The news of the Liberal Democratic Party's victory in the parliamentary elections in Japan allowed the USD / JPY quotes to rise above the 114 mark for the first time since the beginning of the year. Supporters of Shinzo Abe managed to get the so-called super-majority, allowing them to control the country's highest legislative body and increasing the likelihood of the re-election of their leader for a third term. In the end, Abe will be the longest-serving Prime Minister of Japan. His policy, "Three Arrows" will continue to be realized. Simultaneously, the victory of the liberal democrats raises the chances of preserving the ultra-soft monetary policy of BoJ, which is a "bearish" factor for the yen.

Since 2012, the reduction has led to a depreciation of the Japanese currency by 20% and the growth of stock indices by half. The results of the parliamentary elections reduce uncertainty, which allows us to count on the continuation of the rally in the stock market. However, according to BTMU, no serious reforms are expected in the near future so the growth potential of the Nikkei 225 and USD / JPY looks limited. Moreover, Donald Trump, whose position on the devaluation of currencies-competitors of the US dollar is widely known, may visit Tokyo in November. However, the Ministry of Finance and the Bank of Japan did not restrain the weakening of the yen through verbal intervention.

Dynamics of Nikkei 225

Source: Bloomberg.

Curiously, on the eve of the announcement of the results of the October meeting of the ECB, a number of popular media expressed the idea that it would be good for the Governing Council to follow in the footsteps of the Bank of Japan. Their policy of targeting the yield curve is gaining more and more supporters. It allows them to keep the rates of the debt market at a low level, without expending on this previous effort. The volume of bond purchases within QE is gradually decreasing as the yield of US bonds increases. As a result, payments on public debt remain at a low level and the probability of recurrence of the cone-hysteria 2013, when the Fed announced its withdrawal from the quantitative easing program, is reduced to zero.

The continuation of the USD / JPY rally is facilitated by an increase in the yield of treasury bonds against the background of expectations in the implementation of the tax reform. The adoption of the draft budget by the Congress for the next financial year and a reservation of reconciliation allows for a fiscal stimulus to be passed by a simple majority in the Senate, 52 seats of which 100 belong to the Republicans. As a result, the US GDP is able to accelerate by 3% or more, which makes the risks of the Fed's more aggressive monetary restriction significant and inspires optimism in US dollar fans.

USD / JPY dynamics and US Treasury yields

Source: Bloomberg.

The central events of the week ending by October 27 will be the results of the ECB meeting and the release of data on US GDP for the third quarter. The second one will directly affect the rates of the US debt market and the fate of the USD / JPY pair. The market will continue to show increased sensitivity to issues of tax reform and the selection of a new head of the Fed.

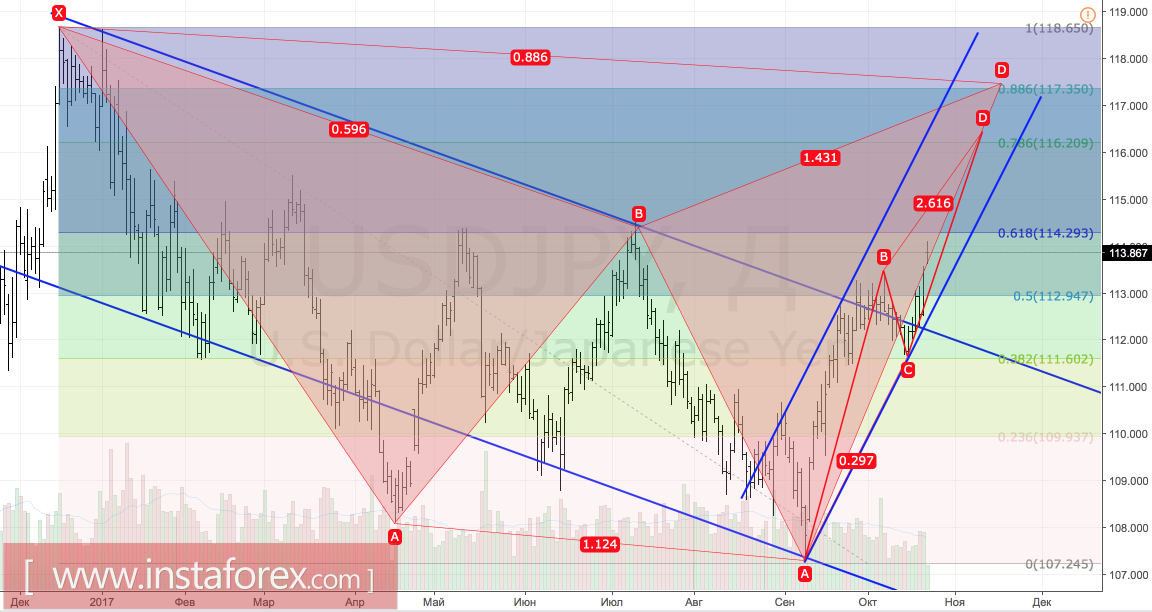

Technically, a breakthrough at resistance level of 114.3 will activate the inverted "Shark" pattern and will increase the risks of targeting by 88.6%.

USD / JPY, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română