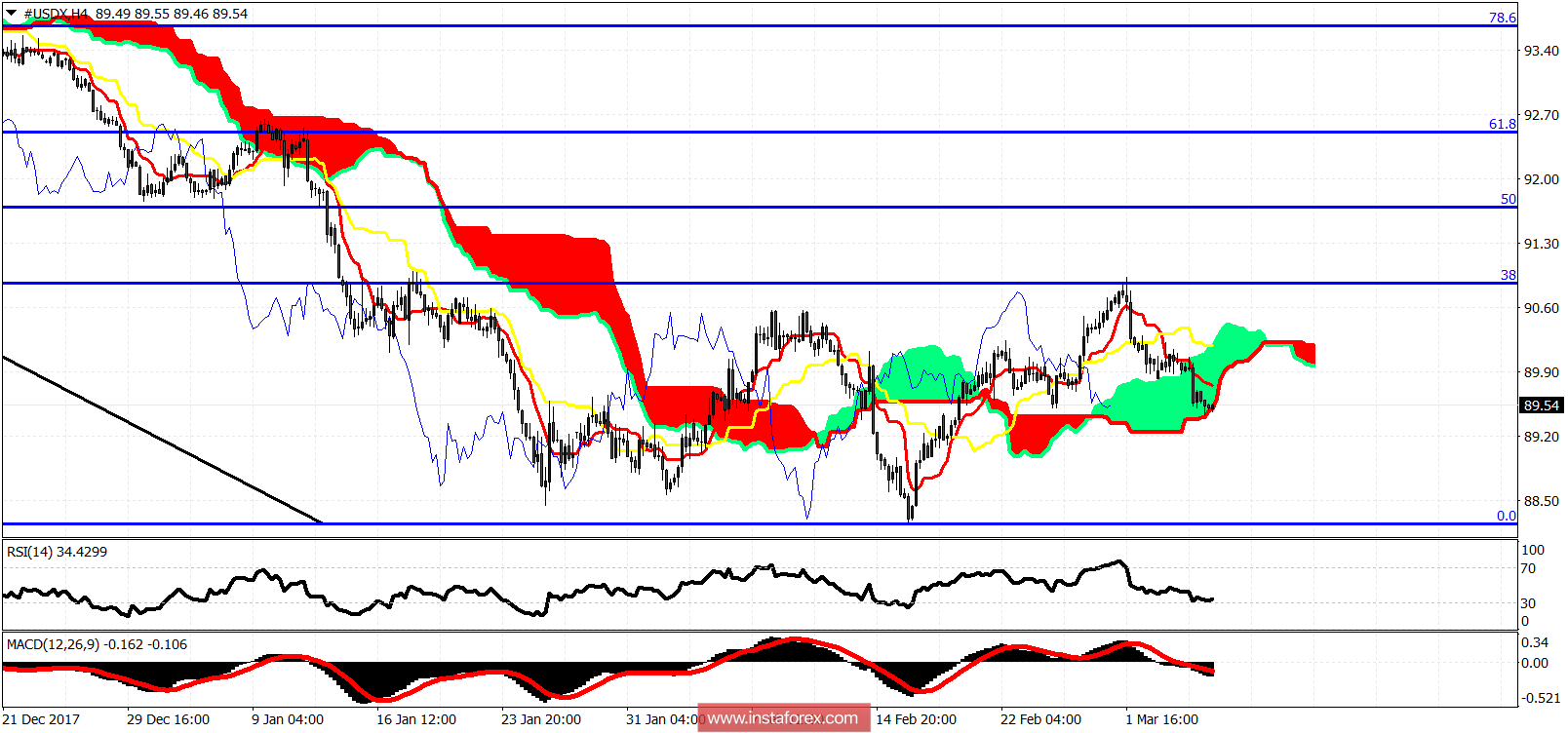

The Dollar index broke below support of 89.80 yesterday and is now testing the lower cloud boundary in the 4-hour chart. Trend has changed from bullish to neutral and is very close to turning bearish.

After being rejected at the resistance of the 38% Fibonacci retracement, the Dollar index is making lower lows and lower highs in the 4 hour chart. Price has broken below all short-term support levels we mentioned and is now testing the cloud support. Resistance is at 89.75 and bulls will need to at least break above this level soon.

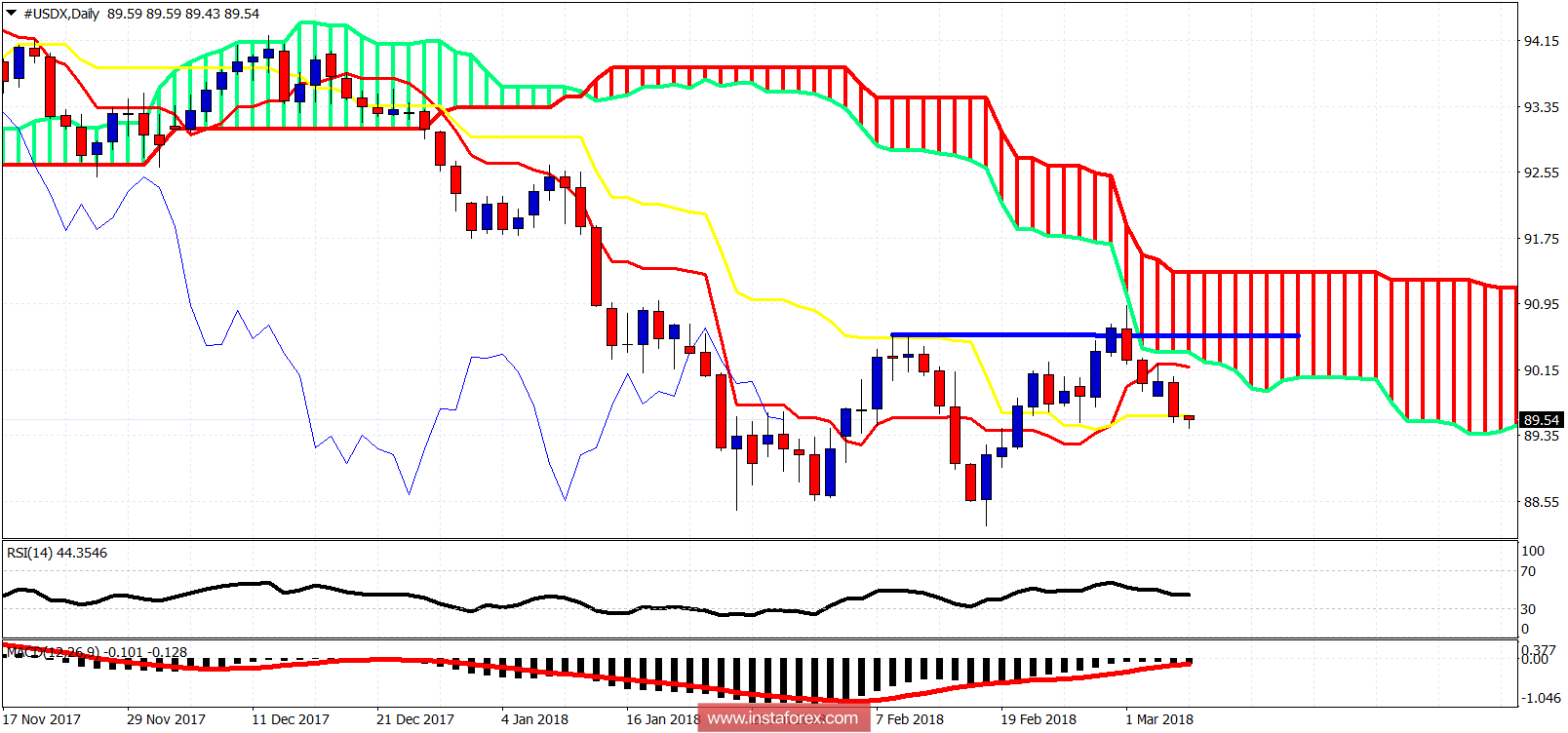

On a daily basis the Dollar index is trading just above the daily kijun-sen support. Bulls want to see buyers step in now and push the index higher. They do not want to see a daily close below the kijun-sen. With price still below the daily cloud, trend remains bearish. Strong resistance is at 90.40 This is the first important obstacle bulls must overcome. Until then, bears are in control.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română