Hi, dear traders!

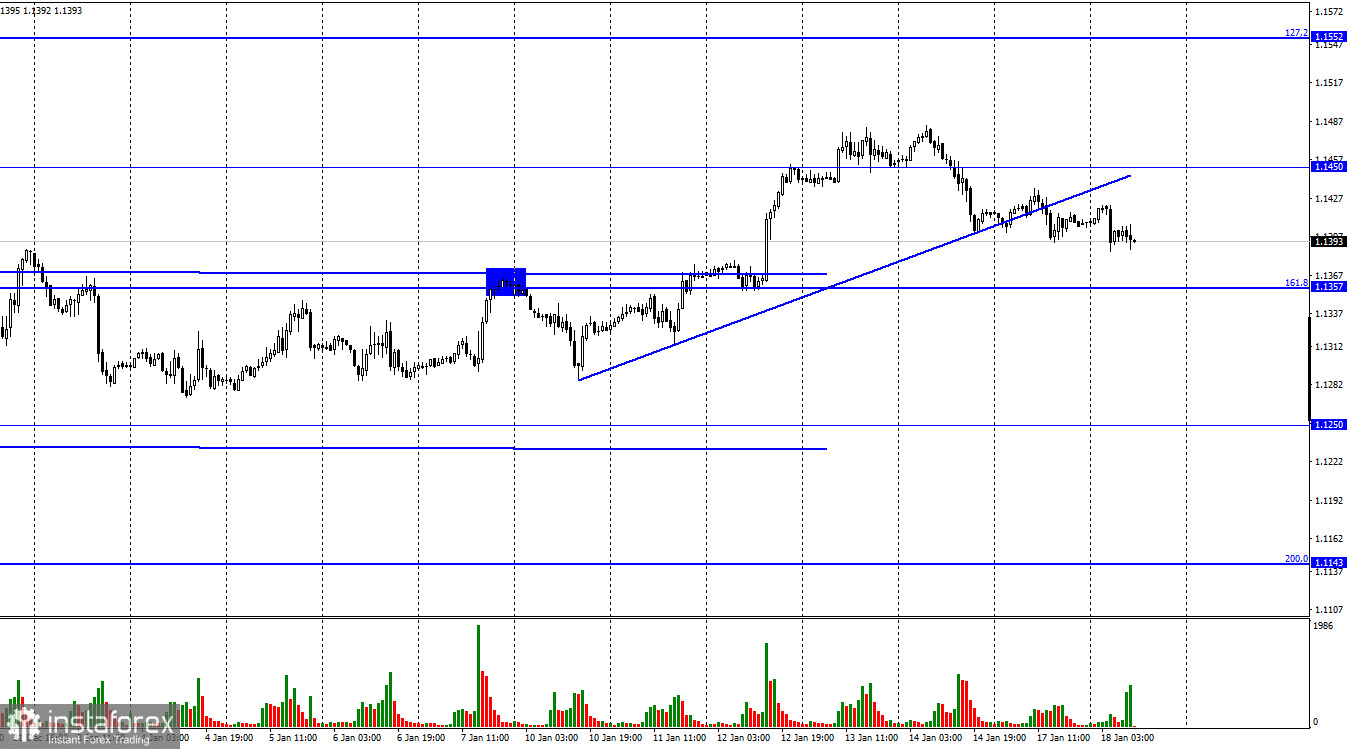

On Monday, EUR/USD closed below the rising trend line, indicating that trader sentiment has changed from bullish to bearish. The uptrend was not strong - the pair managed to gain 200 pips, but the bulls quickly retreated. The quote could continue to decline towards the retracement level of 161.8% (1.1357). At this moment, neither bullish nor bearish traders are ready for any significant actions. The Fed has already outlined its plans for the year, and there are no important events this week that could influence the pair. On Friday, EU CPI data for December will be released, but the final data is unlikely to deviate from the 5.0% year-over-year rate projected earlier.

ECB president Christine Lagarde will give a speech on Friday. Traders do not expect the ECB to change its policy significantly at the moment. The pandemic emergency purchase program (PEPP) will be ended in March. However, the standard asset purchase (EPP) would be extended by tens of billions of euros per month. The European regulator is unlikely to make significant policy shifts now or in the upcoming several months. As a result, traders switched their focus from the euro towards opening long positions in the US dollar, where the Fed is actively planning to tighten its policy and fight inflation. In the meantime, inflation in the EU continues to rise and possibly could match the US inflation rate in a couple of months.

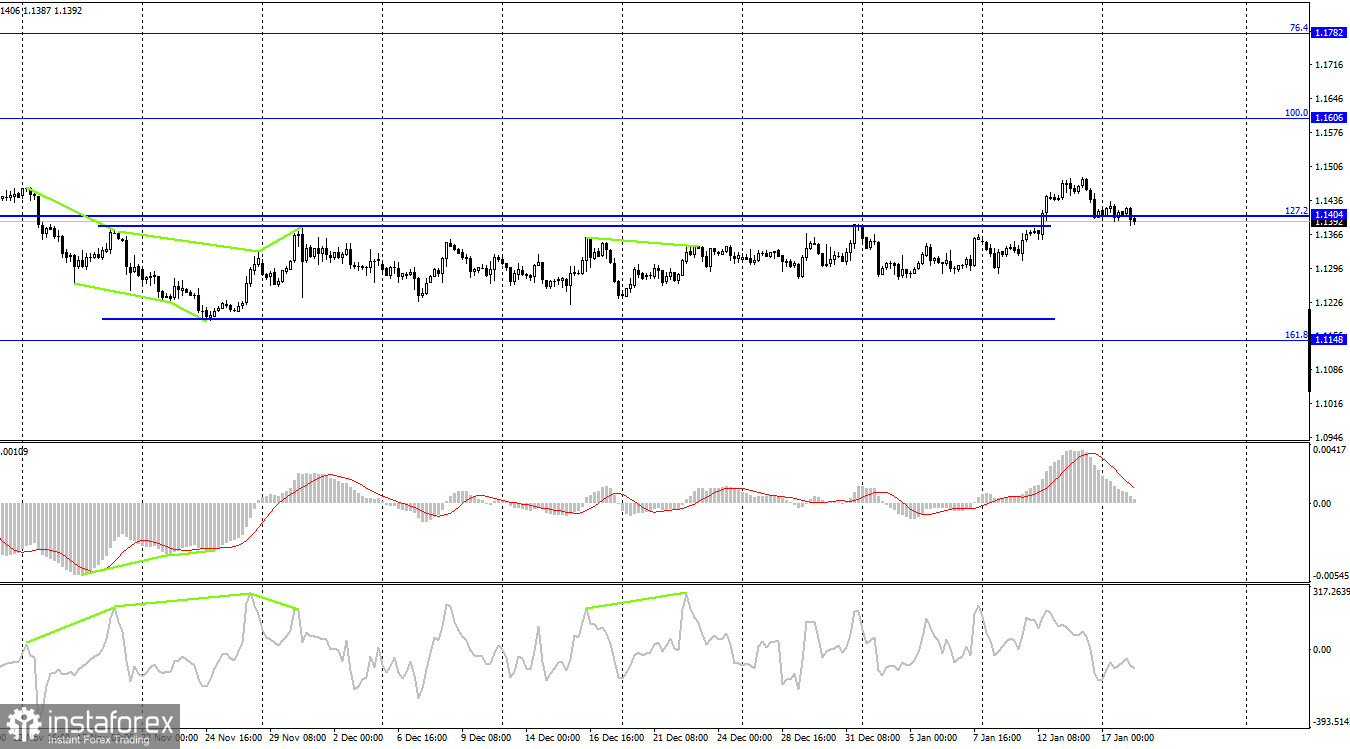

According to the H4 chart, the pair closed above the retracement level of 127.2% (1.1404). Bullish traders have abstained from opening new long positions at the moment. If the pair closes below 1.1404, it could resume its decline towards the retracement level of 161.8% (1.1148). If EUR/USD bounces off 1.1404 upwards, it could rise towards the Fibonacci level of 100.0% (1.1606), but the upward movement is unlikely to be strong. The indicators show no signs of emerging divergences today.

US and EU economic calendar:

This week's economic calendar is very light, and there are no events today in both the EU and the US.

Outlook for EUR/USD:

Previously, traders were advised to open new short positions if the pair closes below the trend line on the H1 chart targeting 1.1357 - these positions can be kept open. Long positions can be opened if EUR/USD bounces off 1.1357 on the H1 chart, with 1.1450 being the target.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română