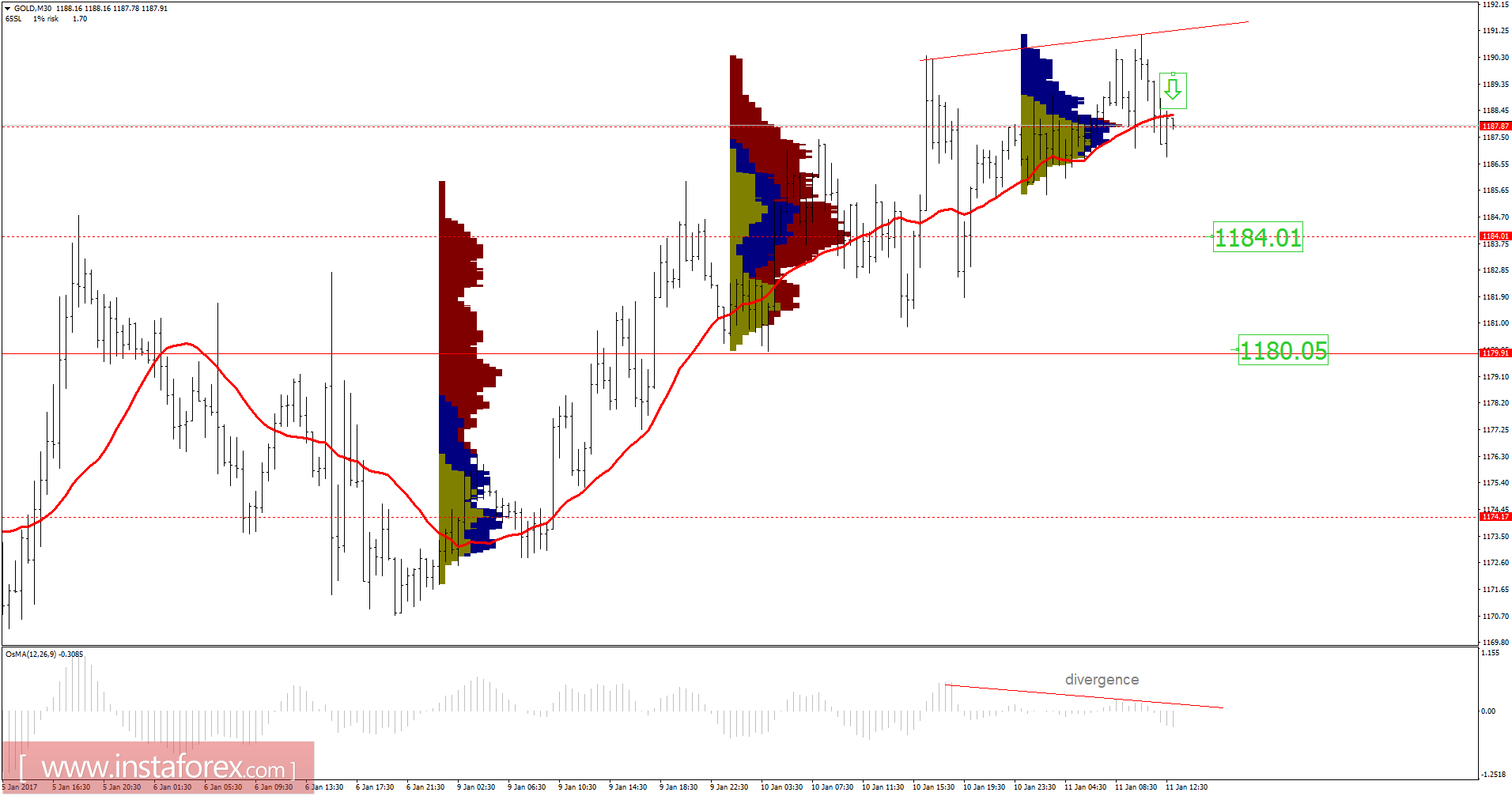

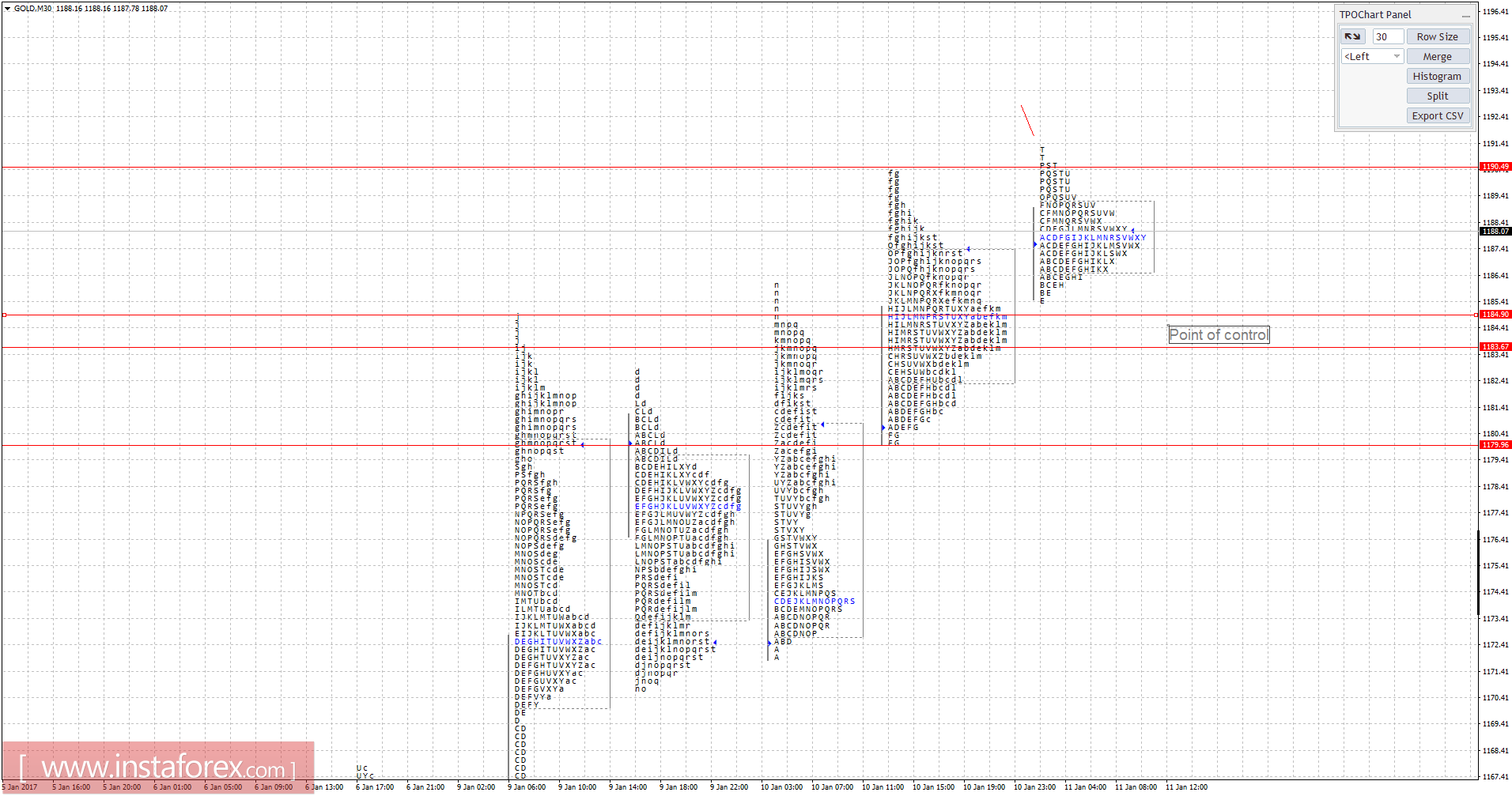

Recently, gold has been trading upwards. The price tested the level of $1,191.10 in an average volume. According to the 30M time frame, I found a fake breakout of yesterday's high, which is a sign of weakness. There is also a divergence in the Moving Average Oscilator. The price made a higher high and the oscilator made a lower high. My advice is to watch for potential selling opportunities. The downward target is set at the price of $1,184.50. Using the TPO Chart, I found yesterday's point of control at the price of $1,184.00. Anyway, if the price breaks the level of $1,191.10 in a high volume, we may see potential testing of $1,195.00

Resistance levels:

R1: 1,187.65

R2: 1,189.00

R3: 1,191.75

Support levels:

S1: 1,182.60

S2: 1,181.00

S3: 1,178.50

Trading recommendations for today: Watch for potential selling opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română