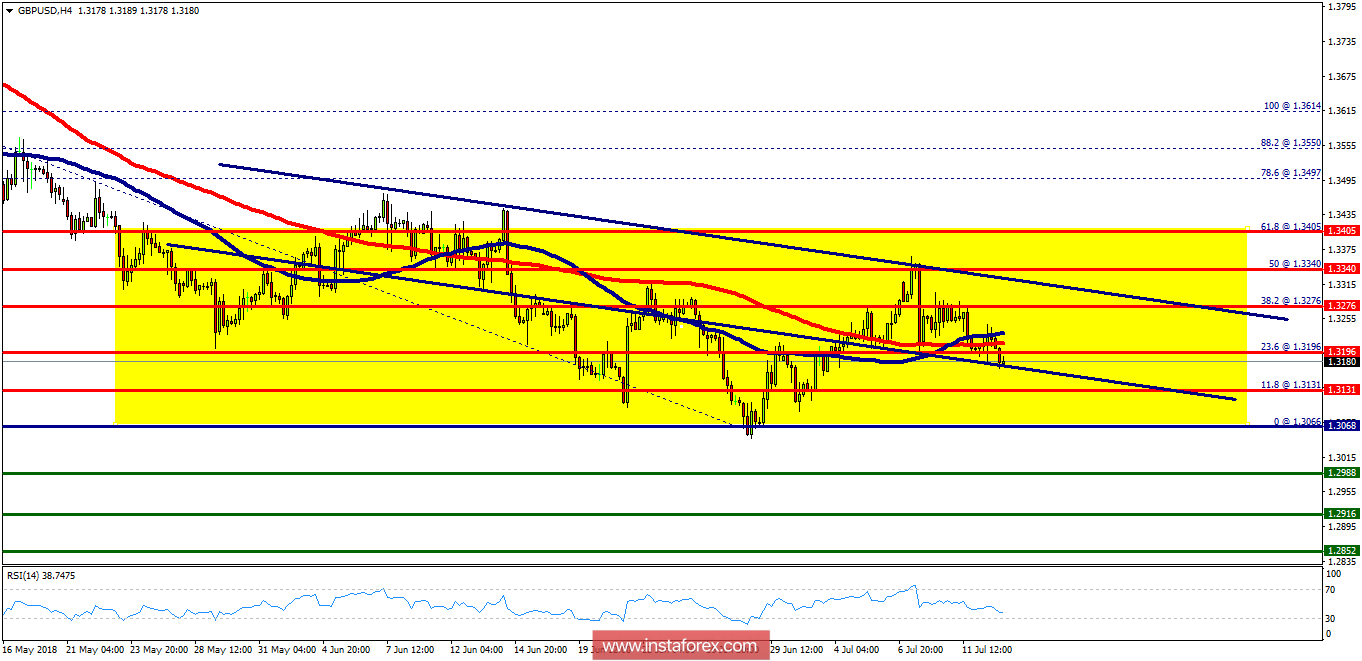

Pivot: 1.3276.

The GBP/USD pair is still moving below the daily major resistance of the 1.3276 level. It will probably continue to move downwards from the level of 1.3276 to the bottom around 1.3191. Today, the first resistance level is seen at 1.3196 followed by 1.3276, while daily support 1 is seen at 1.3068. Furthermore, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.3068. So it will be good to sell at 1.3068 with the first target of 1.2988. It will also call for a downtrend in order to continue towards 1.2919 in the coming hours. The strong daily support is seen at the 1.2919 level, which represents the double bottom on the H4 chart. According to the previous events, we expect the GBP/USD pair to trade between 1.3090 and 1.2919 in the coming two days. The price area of 1.3276 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.3276 is not broken. On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the resistance level of 1.3196, then a stop loss should be placed at 1.3340.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română