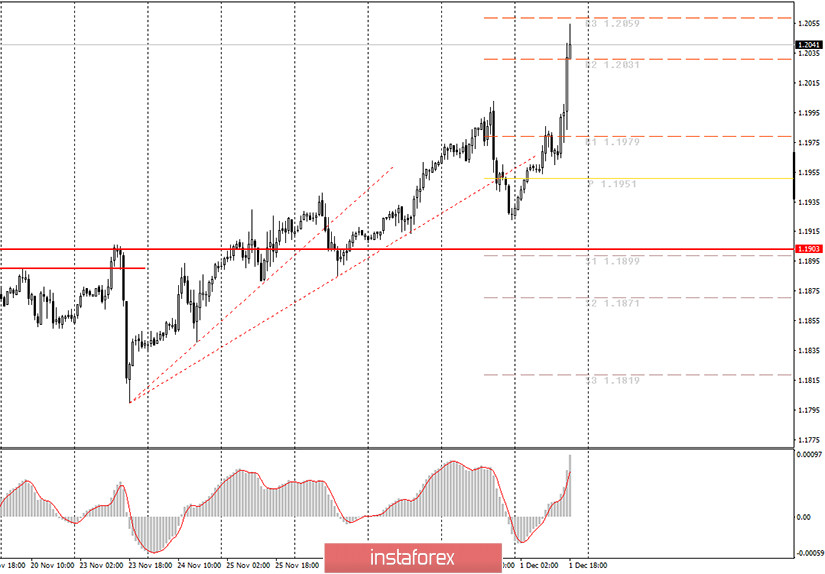

Hourly chart of the EUR/USD pair

The EUR/USD pair could resume its downward movement on Tuesday after a slight pullback to the upside. It would be logical and this is exactly what we expected. However, instead, the euro/dollar pair soared again and this time, it increased by another 80 points. We noted two rising trend lines at once on the chart, below which the pair's quotes were fixed at different times. And each time after that, the upward movement resumed. This suggests that there is no logic in the pair's movement right now. The market is not in a state of shock, not in a state of panic, instead it is in an excited state, when one currency is growing almost uncontrollably and without reason. This phenomenon is called a "bubble". Classic speculators of the currency market "inflate" by maintaining artificial demand for one of the currencies, in our case, the euro. The euro is rising and can grow for a very long time, contradicting absolutely all the laws of logic and fundamental analysis. But at one point, the bubble will burst and then the euro will fall. It is up to novice traders to decide whether or not they would to try to trade in the upward movement. We believe that beginners should be more conscious and understand why a particular trade is open.

There were several macroeconomic publications in the European Union and America on Tuesday, December 1, as well as speeches by Christine Lagarde and Jerome Powell. On the one hand, it seems to be clear why the volatility was high today. However, inflation in the European Union has slowed even more and is now -0.3% y/y, the index of business activity in the manufacturing sector remained almost unchanged in November. Thus, the euro's growth could not have been triggered by these reports. And it gets even more interesting. The US ISM manufacturing PMI slightly declined, but remained at a much higher level than the European one. Again, this report could not provoke a fall in the dollar. And Lagarde and Powell had not even started speaking when the euro grew. Moreover, Lagarde has been speaking almost every day and does not tell the markets anything new, and Powell's speech was published in the public domain yesterday.

A ather important ADP report on changes in the number of employees in the US private sector will be published on Wednesday. This report used to be important and had triggered a reaction from the markets in normal times, but not in 2020, when the pair moves for only one known reason, and traders ignore most of the fundamental and macroeconomic background. Therefore, the euro/dollar pair will most likely move by its own rules tomorrow.

Possible scenarios for December 2:

1) Long positions remain relevant at the moment, but only because the upward trend is still present, which is clearly visible. However, it is extremely difficult to work out this trend now, since there is neither a trend line nor a channel to support it. Formally, you need to wait for a new round of correction and the MACD indicator to discharge to the zero level, and then look for new buy signals.

2) Trading down is not recommended at this time. Although the price crossed the ascending trend lines twice, the upward movement resumed and is still present. So far there is no reason to sell the euro, although the current levels may seem very attractive for selling.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română