The currency market is dominated by narrow ranges of the price fluctuations, but the dollar definitely holds power. On the stock exchanges, modest increases, after data and inventories, oil erases recovery and gold remains on long-term lows.

USD/JPY breaks through 113.00, EUR/USD falls under 1.1650. GBP/USD goes down at 1.31. NZD/USD completely erased the yesterday's inflation-based exchange rate and returned to 0.6760 while AUD/USD keeps close to 0.7370.

The stock markets have moderate optimism. Wall Street indexes have seen modest increases, SP500 has recovered 2,800 points. The weaker yen helps to lift the Nikkei 225, which grows for the fourth session in a row (today by 0.6%) and from the last Wednesday's hole is already about 5.0%. Chinese indices revolve around the line. The yield on US 10Y bonds is currently 2.867%.

On Wednesday the 18th of July, the main event of the day is Consumer Price Index data release from the UK, together with PPI Input and PPI Output data. Moreover, there will be Consumer Price Index data released from the Eurozone and Building Permits data release from the US. There is a scheduled speech from Federal Reserve Chairman Jerome Powell just at the beginning of the US session as well.

EUR/USD analysis for 18/07/2018:

Today, the Fed president will testify before the Senate Bank Committee. Although he may say something interesting, it should not cause a storm in the markets. The Fed very clear in its messages, the interest rate path is known in the near future, there are two more hikes this year. Recent macroeconomic data support expectations, the labor market looks solid and inflation is improving. Powell will probably repeat the message from the Fed minutes from 13 June meeting.

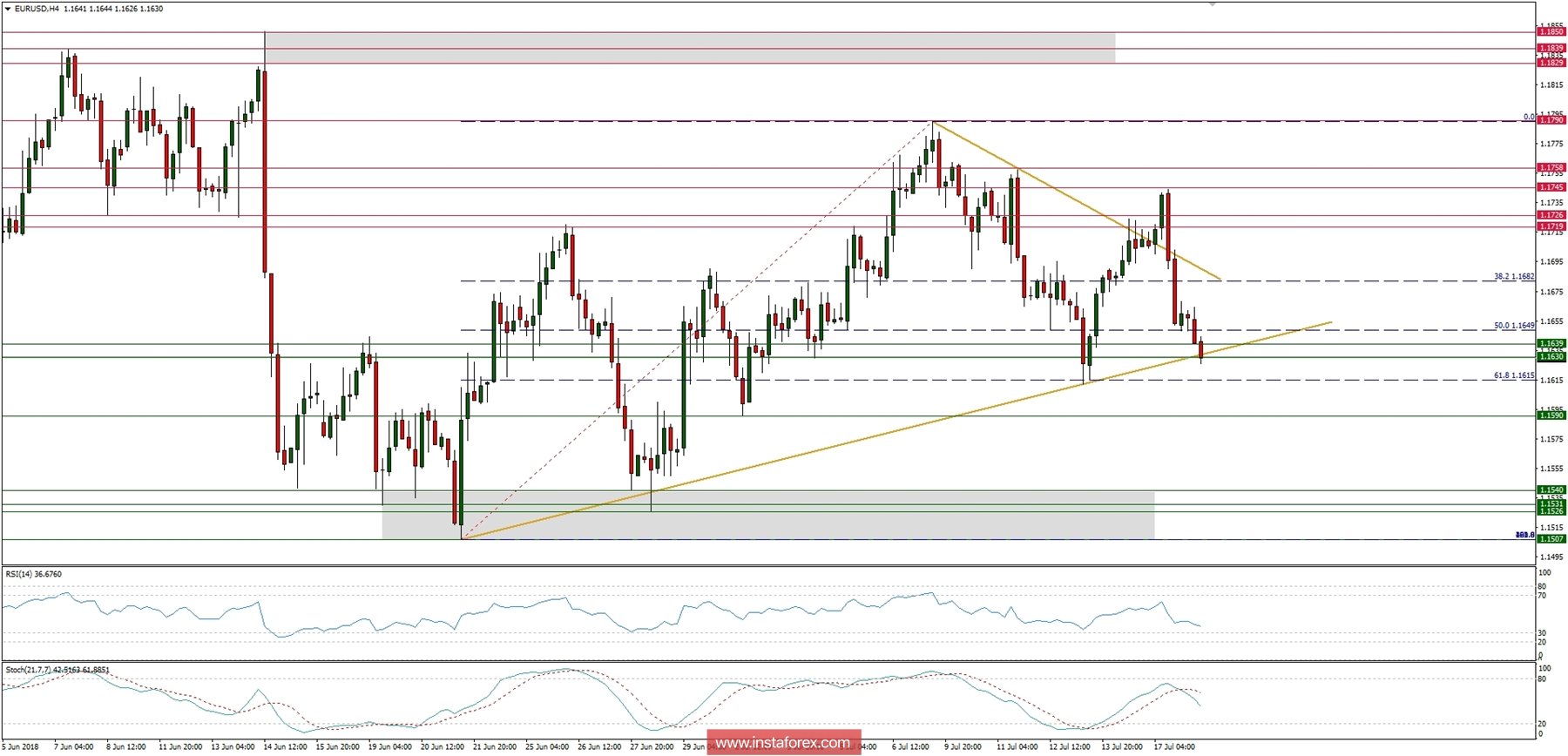

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The current market conditions are rather calm as the price is trading inside of the range between the levels of 1.1615 (61% Fibo) and 1.1790 (swing high). The recent developments have pushed the price closer to the level of 1.1615 and the momentum is now starting to move south, away from its fifty level. This might suggest the bears are preparing for a test of the 61% Figo again and a possible breakout lower towards the levels 1.1590. Please notice the price is currently at the golden trend line dynamic support as well, so it is worth to keep an eye on it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română