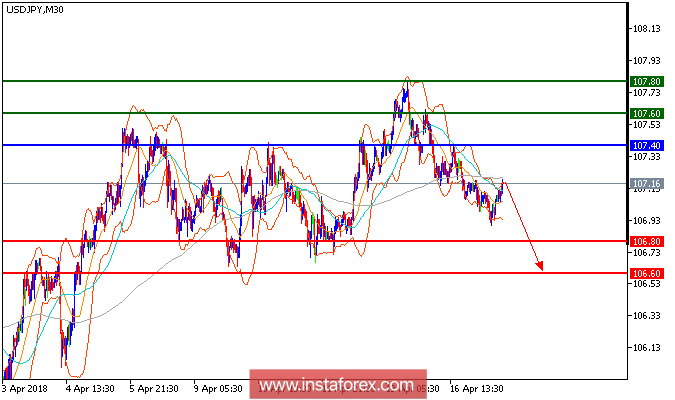

USD/JPY is expected to trade with a bearish outlook. The pair is trading within a bearish channel drawn from last Friday (April 13). It is currently testing the key level of 107.00 on the downside, as the 20-period and 50-period moving averages are badly oriented. The relative strength index remains subdued in the 30s, suggesting a lack of upward momentum for the pair. Below 107.40, the next support (downside target) at 106.80 would come into sight.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, stop loss at 107.40, take profit at 106.80.

Resistance levels: 107.60, 107.80, and 108.20

Support levels: 106.80, 106.60, and 106.20.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română