Speech is silver, silence is golden. While the silence of the Federal Reserve scares financial markets, European Central Bank officials continue to talk about monetary policy. ECB Governing Council member Olli Rehn stated that the central bank has already begun discussions on reducing deposit rates. His colleague, Yannis Stournaras, believes that the eurozone economy has experienced a soft landing. Yes, it is growing slowly, but there is no talk of recession. ECB Vice President Luis de Guindos notes that a strong labor market with wage growth of 5% and above amid low productivity could reignite inflation.

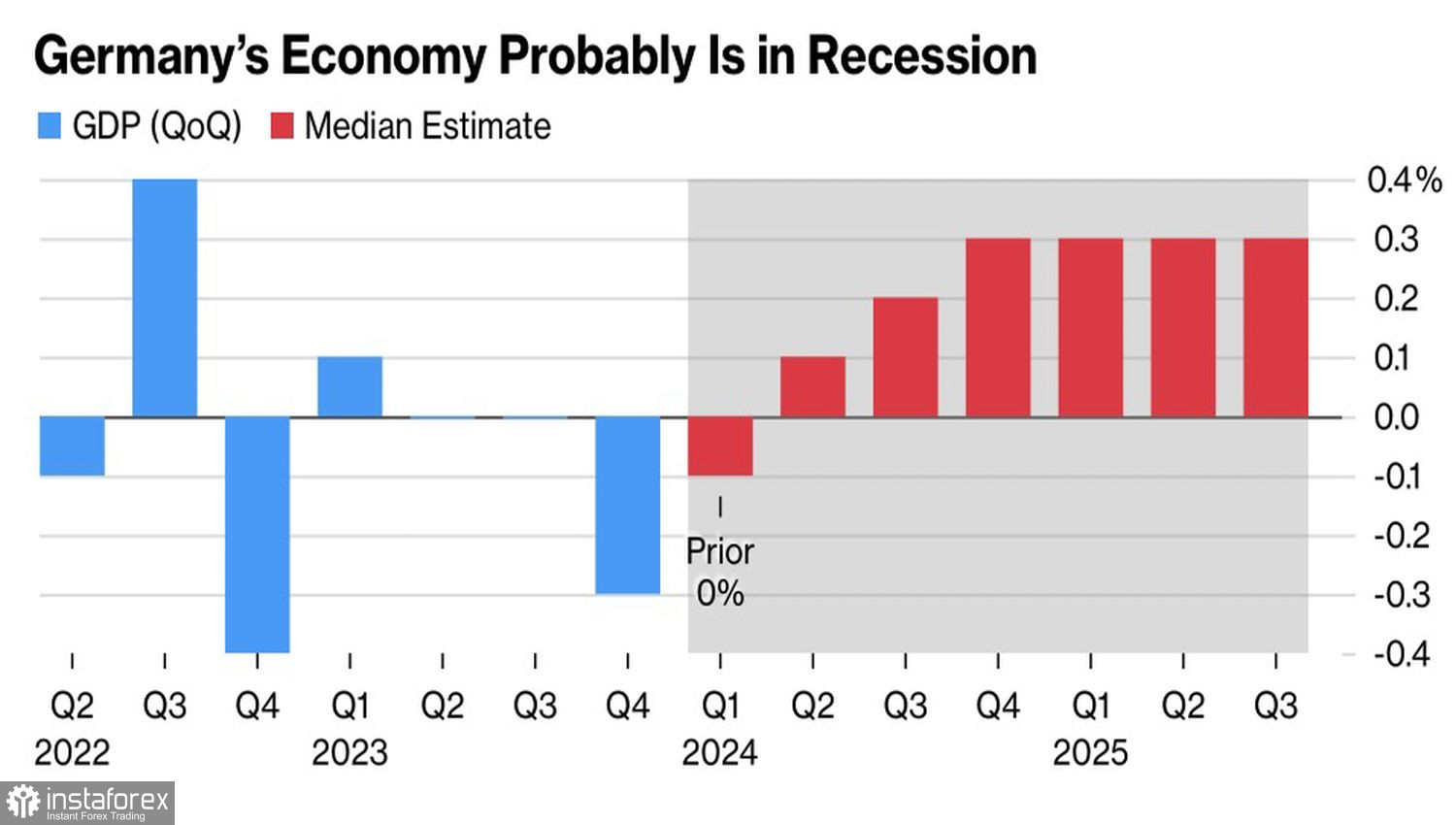

According to Bank of America, the gradual improvement in the eurozone economy against the backdrop of slowing U.S. GDP will allow investors to play the convergence theme. Narrowing the economic growth differential will contribute to a rally in EUR/USD towards 1.15 and 1.20 by the end of 2024 and 2025. Perhaps such a scenario could have been realized, but not now. The consensus forecast of Bloomberg experts suggests that the German economy will be in recession in the first quarter. Its GDP will shrink by 0.1%.

Dynamics of the German Economy

The weaker the economy, the less likely high inflation will return. If in the recent past its main cause was supply shock due to disruptions in supply chains, now everything is different. High wages in a tight labor market are driving up service prices. And here, the eurozone loses to the U.S.

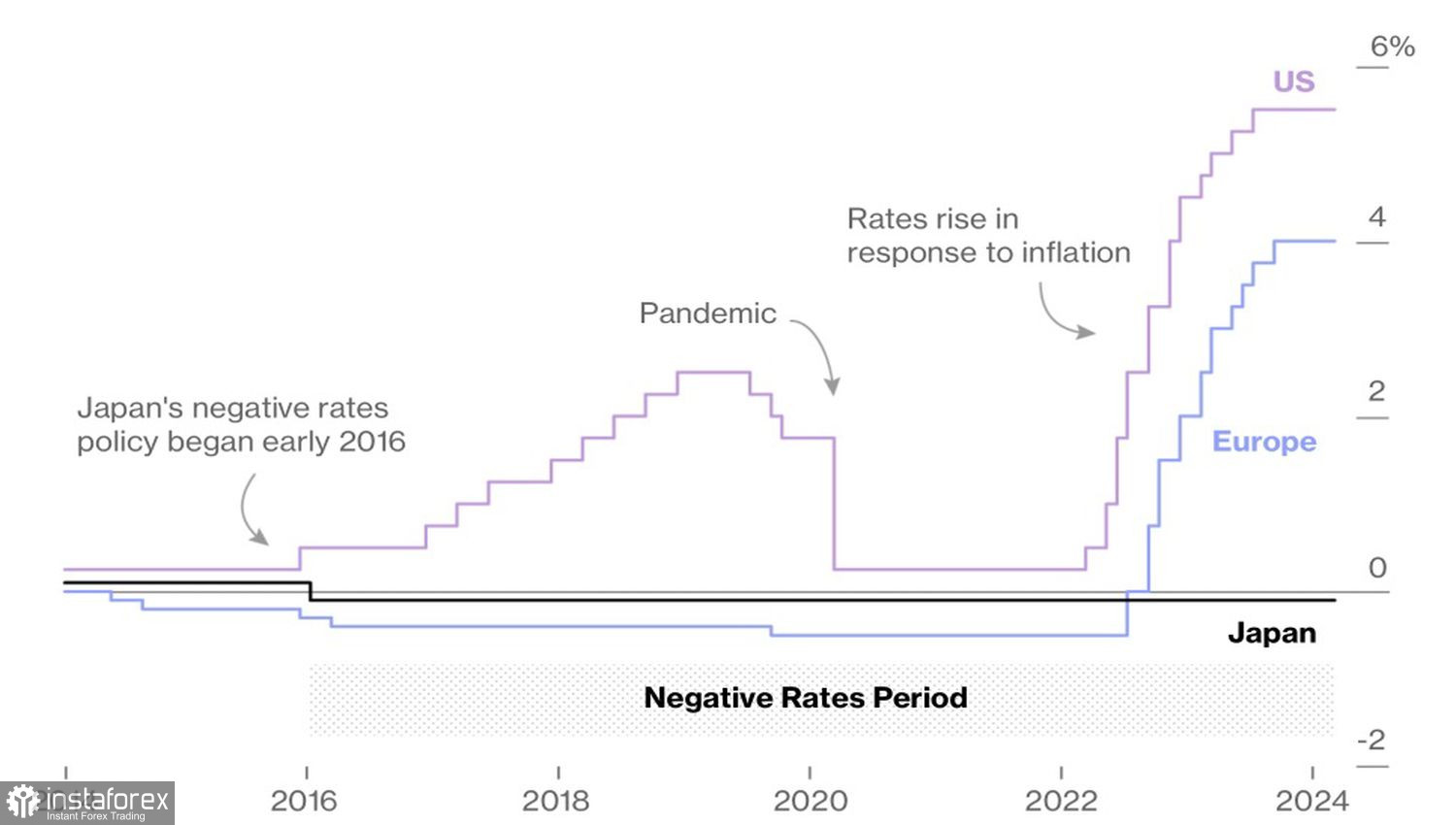

In the States, employment continues to grow at a rapid pace thanks to technology, artificial intelligence, productivity growth, and migration. This increases the risks of inflation indices divergence. It was the accelerated growth of these indices in January and February that allowed the Fed to reconsider its December rate forecasts and postpone the timing of monetary expansion to a later period. It is not surprising that EUR/USD quotes fell below 1.09.

Dynamics of Central Bank Rates

Just like a week ago, the market was fixated on when exactly the Federal Reserve would start easing monetary policy, now it is concerned with another puzzle. Will the FOMC change its rate forecast? Two acts of monetary expansion in 2024 instead of the three announced in December will allow EUR/USD bears to launch a new attack.

In the medium term, everything will depend on economic growth. On the ability of the eurozone to recover. On the stability of the U.S. GDP. But, frankly, looking at what is happening now and the proximity of armed conflict in Ukraine and the Middle East to the eurozone, one seriously doubts that the convergence idea voiced by Bank of America will work.

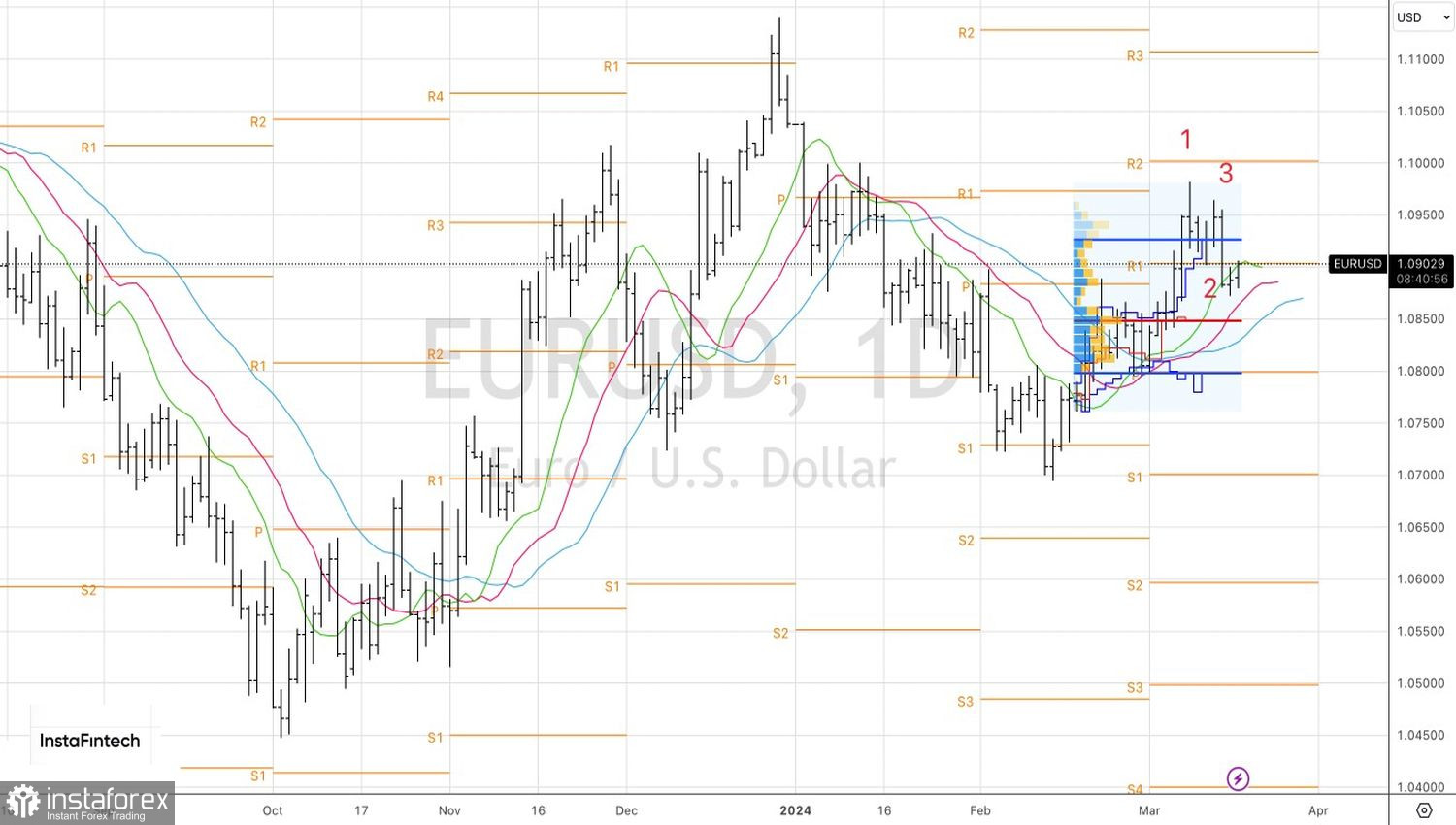

Technically, on the daily chart of EUR/USD, the implementation of the 1-2-3 pattern continues. The bulls tried to play the doji bar and counterattack, but the pivot level at 1.0905 stopped them. As long as quotes remain below it, traders should focus on sales and occasionally add to shorts formed from 1.0945.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română