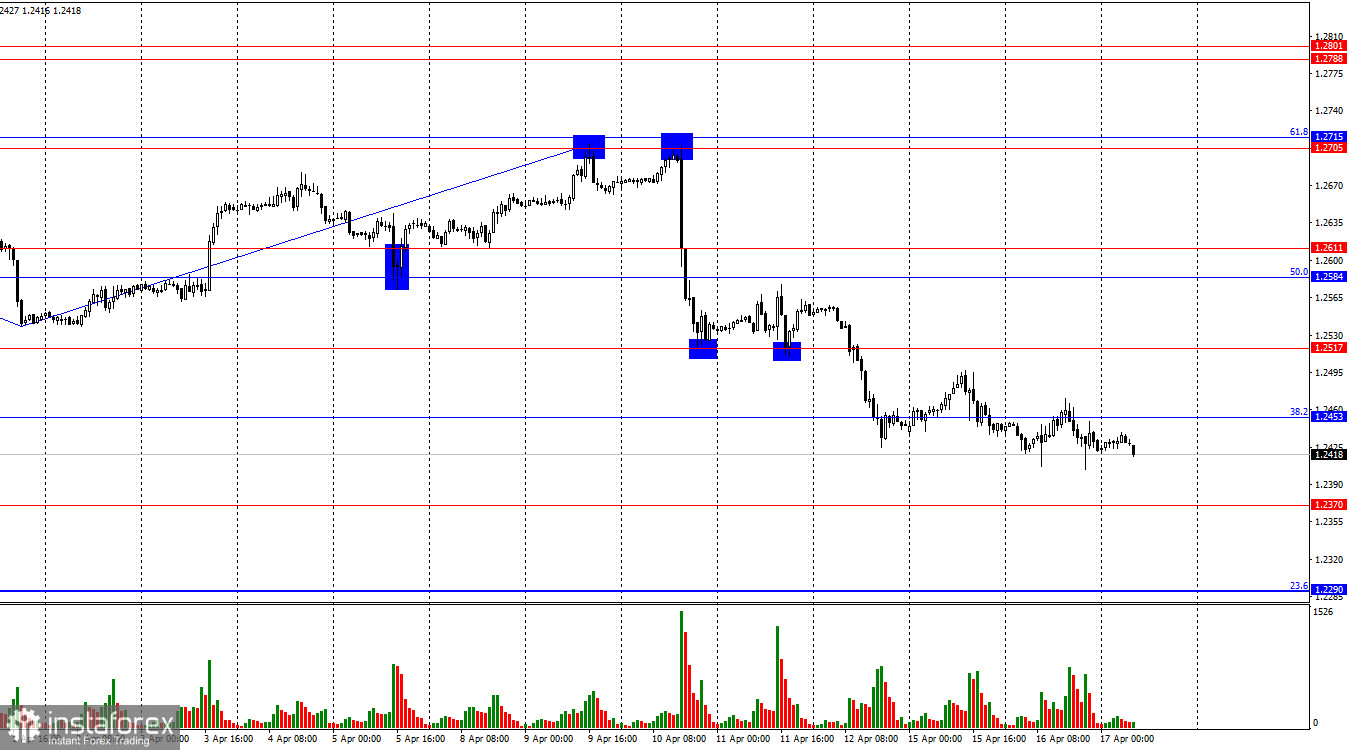

On the hourly chart, the GBP/USD pair executed a new reversal in favor of the American currency on Tuesday and consolidated below the corrective level of 38.2% (1.2453). Thus, the process of the quotes' decline may continue toward the next level at 1.2370. If the pair's rate consolidates above the level of 1.2453, it will work in favor of the pound and show some growth towards the level of 1.2517.

The situation with waves still does not raise any questions. The last completed upward wave failed to break the last peak (from March 21), and the new downward wave broke the previous wave's low (April 1). Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion. The first sign of bulls transitioning to the offensive could be the breakout of the peak on April 9, but bulls need to cover a distance of about 290 points to the zone of 1.2705–1.2715, which is unlikely to happen in the coming days.

On Tuesday, important reports on unemployment and wages were released in the UK, but the values did not become a reason for increased trading activity throughout the day. Today, the inflation report in Britain was published. On one hand, the consumer price index slowed down to 3.2% y/y. On the other hand, traders expected a slowdown to 3.1%. The bulls may try to launch another counterattack during the day, but it is unlikely to be successful and strong.

The Bank of England is approaching when it will be appropriate to start discussing easing monetary policy. However, 3.2% inflation is still too much to expect a rate cut shortly. The information background has not changed; therefore, bearish traders may continue their attacks.

On the 4-hour chart, the pair reversed in favor of the American after forming a "bearish" divergence on the CCI indicator and a decline to 1.2450. The "bullish" divergence on the CCI indicator was canceled, but a second one was immediately formed. The consolidation of the pair's rate below the level of 1.2450 allows counting on a continuation of the decline towards the next corrective level at 50.0% (1.2289). The descending trend channel characterizes the current sentiment of traders as "bearish." Bulls can only count on a slight rise in the pound.

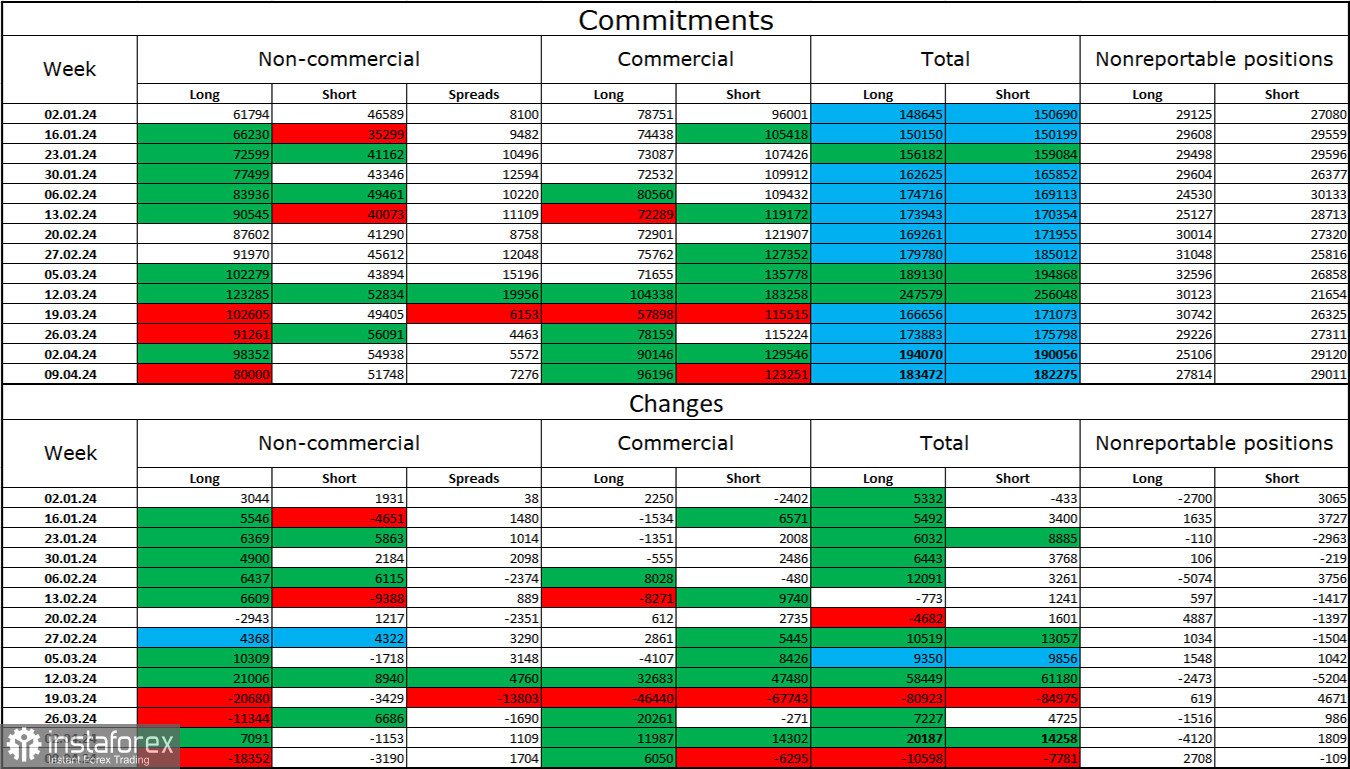

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became less "bullish" over the last reporting week. The number of long contracts held by speculators decreased by 18352 units, and the number of short contracts decreased by 3190. The overall sentiment of major players remains "bullish" but has been weakening in recent weeks. The gap between long and short contracts is now less than double: 80 thousand versus 52 thousand.

There are still prospects for a decline in the pound, but over the last three months, the number of long positions has increased from 61 thousand to 80 thousand, while the number of short positions has hardly changed. Overs will start to unload their buy positions over time, as all possible factors for buying the British pound have already been exhausted. The bears have demonstrated their weakness and complete reluctance to go on the offensive over the past few months, but the US inflation report could give them confidence and strength.

News Calendar for the US and UK:

UK - Consumer Price Index (06:00 UTC).

UK - Speech by Bank of England President Andrew Bailey (16:00 UTC).

Wednesday's economic events calendar contains only two entries. Both are important. The impact of the information background on market sentiment today may be moderate in strength.

Forecast for GBP/USD and trader advice:

Sales of the pound could be initiated upon consolidation below the level of 1.2453 on the hourly chart with a target of 1.2370. Buys today are possible upon closing above 1.2453 on the hourly chart, with targets at 1.2517 and 1.2584.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română