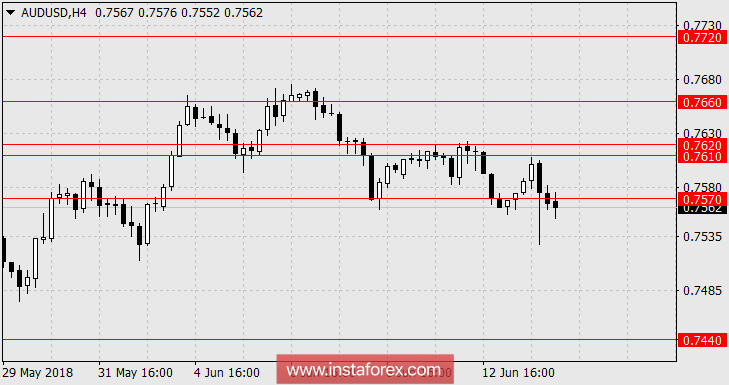

AUD / USD

Previously, the Australian dollar was repeatedly noted as a qualitative, pure indicative response to events in the global financial industry. Yesterday, the law went down to the Federal Reserve's decision to raise the rate and raise forecasts for further tightening of the policy against the speculative movements of the euro and the Australian pound, this happened despite the fact that the consumer sentiment index from Westpac for June increased by 0.3%. Australia's mixed employment figures are coming today. The unemployment rate has fallen from 5.6% to 5.4%, but due to the lowering of share of the economically active population from 65.6% to 65.5%. New jobs created reached 12 thousand against the expectation of 19 thousand Full employment, showing a decreased of 21 thousand workers.

But China was even more disappointed today. In May, industrial production in China dropped from 7.0% YoY to 6.8% YoY while expecting a decline to 6.9% YoY. Investments in fixed assets decreased from 7.0% YoY to 6.1% YoY. Retail sales declined from 9.4% YoY to 8.5% YoY against growth expectations of up to 9.6% YoY. Chinese stock market China A50 is down to 0.55%, and Australian S&P / ASX 200 is down to -0.14%. We are waiting for the AUD/USD pair at 0.7440.

* The presented analysis of the market is informative and is not a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română