The Japanese yen was optimistic about the information regarding the inability of Angela Merkel to form a coalition in Germany. The risks of repeated parliamentary elections or minority governments increased the market uncertainty and hiked the demand for safe haven assets. As a result, the USD / JPY pair confidently moved to a 1.5-month low, the upgrade of which will increase the risk of continuing the downward trend.

After the fall of last year, the Bank of Japan switched to targeting the yield curve. No one is surprised that the yen began to react solely to external factors. The USD / JPY correlation with the yield of US Treasury bonds is great. Meanwhile, the BoJ's internal statistics and desire to adhere to ultra-soft monetary policy have been increasingly ignored by investors. In my opinion, this is not entirely true. These "bearish" factors for the "Japanese yen" make it possible to smooth out its strengthening.

The inability of Republicans to carry out the tax reform through the US Congress in 2017 as well as the increased political risks in the euro area, may lead to a drop in quotations of the analyzed pair in the direction of 108. At the same time, the gradual deterioration of the situation in Japan itself will be an additional catalyst for the flight from risk. The GDP growth for seven consecutive quarters was associated with positive results from net exports. However, the first signs of a deterioration in the situation in foreign trade was found in October's data. Supplies from Japan grew for 11 months in a row but they do not reach the consensus forecast of Bloomberg experts and are late for imports.

Dynamics of Japan's imports and exports

Source: Bloomberg.

If domestic demand is the main driver of the recovery of the euro-zone economy, Japan is growing at the expense of external demand. And if net exports begin to flounder, the credibility of Abenomics against the backdrop of GDP slowdown will melt before our eyes. This will increase the risks of BoJ's departure from its soft monetary policy and will strengthen the yen. However, the October failure of foreign trade may turn out to be the usual market noise.

In any case, the main driver of the future dynamics of USD / JPY is the tax reform. Voting on the project in the Senate will be held on the following week after the Thanksgiving. The slightest negative, in the form of the emergence of new dissenting Republicans, will help strengthen reliable assets. Pressure on the dollar can create a publication of the protocol of the October meeting of the ECB. The tabloids say that there are at least four people who disagree with the QE extension policy without setting a deadline for the program. The split in the ranks of the Governing Council is a bullish factor for the euro and the growth of the EUR / USD will affect other instruments of the foreign exchange market.

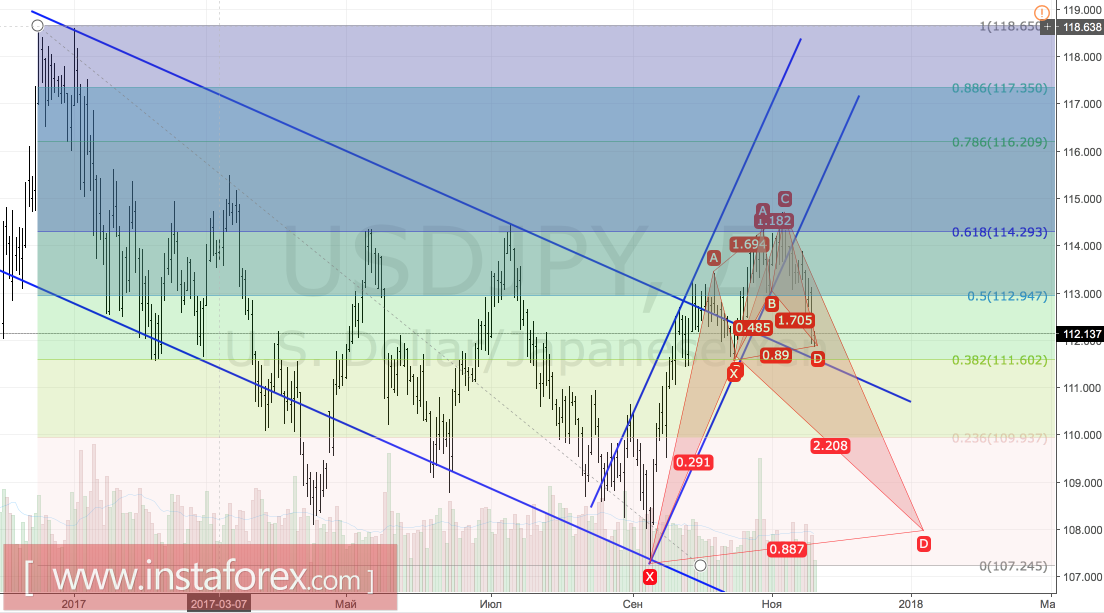

Technically, the future of the USD / JPY pair will depend on the ability of the "bears" to update the October low near 111.6. There is also the upper limit of the previous downward trading channel. Returning quotes to its limits and activating the mother pattern "Shark" will increase the risk of continuing the peak in the direction of 108. On the contrary, the release will create the preconditions for a gradual recovery of the "bullish" trend.

USD / JPY, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română