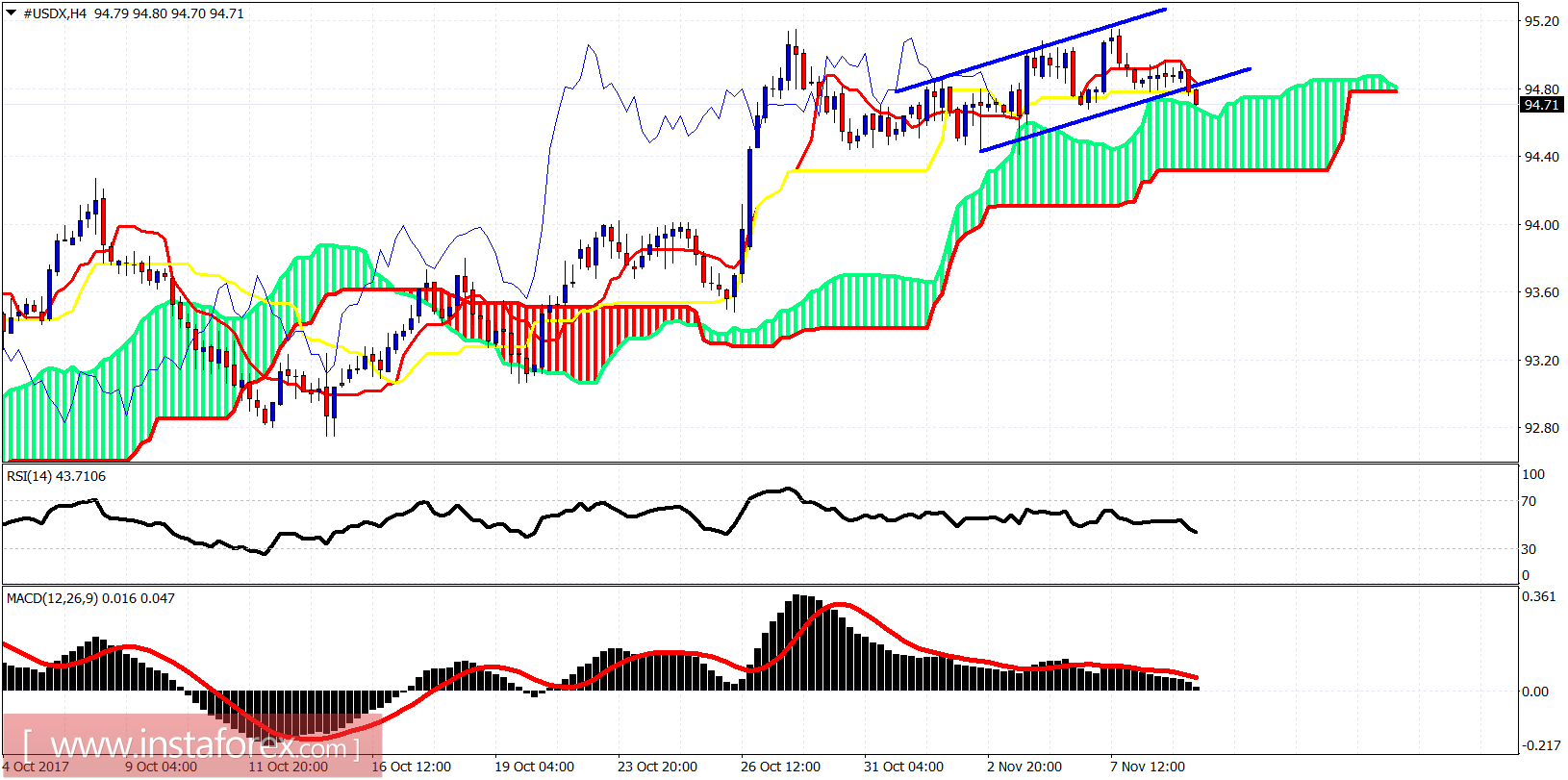

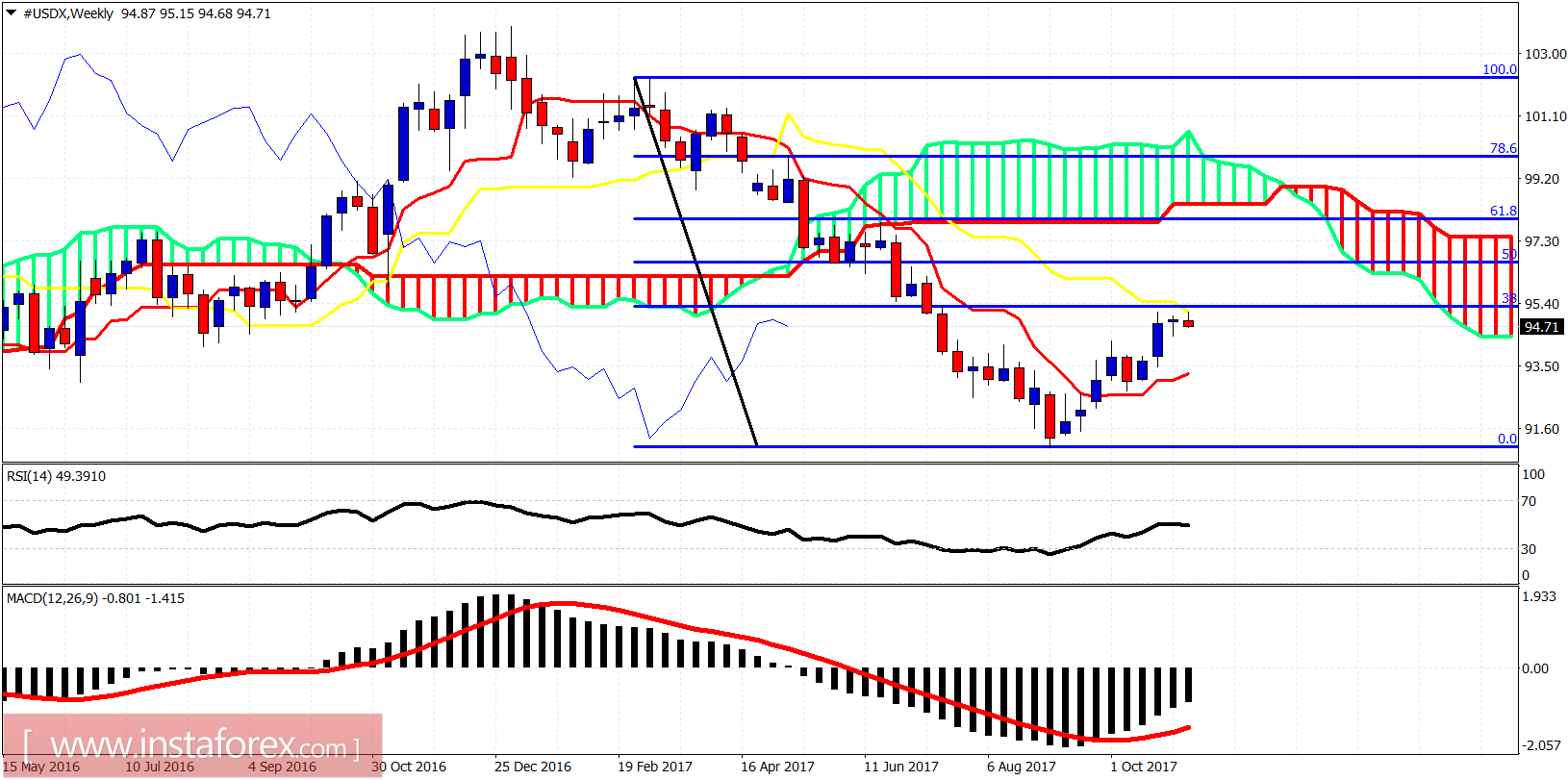

The Dollar index has broken the short-term bullish channel and has entered the 4-hour Kumo (cloud) support area. Trend has changed from bullish to neutral. The Dollar index is showing reversal signs off important medium-term resistance.

The Dollar index is about to enter the 4-hour Ichimoku cloud. This will change short-term trend to neutral. Support is at 94.69 and next at 94.30. As long as we are above these levels I believe there are still chances of seeing a move towards the big resistance at 95.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română