EUR / USD pair

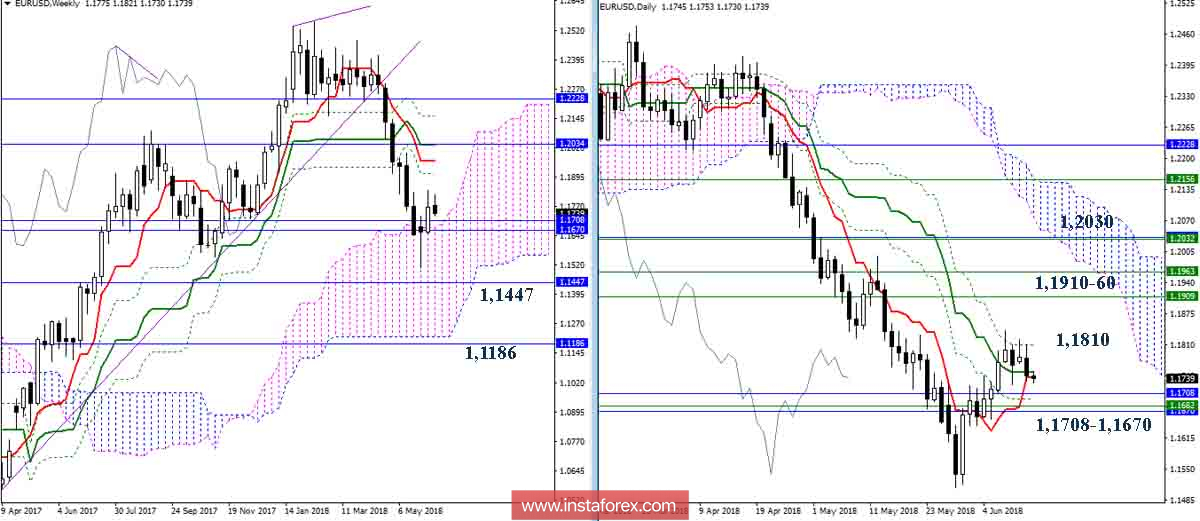

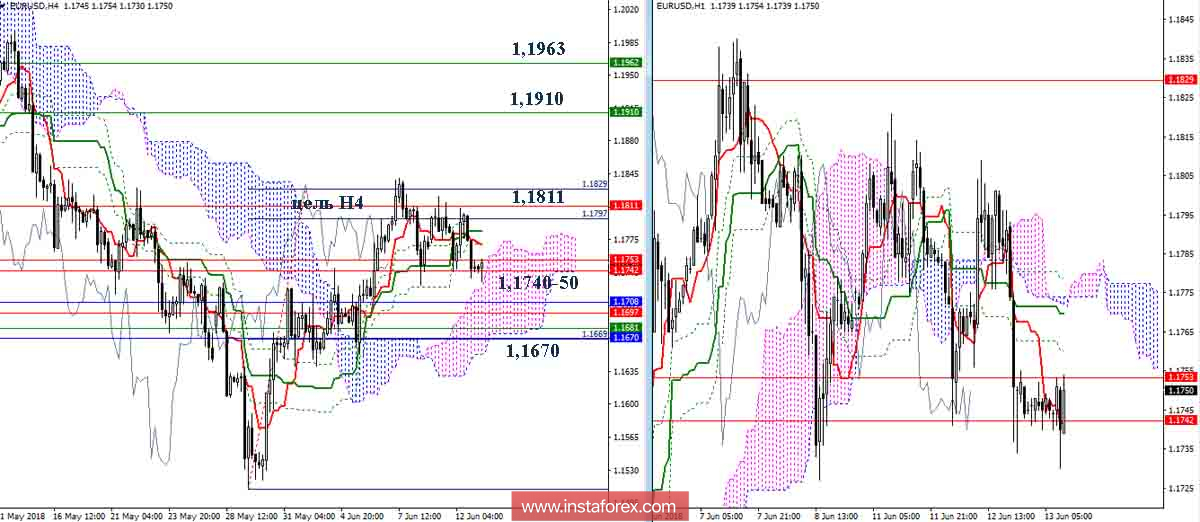

As expected, the players on the rise took a break, having worked out the upward target for the breakdown of the H4 cloud (1.1829) and achieved the final level resistance of the daytime dead cross (Fibo Kijun 1.1810). The key support zone, which combines the boundaries of the monthly and weekly clouds, is in the current situation in the region of 1.1708 - 1.1670. Current support levels are now on the daytime cross and H4 clouds (1.1740-50). The location above the support levels keeps the relevance of the fact the upward correction will continue. The closest reference points, in this case, are the weekly cross and the day cloud (1.1910 - 1.1963 - 1.2032). Reliable fastening under support (1.1708 - 1.1670) can help restore trend movements on the daily and weekly halves (the minimum extremum is 1.1510).

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română