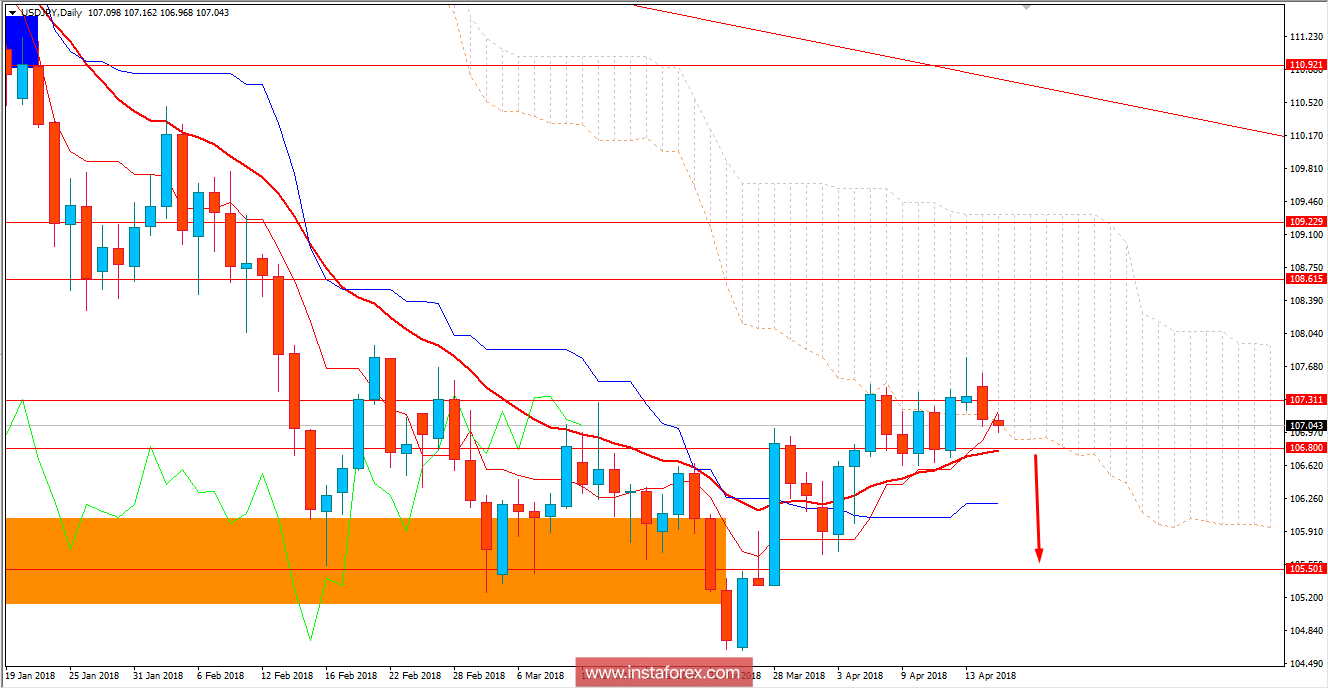

USD/JPY has been residing inside the corrective range of 106.80-107.50 price area for a few days now from where bearish momentum is expected to push the price lower in the coming days. There are certain tensions going on in the market for which certain volatility and correction is being observed. Market participants are currently looking forward to the Wednesday Trump meeting on a possible two-way free trade agreement which is more likely to be rejected by Japan and result in further gains on the JPY side. Today USD Building Permits report is going to be published which is expected to increase to 1.33M from the previous figure of 1.30M, Housing Starts is also expected to increase to 1.27M from the previous figure of 1.24M, Capacity Utilization Rate is expected to have slight decrease to 77.9% from the previous value of 78.1% and Industrial Production report is expected to decrease to 0.3% from the previous value of 1.1%. Moreover, today FOMC Member Williams and Quarles is going to speak about the nation's interest rate and monetary policy which is expected to be neutral in nature. On the JPY side, today Revised Industrial Production report is going to be published which is expected to have slight decrease to 4.0% from the previous value of 4.1%. Moreover, tomorrow Trade Balance report is going to be published which is expected to have a significant increase to 0.10T from the previous negative figure of -0.20T. As of the current scenario, JPY is expected to be quite stronger than USD this week which may lead to further bearish pressure in the pair whereas USD is expected to struggle to maintain certain momentum in the market in the coming days.

Now let us look at the technical view. The price is currently residing below 107.50 price area with confluence to the Kumo Cloud which may lead to further bearish pressure in the coming days. Though the dynamic levels like 20 EMA, Tenkan and Kijun may act as possible support for the price and prevent the impulsive pressure on the bearish side but clearing 106.80 with a daily close is expected to inject more bears in the market for the coming days. As the price remains below 107.50, the bearish pressure is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română