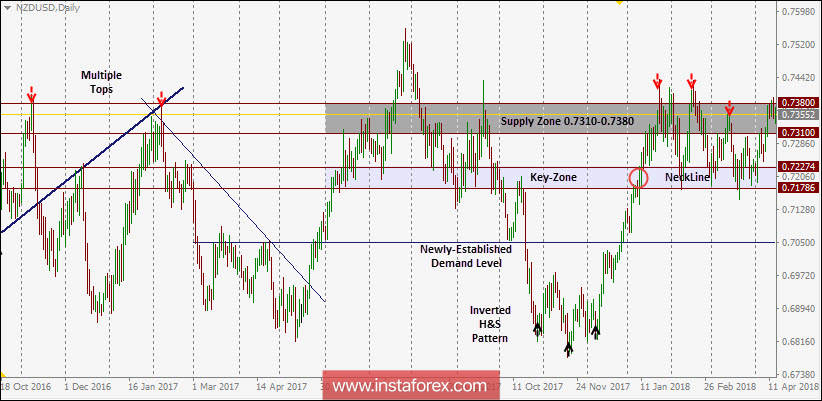

In November 2017, evident signs of bullish recovery were expressed around the depicted low (0.6780). An inverted Head and Shoulders pattern was expressed around these price levels.

The price zone of 0.7140-0.7250 (prominent Supply-Zone) failed to pause the ongoing bullish momentum. Instead, a bullish breakout above 0.7250 was expressed on January 11.

That's why a quick bullish movement was expected towards the depicted supply zone (0.7320-0.7390) where evident bearish rejection and a valid SELL entry were expected.

On February 2, a bearish engulfing daily candlestick was expressed off the price level of 0.7390.

Moreover, a double-top reversal pattern followed by another lower High were expressed around the price zone (0.7320-0.7390) where a valid SELL entry was offered as expected.

In general, the NZD/USD pair remains trapped between the price levels of 0.7200 and 0.7350 until the bearish breakdown of 0.7200 occurs.

The price zone of 0.7320-0.7390 remains a significant supply zone to offer a valid SELL entry during the current bullish pullback. A bullish breakout above 0.7450 invalidates this bearish scenario.

On the other hand, a bearish breakdown of 0.7200 (neckline) is needed to confirm the depicted reversal pattern. Bearish projection target would be located around 0.7050 and 0.7000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română