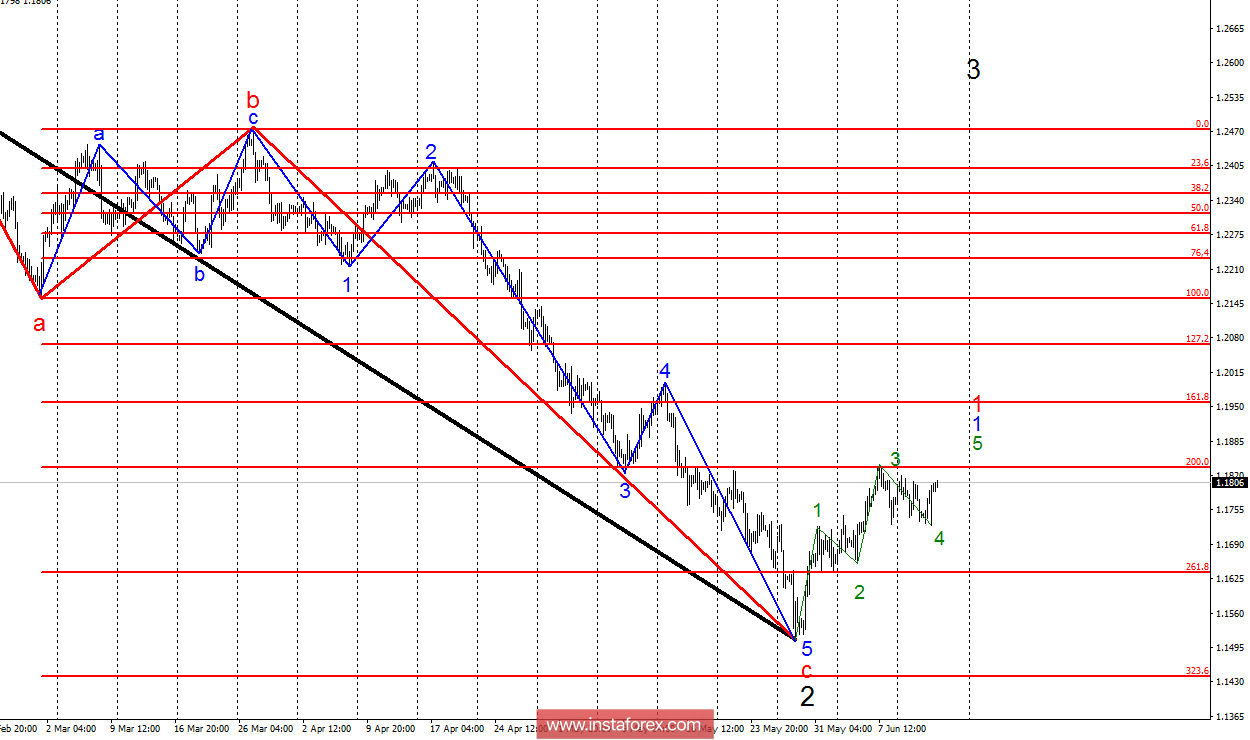

Analysis of wave counting:

As a result of the previous day, the EUR/USD pair added about 45 basis points. Thus, the construction of the supposed wave 1, in 1, in the future 3 was resumed. At the moment, the pair is in the stage of building an internal wave 5, the lowest targets of which are located near the estimated mark of 1.1837, which corresponds to 200.0% of Fibonacci. With a successful attempt to break this mark, wave 5 can acquire a more extended form and complete its construction near the mark of 1,1950. After that, the quotations are expected to fall in the area of the 17th figure in the framework of the construction of wave 2, in 1, in 3.

Targets for buying:

1.1700 - 1.1650

Targets for selling:

1.1958 - 161.8% by Fibonacci of the highest order

1.2070 - 127.2% by Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR/USD currency pair has started to build wave 5, at 1, at 1. On this basis, it is recommended to continue buying with targets near the mark of 1.1837, which corresponds to 200.0% Fibonacci, and above, about 1.1950. In the case of a successful breakthrough attempt at 1.1837 it is recommended to gradually reduce buying, as the trading instrument will be ready to start building a corrective wave 2 with targets that are around 17 figures.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română