Trading plan 30.10 - 3.11.2017

Important news of the week.

The overall picture: Last week, the EUR/USD pair ended with a strong fall in its rate due to the ECB's decision and the crisis on Catalonia-Spain.

On Monday morning, the Catalonia crisis seems to have receded. ECB's decisions as a whole were more likely to strengthen the euro, so the fall of the euro may not be very deep and long. But the 1.1500 rate is quite achievable, and can even reach up to 1.1300.

Important news of the week. On Monday, an important report on US consumer income/expenditures shows the market expects a fresh data on the RFE inflation index scheduled today at 12.30 London time.

Then, an important data on Wednesday is from the Fed.

In addition, on the same day, Wednesday, the report on US employment from ADP and the ISM manufacturing index, in general, is a day of big news and possible volatility.

On Friday - the report on employment in the US Nonfarm payrolls shows forecasts are very high, reaching up to +300K.

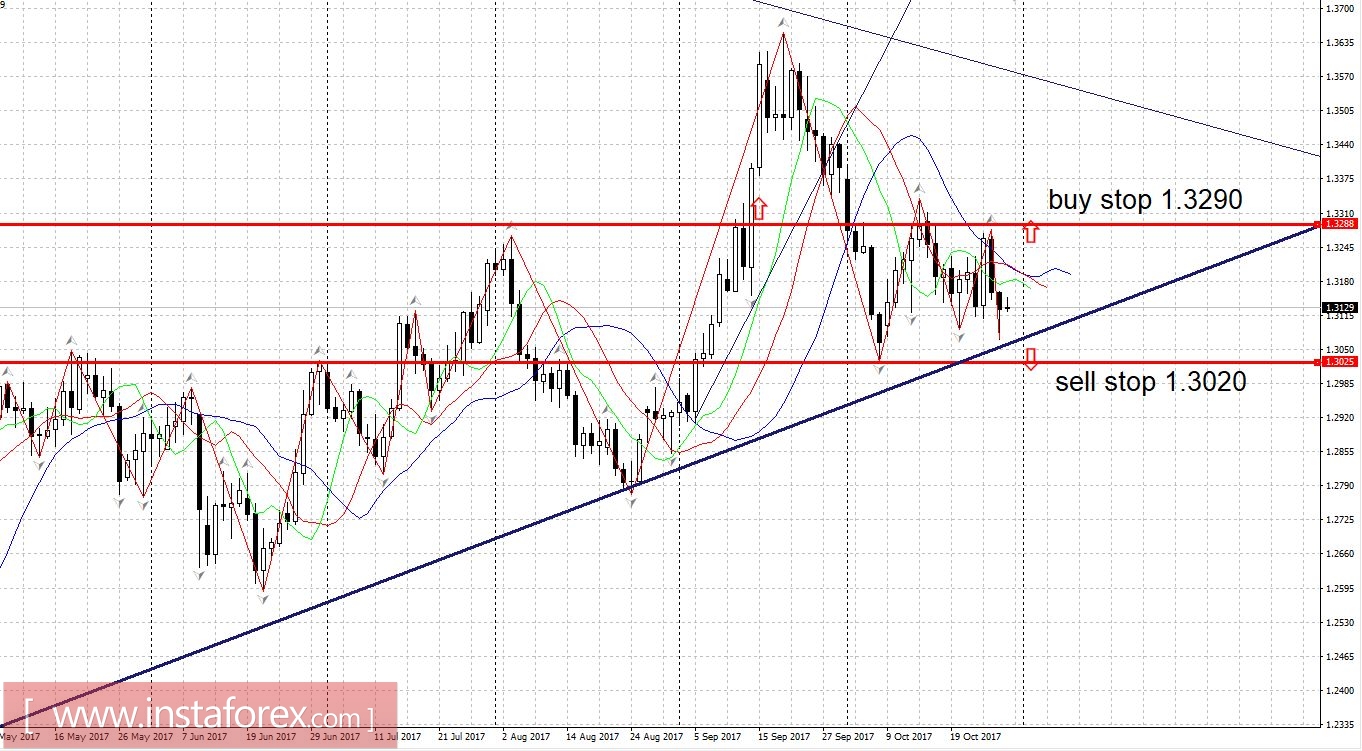

On GBPUSD: On Thursday, the decision of the Bank of England about the rate hike is highly expected by everyone.

The pound formed a hard range before deciding on rates.We trade for a breakthrough:

We are buying from 1.3290.

Sell from 1.3020.

* The presented market analysis is informative and does not represent a transaction guide

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română