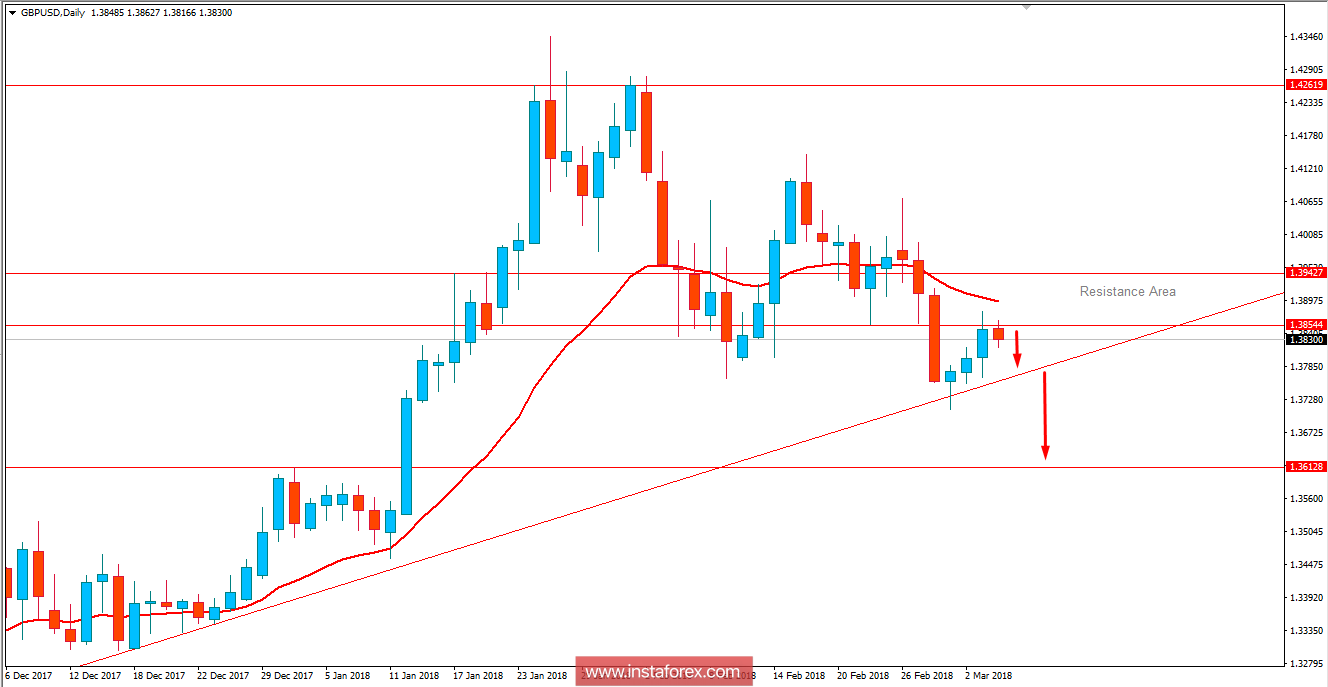

GBP/USD has been quite impulsive with the bullish gains leading to retracement towards 1.3850 price area before showing bearish pressure in the pair. The price is currently struggling to push lower towards 1.36 support area due to indecision in the market flow. Ahead of the high impact economic reports on the USD side this week and the looming rate hike in the US, the market sentiment is currently biased on the USD gains which is reflected in the market movement. Today, UK BRC Retail Sales monitor report was published with an unchanged figure of 0.6% which did not quite help the currency to gain strong momentum over USD to break higher. Moreover, today MPC Member Haldane is scheduled to speak. On the other hand, today US Factory Orders report is going to be published which is expected to decrease to -0.4% from the previous value of 1.7% and IBD/TIPP Economic Optimism report is expected to show an increase to 58.2 from the previous figure of 56.7. Later this week, Average Hourly Earnings and Unemployment Rate report are due in the US which are forecasted to be quite positive in nature ahead of the upcoming rate hike in this month. At present, USD is expected to gain further momentum over GBP in the coming days.

Now let us look at the technical view. The price is currently residing below 1.3850 resistance area from where the price is currently showing some bearish pressure as well. The dynamic level of 20 EMA is having a downward sloping shape which is currently working as confluences for the overall bearish structure. As the price remains below 1.3850-1.3950 resistance area, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română