GBP/JPY

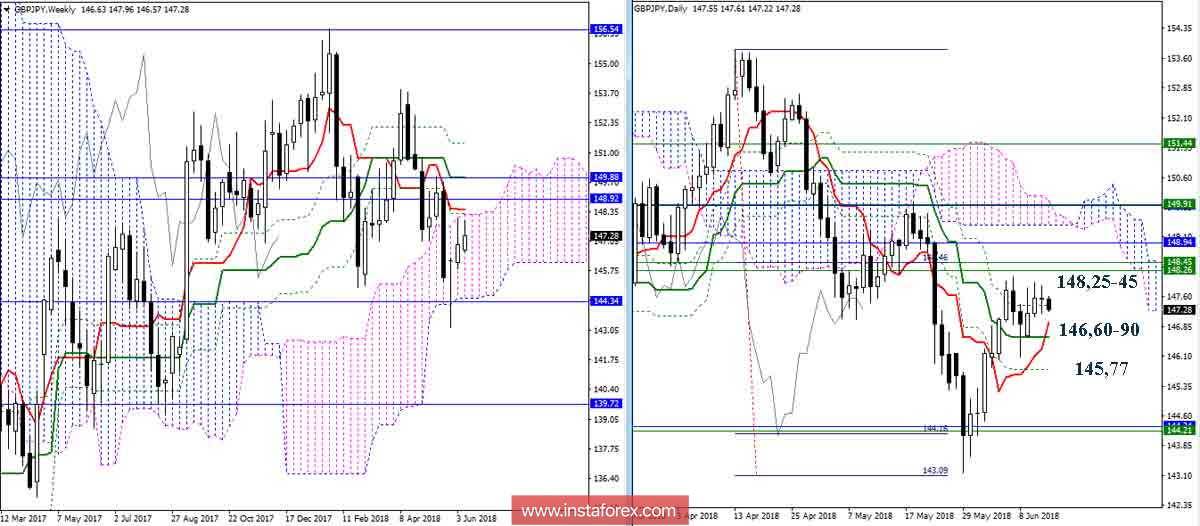

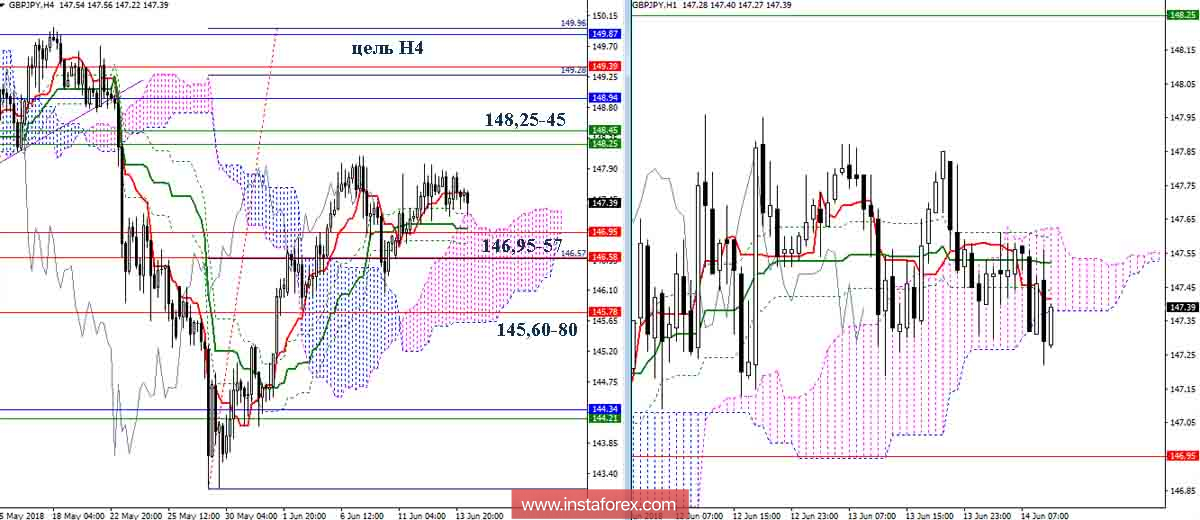

Throughout the current week, players on the rise, to continue the climb, tried to go beyond the upper shadow of the last week candle, but they have not been able to achieve a positive result so far. The maximum extremum (148.09) has not been updated, the resistance uniting weekly levels (Senkou Span A 148.25 + Tenkan 148.45 + Fibo Kijun 148.29) has not been tested. These tasks remain a priority. But if there is no progress again today, players on the slide can take advantage of the weakness of the opponent, which will lead to a decrease. The most important support now is the area of 146.95-57 (day cross level + Kijun H4 + upper boundary of the H4 cloud), then you should note the area 145.60-80 (daytime Fibo Kijun + lower boundary of the cloud H4). The consolidation under these supports will change the current balance of power, which is now largely on the side of the bulls, and will require a new assessment of the situation.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română