To open long positions for EURUSD, it is required:

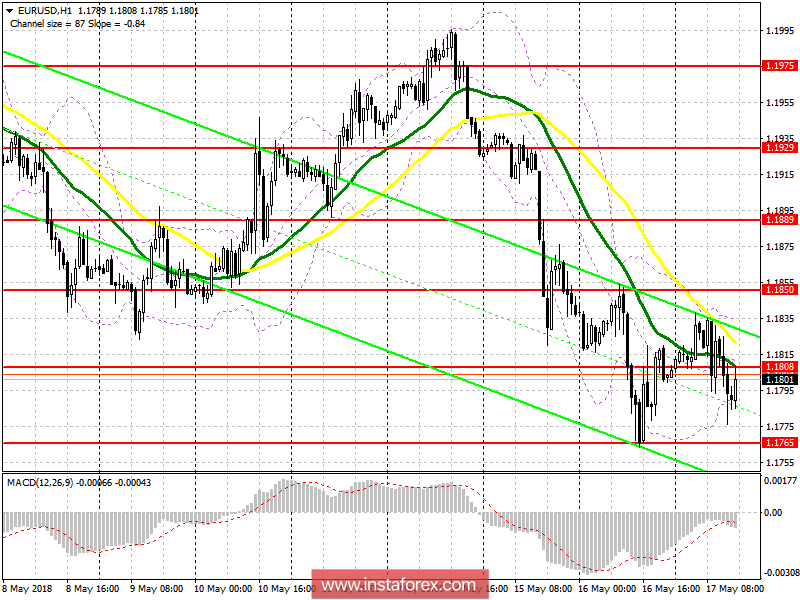

It is best to consider long positions for the euro after returning to the resistance level of 1.1808, from which we can expect a repeated upward trend in the area of 1.1850 with an exit to 1.1889. In case the euro declines in the second half of the day, the purchase will be relevant at the low of the month in the area of 1.1765, or towards a rebound from 1.1742.

To open short positions for EURUSD, it is required:

While the trade is below 1.1808, the pressure on the euro will remain, and an unsuccessful attempt to consolidate above this range will serve as a good signal for the opening of short positions, in order to reduce the area of the month's low of 1.1765 and its update in the area of 1.1742 and 1.1710, where I recommend locking in profits. Otherwise, you can sell the euro on a rebound from 1.1850.

Indicator description

- Moving Average (average sliding) 50 days - yellow

- Moving Average (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română