Euro failed to rise against the US dollar yesterday, due to the good report on US PPI, which equaled the positive influence of the strong German data released just hours earlier.

The data in Germany indicated that economic prospects in the country rose strongly in August, coming out at 71.5 points against its earlier 59.3 points in July. Economists predicted the indicator to decrease to 54.5 points. However, the assessment of the current economic situation has worsened, which indicates a possible slowdown in the rapid recovery of the German economy. The data revealed that the indicator fell to -81.3 points in August, lower than its previous -80.9 points in July. The Economists expected the index to rise to -67.5 points.

Meanwhile, producer prices in the US also rose in July, the data of which equaled the positive effect of the German data in the market. Thus, demand for the US dollar rose in the afternoon, which led to a sharp collapse of gold in the market. The data said that US PPI jumped 0.6% in July, the most significant monthly increase since October 2018. As for the core index, which does not take into account volatile food and energy prices, an increase of 0.5% occurred compared to the previous month , while compared to last year, the overall PPI fell by 0.4%.

Today, data on US inflation will be published, and if the report comes out better than the forecast, the US dollar may rise even further in the market. This is because any rise in inflation indicates that the Fed will have to change its attitude towards interest rates in the distant future, which will affect profitability bonds, into which investors will gradually return.

With regards to retail sales in the US, the report published by the Retail Economist and Goldman Sachs revealed that from August 2 to August 8, the index fell by 1.5%, and for year-on-year dropped by 6.8%. But on the report published by Redbook, retail sales jumped 2.5% in the first week of August, but fell 3.4% from last year. Nonetheless, these data failed to influence the direction of the market.

Needless to say, the rise of the US dollar will most likely continue, and for this, sellers of risky assets, particularly in the EUR / USD pair, need to protect the resistance level of 1.1775, just above which is the upper limit of the downward correction channel. A break of the support at 1.1700 will increase the pressure on the trading instrument, which will push it to fresh lows in the levels 1.1640 and 1.1580.

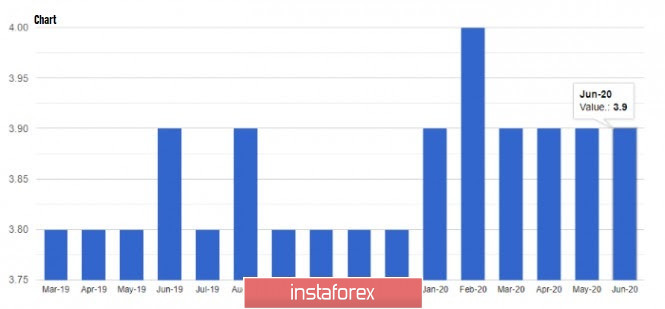

As for the British pound, price continues its decline, even amid good reports on the UK labor market and GDP. Recent data reveals that unemployment rate from April to June came out 3.9%, which is a very good sign for the economy. Unfortunately, the overall picture is distorted by the current employment support program that the UK authorities introduced after the spread of the coronavirus, as such makes the published and will-be-published data on the labor market quite unreliable. The completion of the program is expected only in October this year.

So, for the technical picture of the GBP / USD pair, the further direction of the quote will depend on how the bulls cope with the support level at 1.3020. The good UK GDP data allowed the bulls to protect this level, but now the return to the middle of channel 1.3105 is required. If the low at 1.3020 is broken, it is best to open short positions on the trading instrument in the hope of a return to the support level of 1.2940.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română