Daily Outlook

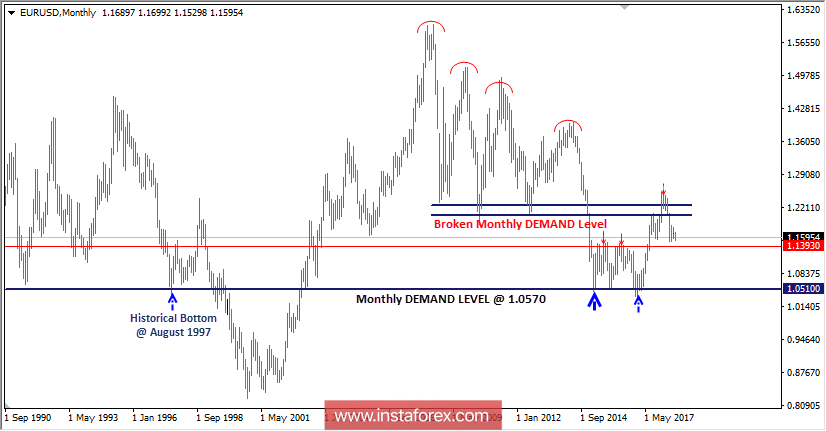

In April 2018, the EUR/USD pair outlook turned to become bearish when the pair pursued trading below the broken uptrend as well as the lower limit of the depicted consolidation range.

Shortly after, the price zone (1.1850-1.1750) offered temporary bullish rejection towards 1.1990. The EUR/USD bulls failed to pursue towards higher bullish targets. Instead, a descending high was established around 1.1990.

This was followed by a bearish breakdown below the price zone of 1.1850-1.1750. This price zone has been standing as a significant Supply zone since June 2018.

On the other hand, the price zone of 1.1520-1.1420 was considered a prominent demand zone where a valid bullish BUY entry was offered during previous weeks' consolidations.

On July 10, signs of bearish rejection were manifested around 1.1750. That's why a bearish movement was expected to occur towards 1.1650.

Lack of enough bearish momentum allowed another bullish pullback to occur again towards 1.1750 (the depicted supply zone) where another episode of bearish movement was initiated towards 1.1520.

On the other hand, recent signs of bullish rejection were expressed around the lower limit of the mentioned consolidation range (1.1520). Hence, another bullish movement towards 1.1750 should be expected.

The EUR/USD pair remains trapped within the consolidation range of 1.1750-1.1520 until breakout occurs in either direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română