The third quarter Preliminary German GDP data has beat the market expectations by 0.2% on a quarterly basis (0.8% vs. 0.6%) and by 0.3% on a yearly basis ( 2.3% vs. 2.0%). The detailed growth components will only be released at the end of the month but based on monthly data, the economy continues to advance. Growth was driven by three main sectors: public consumption, investment and net exports. Only the construction sector figures were worse than expected. Even if the German economy would stagnate in the final quarter of the year, GDP growth for the entire year would still come in at 2.4%; the highest reading since 2011.

Germany's economic success story goes on and on and on. Since the second quarter of 2009, the German economy has grown at a quarterly average of 0.5%. Out of the last 34 quarters, only three quarters recorded negative GDP growth. The German economy is currently showing its best performance over such a long period since the mid-1990s. And it does not look that anything is going to stop it anytime soon, which will eventually be another fundamental reason to strengthen the Euro in the mid-term across the board.

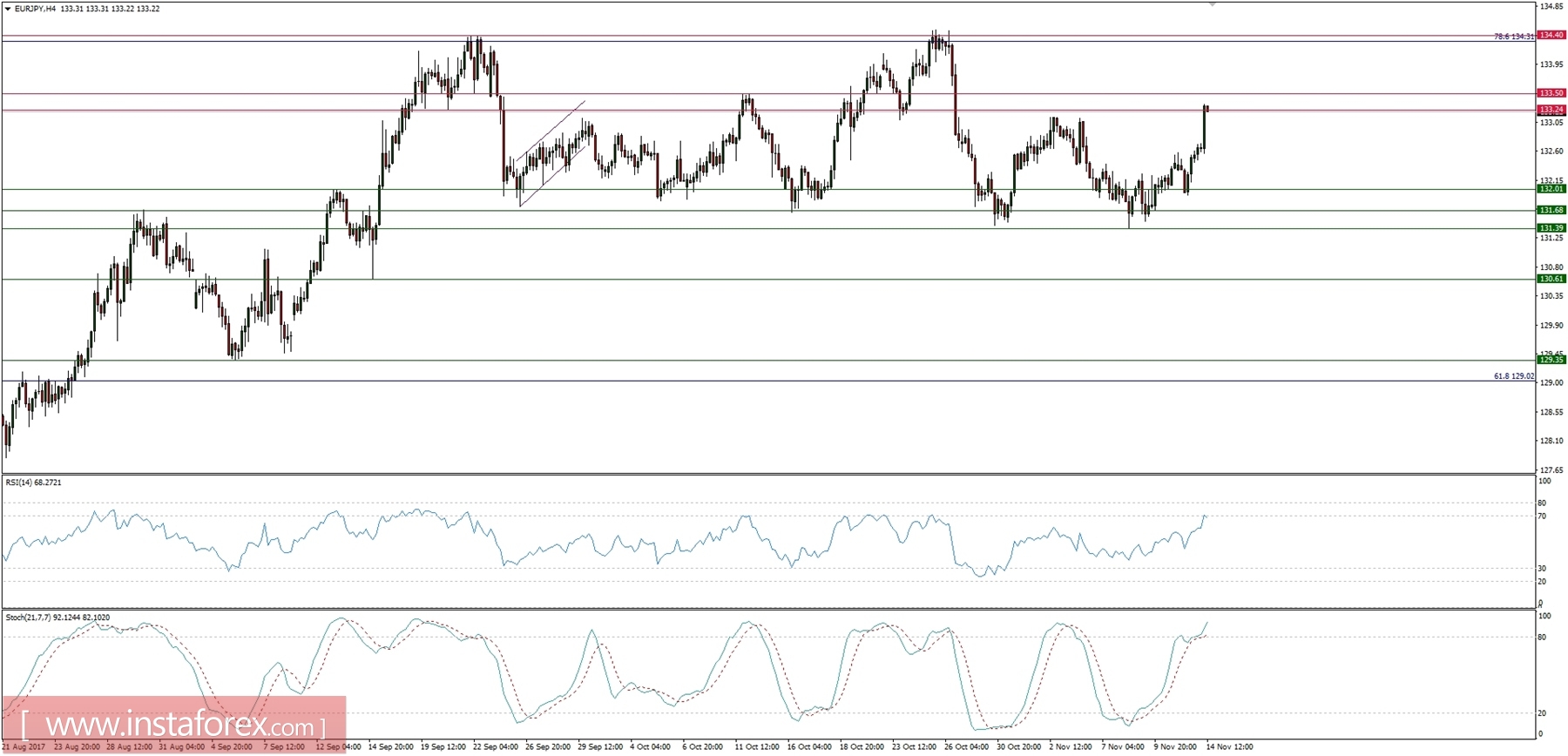

Let's now take a look at EUR/JPY technical picture at the H4 time frame. The market remains closed in a narrow consolidation zone between the levels of 131.39 - 132.24. Currently, the price is testing the technical resistance at the level of 132.24 and in a case of a breakout higher, the next technical resistance is seen at the level of 134.40.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română