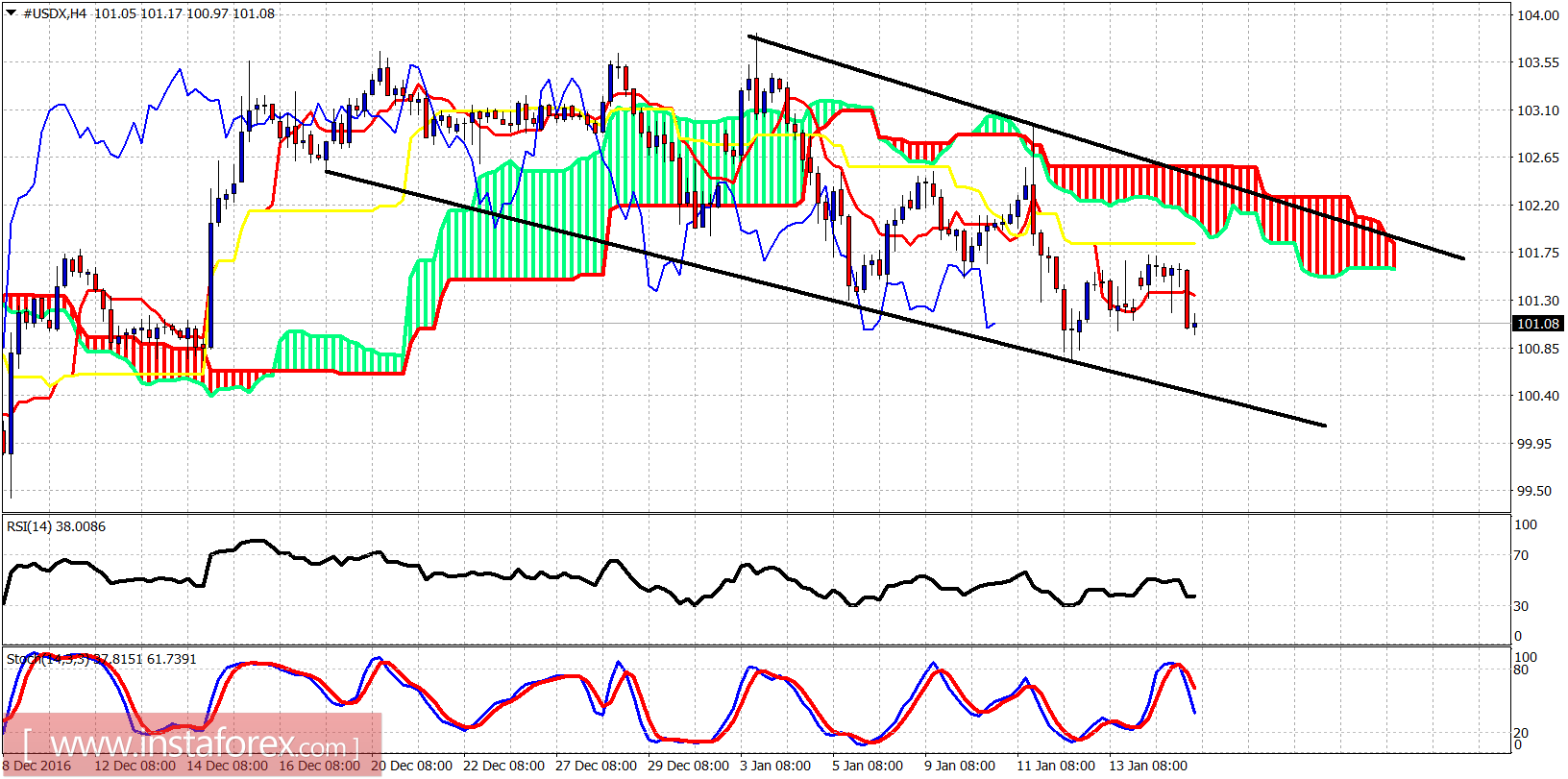

The dollar index is still inside the bearish channel on a short-term basis. Price is heading towards 100 where the medium-term support is found. If the index breaks above 102.65, the trend can change to bullish targeting 105-106.

Price is making lower lows and lower highs. The fact that it is trading below the Ichimoku cloud confirms the bearish trend. Short-term support is at 100.50 while resistance lies at 102. Bulls need to break above 102.65 in order to confirm a bullish trend reversal. However there are still no signs of a bullish divergence on the 4 hour chart, so the dollar index may continue to be pressured.

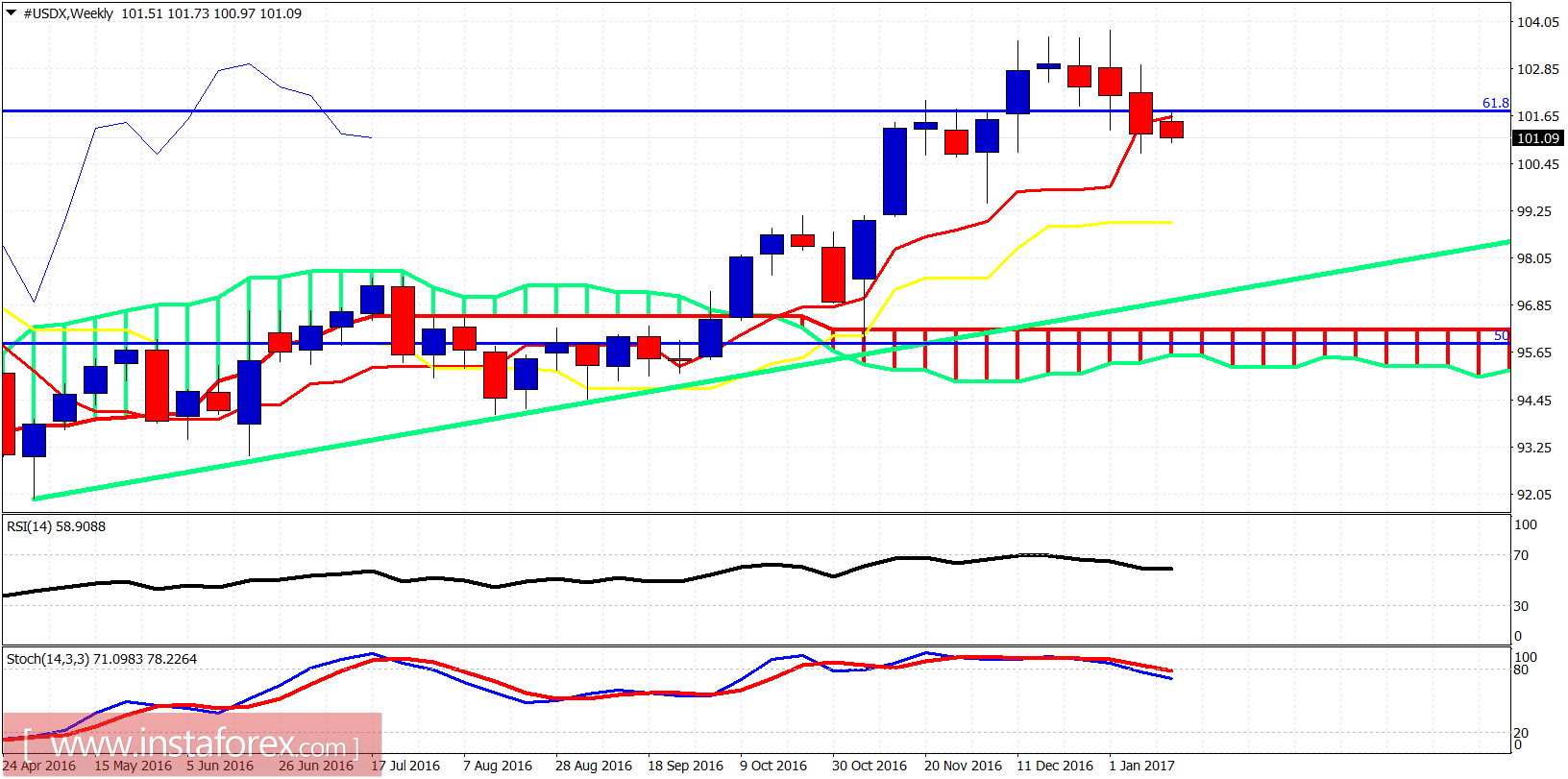

On a weekly basis, we can see the index closed last week below the Tenkan-Sen (red line indicator). A lower low this week will open the way for a move lower towards the Kijun-sen (yellow line indicator) at 99 where critical long-term support is found. The oscillators are turning lower from overbought levels and this is a bearish long-term sign. The long-term green trend line remains the most important support of the longer-term trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română