Daily Outlook

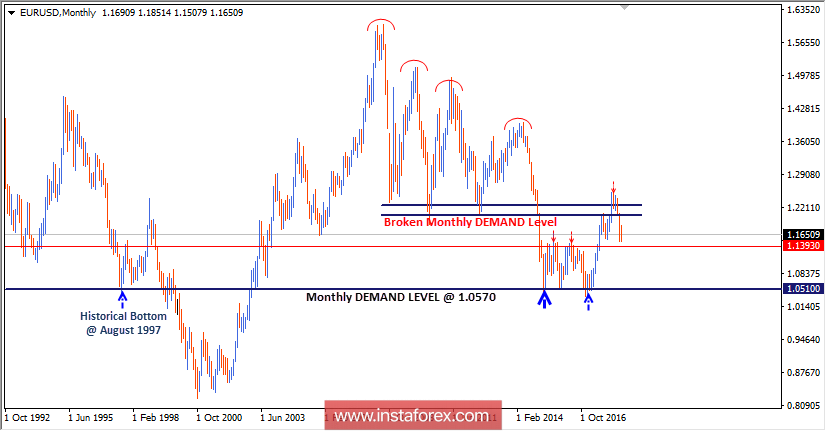

In April 2018, the short-term outlook turned to become bearish when the EUR/USD pair maintained trading below the broken uptrend as well as the lower limit of the depicted consolidation range.

Bearish persistence below the price level of 1.2200 allowed further bearish decline towards the price levels of 1.1990 and 1.1880.

As mentioned, the price zone (1.1850-1.1750) offered temporary bullish rejection towards 1.1990 where a descending high was established.

The EUR/USD bulls failed to pursue towards higher bullish targets. Instead, further bearish momentum was expressed in the market.

The price zone (1.1850-1.1750) was considered a prominent Supply zone where bearish rejection and a valid SELL entry were offered last week. Bearish target around 1.1520 was already reached on Thursday.

On the other hand, the price zone of 1.1520-1.1420 was considered a prominent bullish demand where a valid bullish BUY entry was offered during this week's consolidations. It's already running in profits. Bullish target levels are located around 1.1650 and probably 1.1740.

However, a bearish breakdown below 1.1400 might occur if enough bearish pressure is applied. This can potentially enhance further bearish decline towards 1.1270 (recent consolidation range and demand level).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română