To open long positions on EURUSD, it is required:

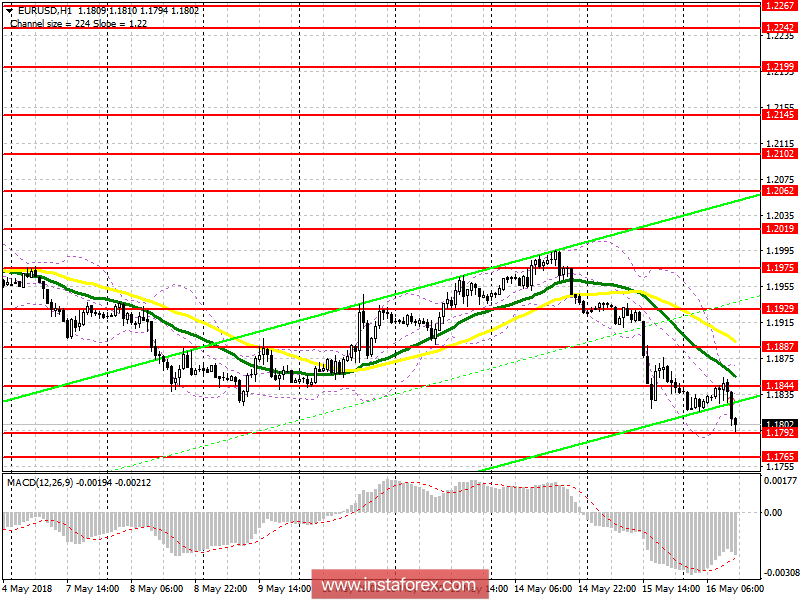

Pressure on the euro persists. Buyers are trying to cling to the level of 1.1792, after the test which formed a divergence on the MACD indicator. However, it is best to consider long positions in the euro after updating the larger support area 1.1765 and 1.1742. Only consolidation at 1.1844 resistance in the second half of the day will allow talking about the corrective growth of the euro to the area of 1.1887 and 1.1929.

To open short positions on EURUSD, it is required:

The break of yesterday's lows led to the first support of 1.1792, but it is unlikely that the sellers of the euro will stop there. Trading at 1.1792 could cause a bigger decline in EUR/USD in the second half of the day, which will result to the update of supports 1.1765, 1.1742 and 1.1710, where it is recommended fixing the profit. In case of euro growth, selling can be after testing the resistance level of 1.1844.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română