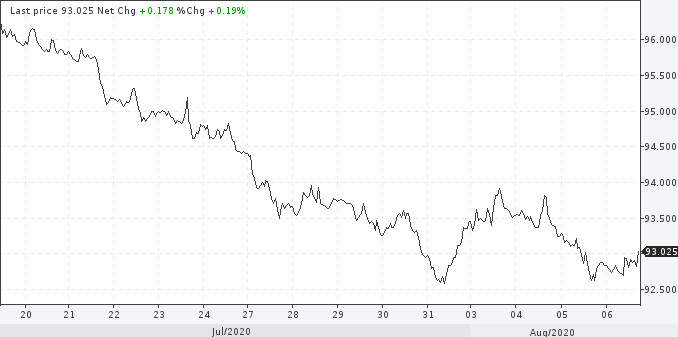

There was no unidirectional movement in the dollar index on Thursday. Indicator volatility and attempts to slow down at around 93 points were observed. This is logical after the dwindling decline in recent sessions. In general, the greenback remains under pressure. The downward trend is also based on the behavior of the stock and commodity markets. The Dow Jones Index rapidly tested the 27155 marks, where the current line of the current upward trend is located. The growing Dow, however, as well as oil, which is trying to gain a foothold higher, negatively affects the position of the dollar.

USDX

The upcoming presidential elections in the United States, the loss of its high profitability advantage due to the actions of the Fed and the government, as well as an increase in the budget deficit and the current account of the country's balance of payments are not on the side of the dollar.

The growth of the national debt, coupled with the money supply, makes one fear a rise in inflation and an even greater fall in the exchange rate of the US dollar. Moreover, the lack of progress in negotiations on the amount of disaster aid to the US economy also adds as one of the negative factors pulling the dollar downward. As well as the growing contradictions between the United States and China and, of course, the continued increase in the number of people infected with the coronavirus.

A new surge in infection last month could have paused the ongoing economic recovery. Quarantine measures in the country left millions of Americans unemployed, especially in the tourism and retail sectors. Other sectors also suffered, such as construction and financial services. According to ADP, the number of jobs in the US nonfarm private sector increased only by 167,000 weaker than the expected growth of 1.5 million. Note that the ADP report is not directly related to the official data of the US Department of Labor, the publication of which is scheduled on Friday. However, they are likely to fall short of market expectations, pointing to a decline in non-farm jobs instead of an expected 1.6 million increase. This is happening at a time when millions of Americans have lost their higher unemployment benefits.

Until new support measures are taken, the Fed may enter the scene. The regulator will be forced to take further steps to ease monetary policy, which is another factor that urges the decline of the dollar.

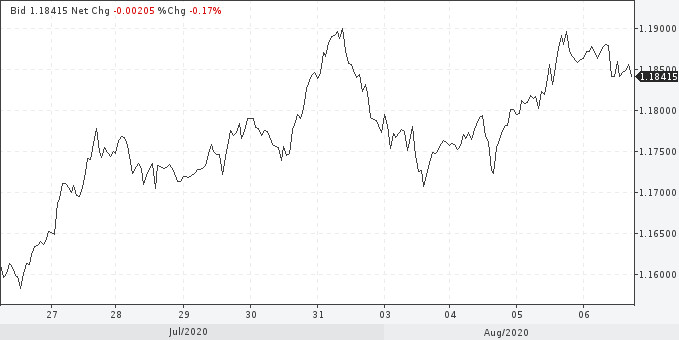

Meanwhile, in Europe, conditions are now completely different for a smooth and faster economic recovery. It is also worth considering the recently adopted support program in the form of an expenditure package of 1.8 trillion euros. An improvement in the situation in the EU countries is evidenced by macroeconomic statistics, European assets look more attractive than American ones. Everything speaks in favor of the growth of the euro, so the EUR / USD pair maintains positive dynamics and a tendency to further increase.

On Thursday, at the start of the European session, the pair rose to a new 26-month local maximum, at the moment exceeding 1.1900. Although the euro rolled back in the American session, this does not mean that it will not catch up in the very near future. The next target for growth is around 1.2000.

EUR / USD

The movement of the main pair is now in the medium-term ascending channel. Correction to the level of 1.1831 is admissible, then again the upward movement to the levels of 1.1928-1.1949 and above. If the price still consolidates below 1.1790, then it is worth considering the scenario of a hike to 1.1720.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română