Dear colleagues.

For the EUR / USD pair, there is a high probability of resuming the upward movement, which requires a breakdown at the level of 1.1850. For the GBP / USD, the price is still in the correction zone from the upward movement. For the USD / CHF pair, the price forms a strong potential for the upward movement of June 7. The development of this level is expected after the breakdown of 0.9896. For the USD / JPY pair, the continuation of the movement towards the top is expected after the breakdown of 110.92. For the EUR / JPY pair, we expect the movement towards the level of 130.83. For the GBP / JPY pair, the continuation of the movement towards the top is expected after the breakdown of 148.20.

Forecast for June 14:

Analytical review of currency pairs in the scale of H1:

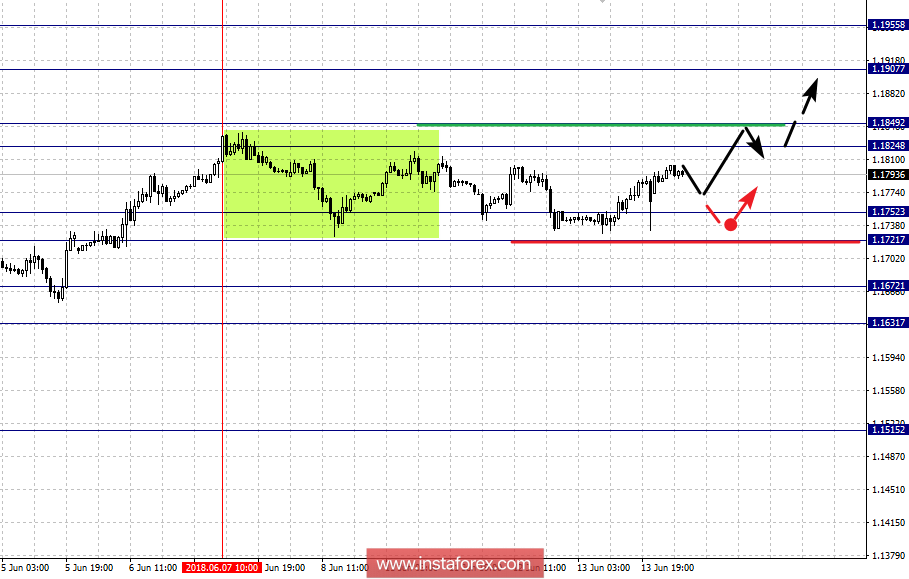

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1955, 1.1907, 1.1849, 1.1824, 1.1752, 1.1721, 1.1672 and 1.1631. Here, we continue to follow the upward structure of May 30. The continuation of the development of the upward trend is expected after passing the price of the noise range at 1.1824 - 1.1849. In this case, the target is 1.1907. Near this level is the consolidation of the price. For the potential value for the top, consider the level of 1.1955. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 1.1752-1.1721. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.1672. This level is the key support for the upward structure from May 30. Its breakdown will lead to the development of a downward structure. In this case, the first target is 1.1631.

The main trend is the upward structure of May 30.

Trading recommendations:

Buy: 1.1850 Take profit: 1.1905

Buy 1.1908 Take profit: 1.1955

Sell: 1.1750 Take profit: 1.1722

Sell: 1.1718 Take profit: 1.1674

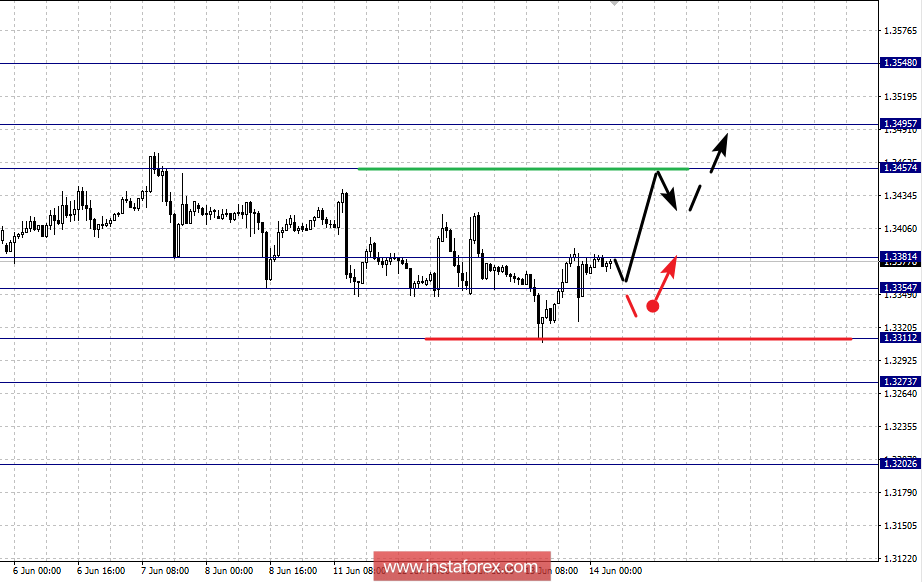

For the GBP / USD pair, the key levels on the scale of H1 are 1.3548, 1.3495, 1.3457, 1.3381, 1.3354, 1.3311 and 1.3273. Here, we follow the upward structure from May 29. Currently, we expect the movement towards the level of 1.3457. The breakdown of this level, in turn, will lead to a movement towards the level of 1.3495. Near this level, we expect the consolidation of the price. For the potential value for the top, consider the level of 1.3548. From this level, we expect a departure towards correction.

Short-term downward movement is possible in the area of 1.3381 - 1.3354. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.3311. This level is the key support for the top. Its breakdown will lead to a downward structure. In this case, the potential target is 1.3273.

The main trend is the upward structure of May 29.

Trading recommendations:

Buy: 1.3460 Take profit: 1.3490

Buy: 1.3497 Take profit: 1.3545

Sell: 1.3380 Take profit: 1.3355

Sell: 1.3352 Take profit: 1.3313

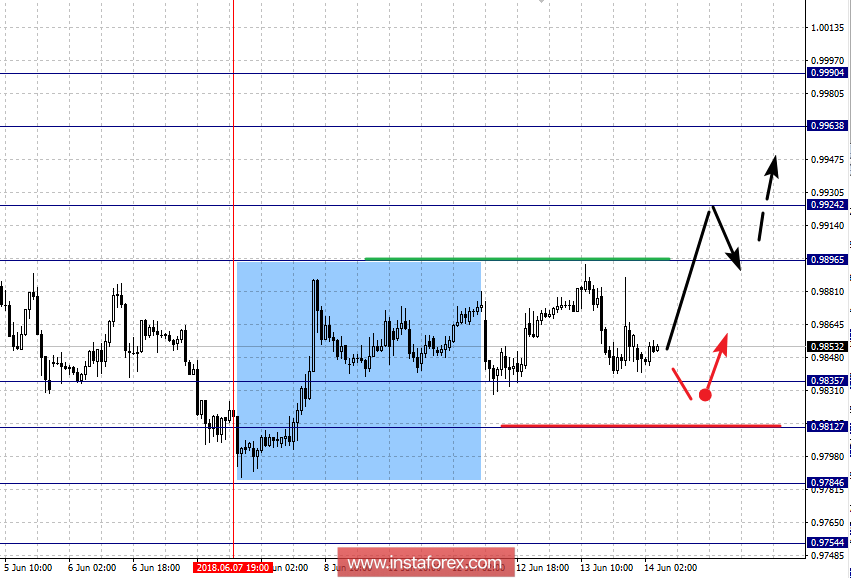

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9990, 0.9963, 0.9924, 0.9896, 0.9835, 0.9812, 0.9784 and 0.9754. Here, the price issued a pronounced structure from June 7 for the development of an upward trend. The continuation of the movement towards the top is expected after the breakdown of 0.9896. In this case, the target is 0.9924. Near this level is the consolidation of the price. The breakdown of 0.9926 should be accompanied by a pronounced upward movement. The target here is 0.9963. For the potential value for the top, consider the level of 0.9990. After reaching this level, we expect a correction.

Short-term downward movement is possible in the area of 0.9835 - 0.9812, hence the probability of a turn to the top is high. The breakdown at the level of 0.9812 will lead to the development of a downward movement. In this case, the target is 0.9784.

The main trend is a local downward structure from May 29, the formation of the potential for the top of June 7.

Trading recommendations:

Buy: 0.9896 Take profit: 0.9922

Buy: 0.9926 Take profit: 0.9960

Sell: 0.9833 Take profit: 0.9814

Sell: 0.9810 Take profit: 0.9786

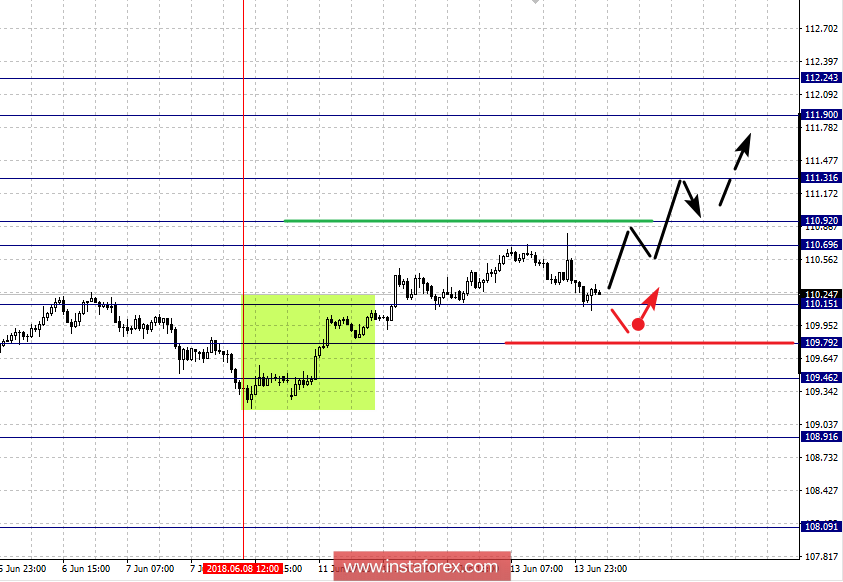

For the USD / JPY pair, the key levels on a scale are: 112.24, 111.90, 111.31, 110.92, 110.69, 110.15, 109.79, 109.46 and 108.91. Here, we follow the development of the upward structure of May 29. The price formalized the local structure for the top of June 8. The continuation of the movement towards the top is expected after passing through the price range of 110.69 - 110.92. In this case, the target is 111.31. For the potential value for the top, consider the level of 112.24. Upon reaching this level, we expect consolidation in the area of 112.24 - 111.90.

Departure in the correction is expected after the breakdown of 110.15. Here, the target is 109.79. Short-term downward movement is possible in the area of 109.79 - 109.46. The breakdown of the latter value will lead to the development of the downward structure. Here, the potential target is 108.91.

The main trend is an upward cycle from May 29.

Trading recommendations:

Buy: 110.92 Take profit: 111.30

Buy: 111.33 Take profit: 111.90

Sell: 110.12 Take profit: 109.82

Sell: 109.77 Take profit: 109.48

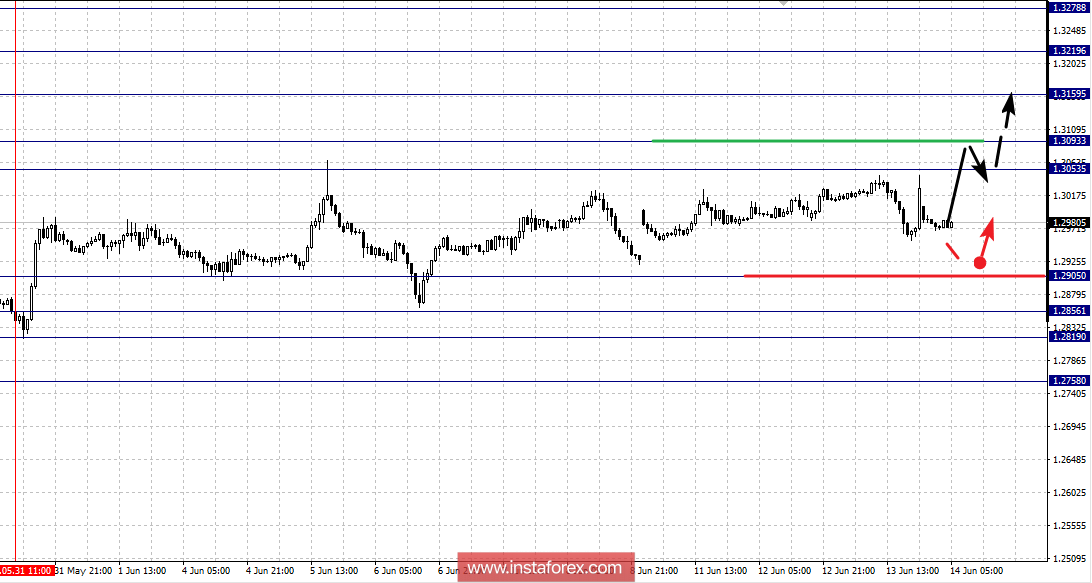

For the CAD / USD pair, the key levels on the scale of H1 are: 1.3278, 1.3219, 1.3159, 1.3093, 1.3053, 1.2905, 1.2856, 1.2819 and 1.2758. Here, we follow the upward structure of May 31. The development of this level is expected after passing the price of the noise range at 1.3053 - 1.3093. In this case, the target is 1.3159. Near this level is the consolidation of the price. The breakdown at 1.3160 will lead to the movement towards the level of 1.3219. From this level, there is a high probability of leaving the correction. For the potential value for the top, consider the level of 1.3278.

Short-term downward movement is possible in the range of 1.2905 - 1.2856. The breakdown of the last value will lead to the development of a downward structure. In this case, the potential target is 1.2758.

The main trend is the upward structure of May 31.

Trading recommendations:

Buy: 1.3093 Take profit: 1.3156

Buy: 1.3162 Take profit: 1.3216

Sell: 1.2905 Take profit: 1.2858

Sell: 1.2819 Take profit: 1.2760

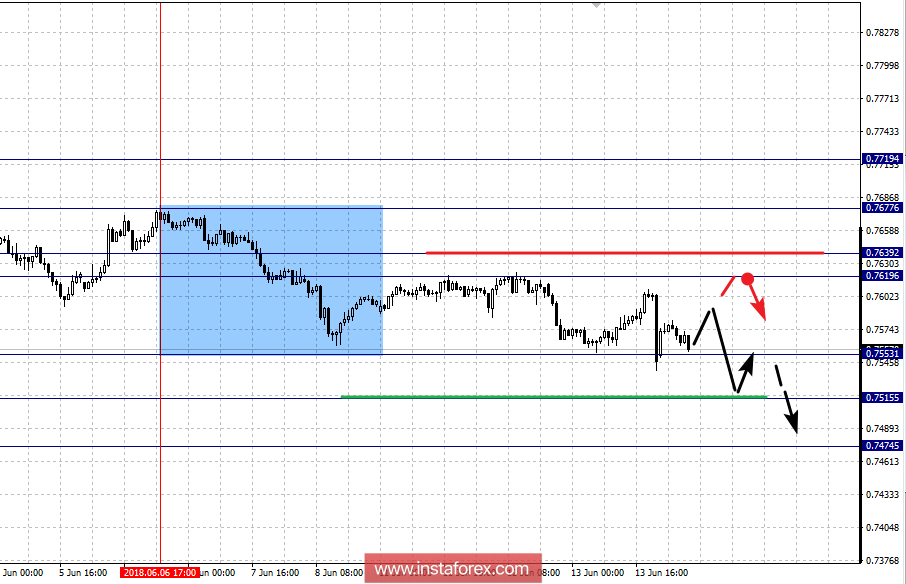

For the AUD / USD pair, the key levels in the scale of H1 are: 0.7719, 0.7677, 0.7639, 0.7619, 0.7553, 0.7515 and 0.7474. Here, the price forms the potential for a downward movement from June 6. The continuation of the movement towards the bottom is expected after the breakdown of 0.7553. In this case, the target is 0.7515. Near this level is the consolidation of the price. For the potential value for the bottom, consider the level of 0.7474.

Short-term upward movement is possible in the area of 0.7619 - 0.7639. The breakdown of the latter value will lead to the development of an upward structure. Here, the first target is 0.7677. This level is the key resistance for the subsequent development of the upward trend.

The main trend is the formation of a downward structure from June 6.

Trading recommendations:

Buy: 0.7640 Take profit: 0.7674

Buy: 0.7679 Take profit: 0.7717

Sell: 0.7550 Take profit: 0.7516

Sell: 0.7513 Take profit: 0.7476

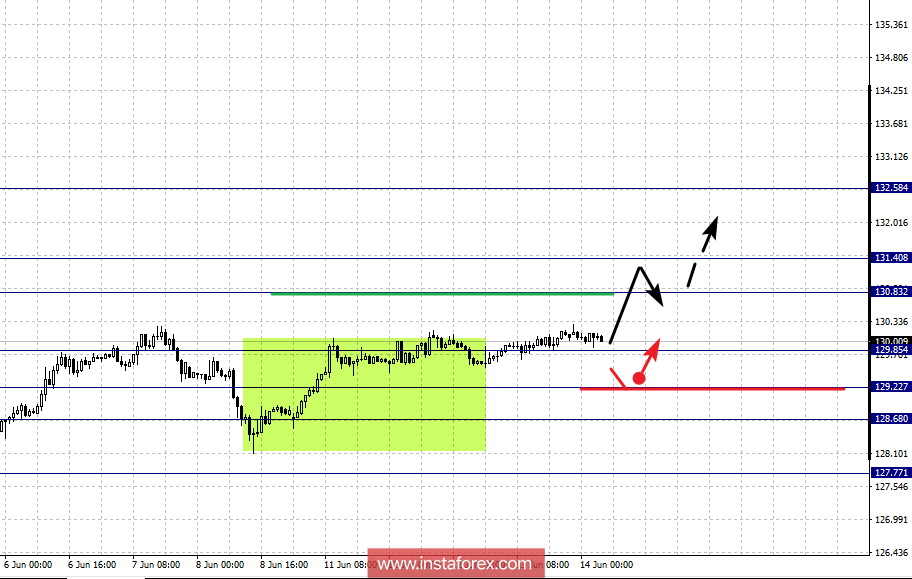

For the EUR / JPY pair, the key levels on the scale of H1 are: 132.58, 131.40, 130.83, 129.85, 129.22, 128.68 and 127.77. Here, we follow the upward structure of May 29. At the moment, we expect the movement towards the level of - 130.83. In the area of 130.83 - 131.40 is the consolidation of the price. For the potential value for the top, consider the level of 132.58. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in the area of 129.22 - 128.68. The breakdown of the last value will lead to in-depth correction. Here, the target is 127.77. This level is the key support for the top.

The main trend is the upward structure of May 29.

Trading recommendations:

Buy: 129.87 Take profit: 130.80

Buy: 131.42 Take profit: 132.55

Sell: 129.20 Take profit: 128.70

Sell: 128.65 Take profit: 127.80

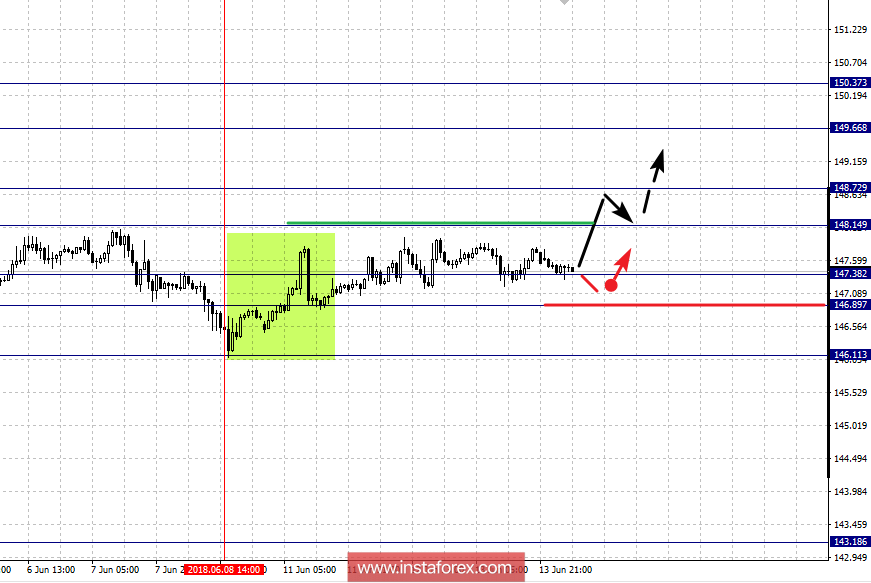

For the GBP / JPY pair, the key levels on the scale of H1 are: 150.37, 149.66, 148.72, 148.14, 147.38, 146.89 and 146.11. Here, we follow the development of the upward cycle of May 29. Short-term upward movement is possible in area of 148.14 - 148.72. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 149.66. Near this level is the consolidation of the price. For the potential value for the top, consider the level of 150.37. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possible in area of 147.38 - 146.89. The breakdown of the last value will lead to in-depth correction. Here, the target is 146.11. This level is the key support for the top.

The main trend is the upward cycle from May 29.

Trading recommendations:

Buy: 148.16 Take profit: 148.70

Buy: 148.76 Take profit: 149.64

Sell: 147.36 Take profit: 146.92

Sell: 146.85 Take profit: 146.15

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română