Fed tweaks the program

- Adjusts main street program to encourage small loan provision

- PPP loans of up to $2m can be excluded from borrower debt

- Main St to date has made loans totaling $3.7B

- Feeds have also been adjusted to encourage provision of smaller loans

The Fed will do anything to keep the market up.

Further Development

Analyzing the current trading chart of Gold, I found that Gold reached my frist downside target at $1,870 but that today we got reaction from buyers.

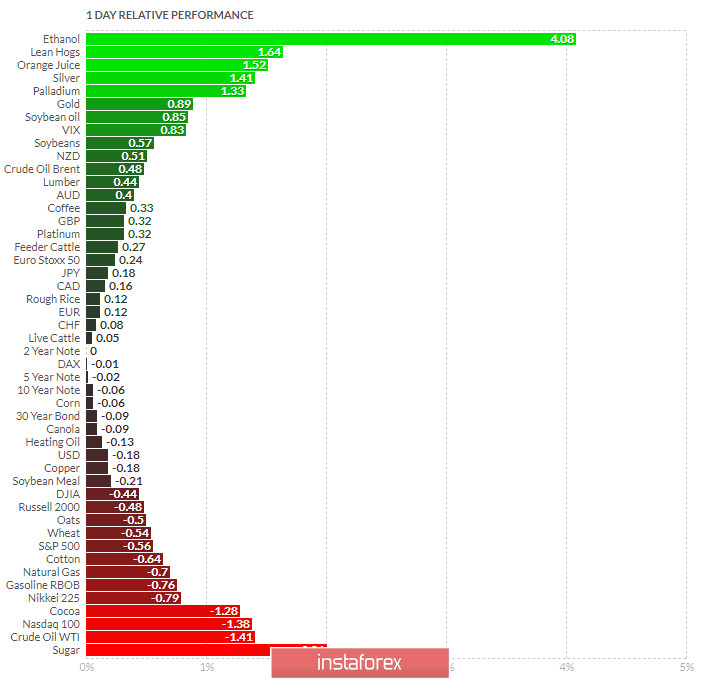

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Ethanol today and on the bottom Nasdaq100 and SP 500.

Gold is positive today on the relative strength list but with potential for overbought zone on intraday.

Key Levels:

Resistance: $1,890

Support level: $1,848

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română