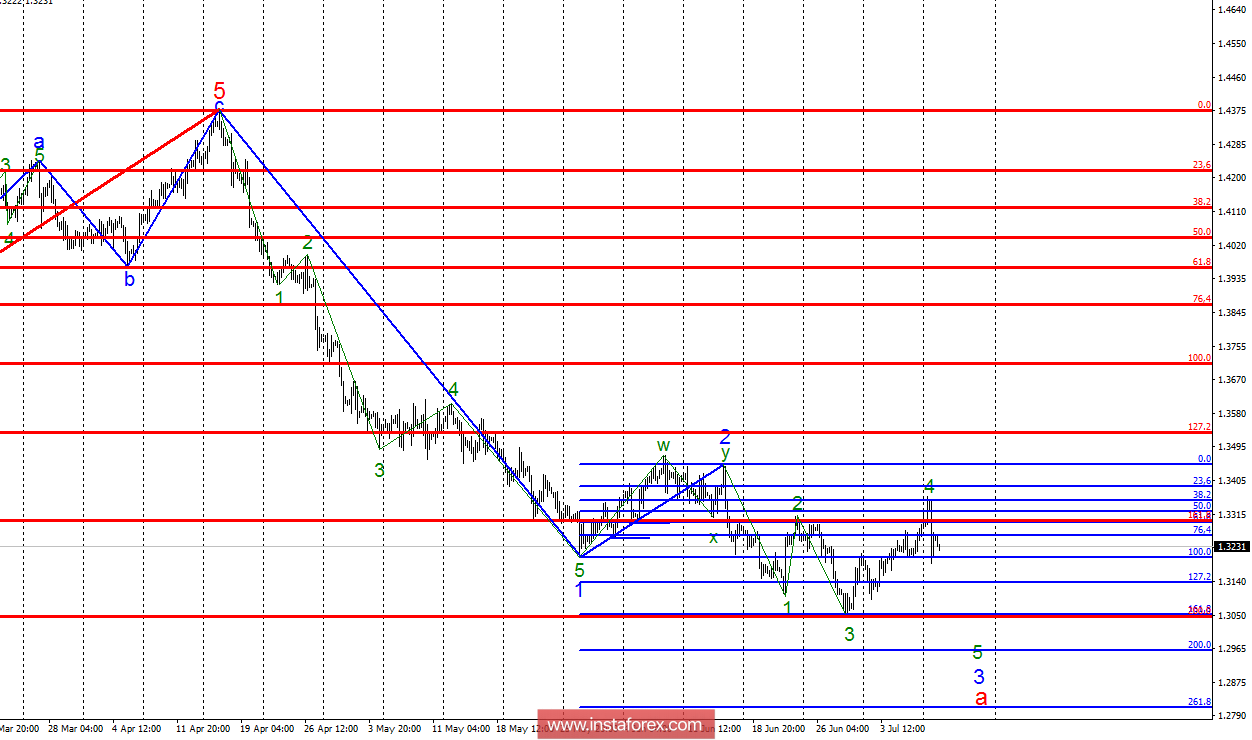

Analysis of wave counting:

During the trades on July 9, the GBP / USD fell from the maximum of the day by 175 percentage points, but by the end of the day still returned some of the lost positions. Nevertheless, this reduction allows us to assume the completion of the construction of future wave 4, 3, a. If this is the case, then the pair will continue to decline within wave 5 with targets located near the estimated level of 1.3054, and possibly lower. The entire wave 3, a, assumes the form of a diagonal triangle, as expected. The fundamental component is currently supported by the US dollar, increasing the chances of implementing a variant with a downward trend segment.

The objectives for the option with purchases:

1.3445 - 0.0% of Fibonacci (formal goal)

The objectives for the option with sales:

1.3054 - 161.8% of Fibonacci

1.2962 - 200.0% of Fibonacci

1.2809 - 261.8% of Fibonacci

General conclusions and trading recommendations:

The GBP / USD currency pair supposedly completed the construction of wave 4, 3, a. If this is the case, then now it is expected to fall further, and I recommend selling the pair with targets near the calculated marks of 1.3054 and 1.2962, which corresponds to 161.8% and 200.0% of Fibonacci. Breaking the high of July 9 will lead to the need to refine the current wave counting.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română