The dollar finished the week in different directions. It withstood the pace of strengthening against commodity currencies but noticeably sagged against defensive assets.

There are several reasons, as usual. The expected inflation report on Wednesday was slightly higher than forecast and core inflation rose to 1.8% for the first time in 5 months. However, there is still no confidence in a sustainable recovery. What's disappointing was the report on retail sales for October where growth was only by 0.2% against 1.9% a month earlier. Without taking into account cars, the growth was even symbolic. Weak consumer activity does not give confidence that inflation will accelerate.

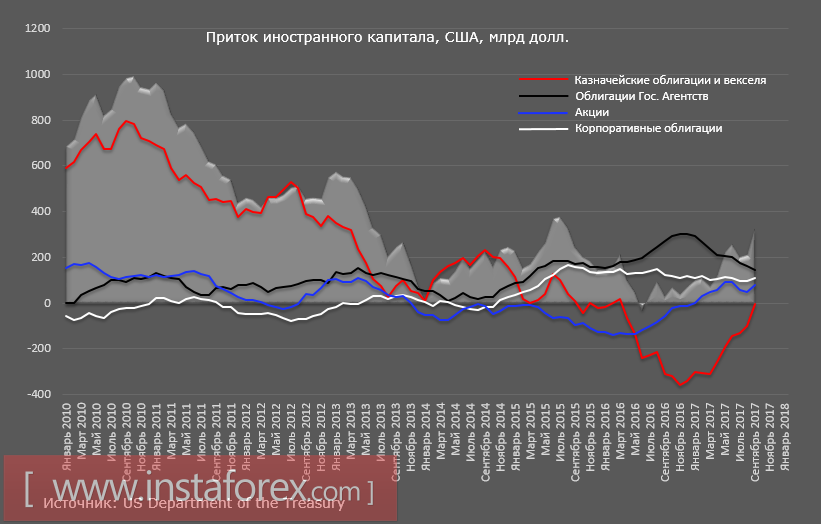

As per the report published on Wednesday by the Treasury, the inflow of foreign capital into the US is gradually increasing. The break occurred in December last year, after the victory of the Donald Trump in the presidential elections. The demand for US Treasury bills began to recover, which indicates the growing level of expectations associated with the implementation of reforms.

The question of trust at the current stage looks somewhat unusual. On Thursday, the House of Representatives of Congress approved a bill on tax reform in the US. This step was to inspire bulls in the dollar to reach new heights. However, the opposite happened. The demand for gold and defensive assets increased sharply despite the fact that the overall macroeconomic background remained generally positive. The reason for this is that, despite the victory in the lower house, the risks of non-passage of the law through the Congress have increased. The House of Representatives adopted a reform plan with a vote of 227/205. No Democrat voted for the bill and moreover, 13 Republicans also voted against it. This means that there is no consensus among Trump's associates on the party of unity. The approval by the Senate is thus, jeopardized despite Republicans having a slight advantage in the upper house of Congress with 52 votes against 48.

The market took this result as a threat of growth in political risks, which led to an increase in demand for defensive assets.

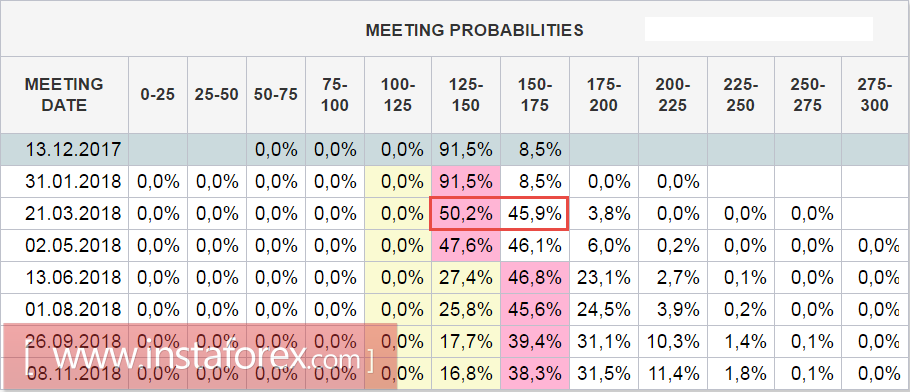

As for the economic risks here, in fact, no changes are observed. According to the CME futures market data, the forecast for the growth rate of the Fed rate is that there will be no changes. Investors take into account the 50% chance that in March 2018, the rate will be raised again. This means that the market sees no macroeconomic threats to the Fed's plans.

The same position is also voiced in the results of the annual meeting of the IMF, which marks a steady recovery in the US economy. However, this did not prevent the revision of the forecast for GDP growth rates of the US in the direction of decline. This step of the IMF explains that there was a need for correction in US fiscal policy because reducing taxes will result in the budget losing about 1.5 trillion in revenues over 10 years. For sustainable development, they need to be found elsewhere.

The key day of the coming week is Wednesday. A report on orders for durable goods, which accurately reflects consumer activity and the level of production loading, will be published. Forecasts are bad. It is expected to indicate a reduction in the volume of orders to 0.5% versus 2.2% in September. Weak expectations will put pressure on the dollar. The minutes of the FOMC meeting on November 1 will also be published on Wednesday, which is unlikely to have a significant impact on market sentiment. The last meeting of the Committee did not bring any new information and from the protocols, the markets also do not expect any revelations.

In general, the dollar remains to be the favorite. There are no threats to the Fed's adjustment so the spread of yields will grow, regardless of any political risks. The defensive currencies will need to find some additional arguments for it to continue growing. In general, the markets can spend a week in a sideways movement since no important events that can dramatically change the mood of investors are expected.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română