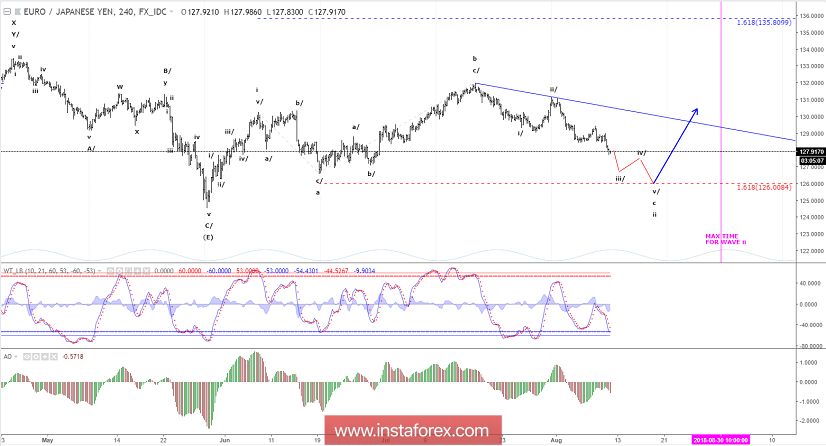

The break below support at 128.48 has shifted the preferred count in favor of a large expanded flat developing as wave ii. Under this count, the ideal target for wave C of ii is seen at 126.00 from where a new impulsive rally in wave iii should take over.

Time wise wave ii is approaching its limit, which is nine times the time-span of wave i. This time-limit is seen on August 30.

Short-term resistance is now seen at 128.48 and again at 129.00. The later should be able to cap the upside. A break above 129.00, will be the first warning that the corrective pattern in wave ii could have completed.

R3: 129.46

R2: 129.00

R1: 128.48

Pivot: 128.14

S1: 127.78

S2: 127.34

S3: 127.06

Trading recommendation:

Our stop at 128.45 was hit for a 27 pips loss. We will be looking for a new EUR-buying opportunity at 126.25 or upon a break above 129.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română