GBP / USD

Bears are close to the breakdown of the next support zone. What's next? Overcoming the current support and secure securing below reveals fairly long horizons before the players to descend, a downward target for the breakdown of the weekly cloud (1.2302 - 1.2027) and an update of the January-March minimum (1.1986). There is something to try for now.

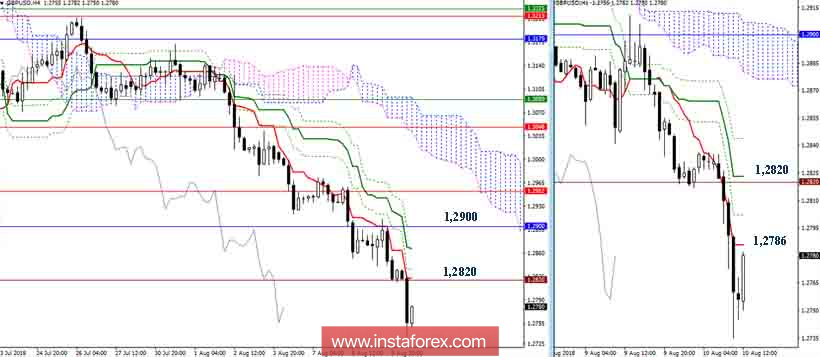

The advantages are now on the side of the players to downgrade. Nevertheless, at the moment, there is a braking and corrective lift. The nearest resistance is 1.2786 (Tenkan N4), further 1.2820 (Tenkan N4 + Kijun N1 + historical level) and 1,2900 (Fibo Kijun N4 + cloud N1 + monthly Fibo Kijun). Today, we close the week, because, how deep the upsurge will be, the preferences and prospects of the next week depend.

Indicator parameters:

All time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

Clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română