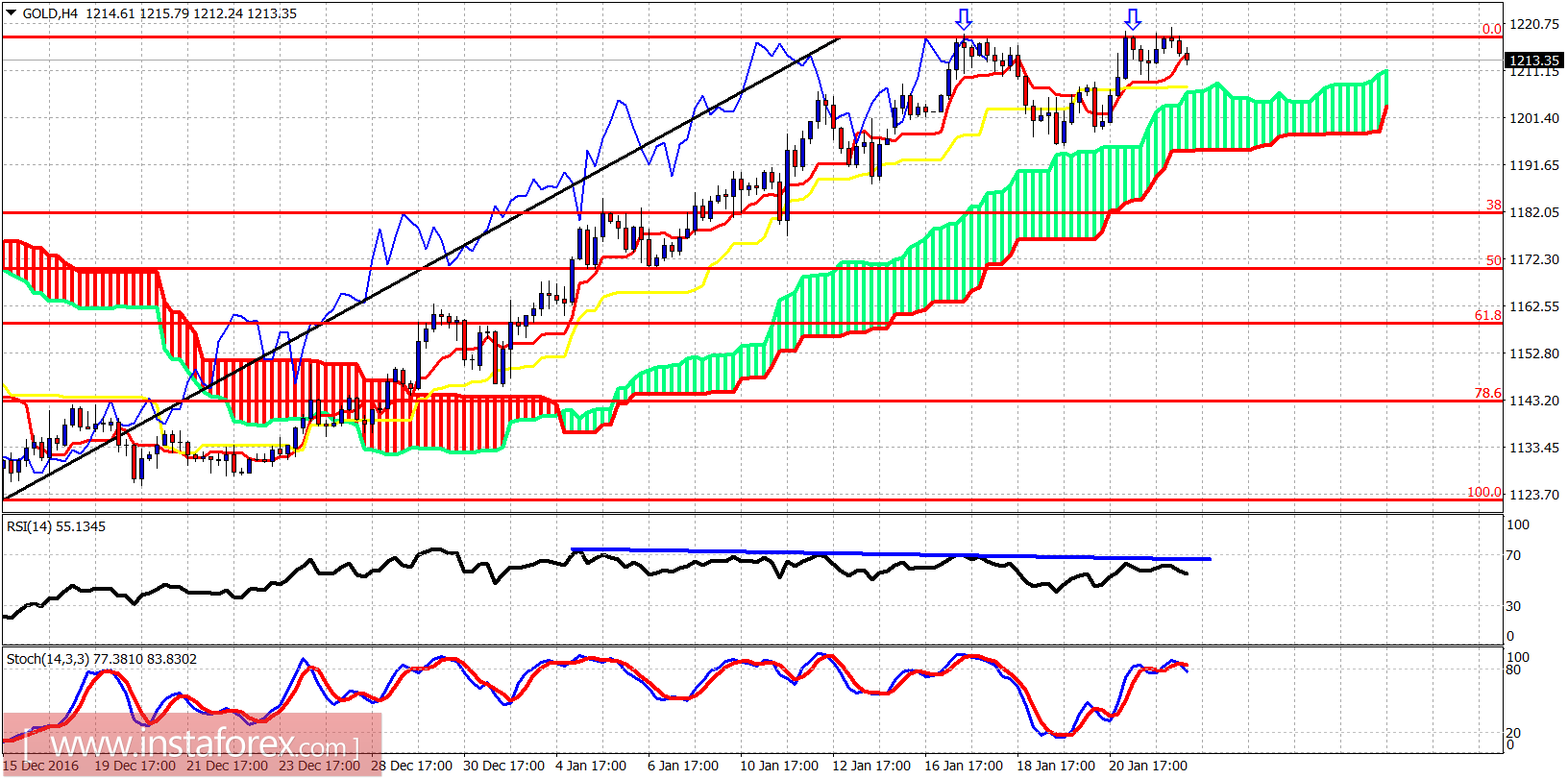

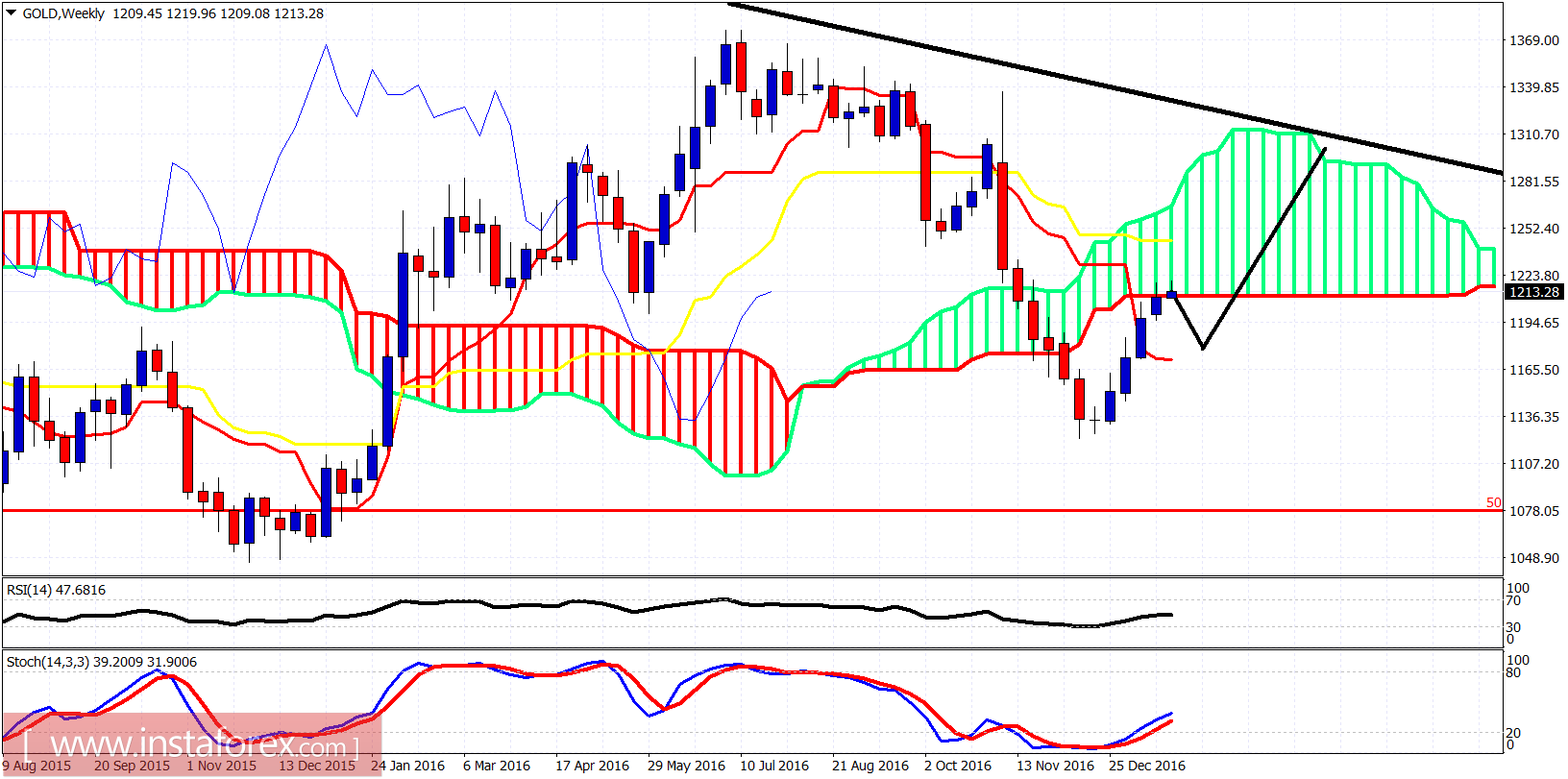

Gold price has made a double top at $1,220. Despite the continued Dollar weakness Gold has not managed to break to new highs. There are several bearish short-term indications and I continue to expect a pullback towards $1,160-$1,180.

Arrows - double top

Short-term resistance is at $1,220. If broken, we should push towards $1,235. Support is at $1,210 and at $1,197. If broken, we go towards $1,180 first and then towards $1,160. Short-term trend remains bullish as long as price is above the Ichimoku cloud. But the RSI is diverging for some time now and the stochastic turning lower from overbought levels provide a warning for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română