To open long positions for EUR / USD, you need:

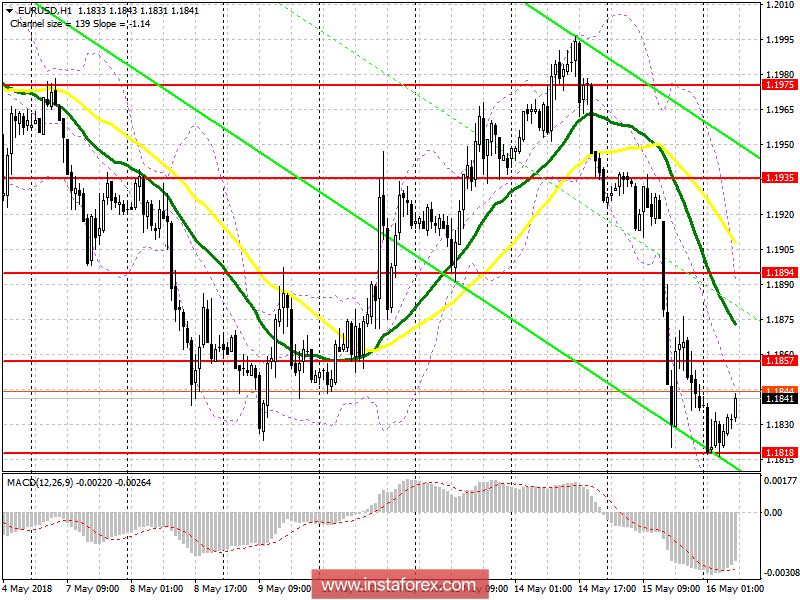

I do not recommend rushing to buy euros. Only the formation of a false breakout in the support area of 1.1818 with the confirmation of the divergence on the MACD indicator will serve as a signal for the opening of long positions with the expectation of returning and renewing the resistance levels of 1.1857 and 1.1894. Otherwise, you can count on purchases only after testing the new support levels in the area of 1.1792 and 1.1765.

To open short positions for EUR / USD, you need:

Failure to consolidate and return to the level of 1.1857 will be a good signal for the opening of new short positions in the euro with the expectation of a decline and a test of the low of the month at 1.1818. The breakthrough of which will lead to a bigger sale of the euro with the renewal of the area of 1.1792 and 1.1765, where I recommend fixing the profits. In the case of growth above the level of 1.1857 in the morning, sales can be returned to a rebound of 1.1894.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română