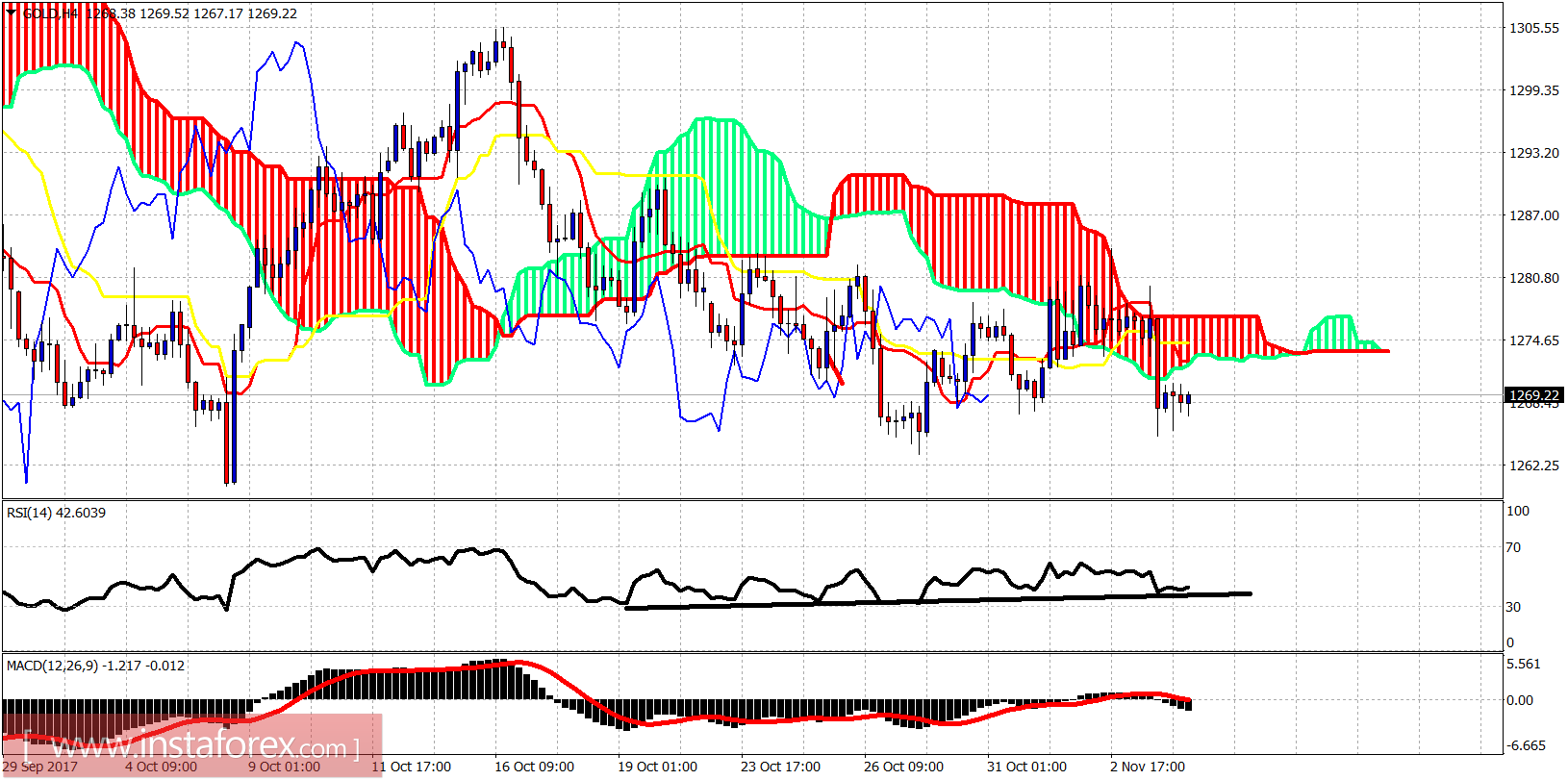

Gold price remains in a bearish trend. Price has broken again below the 4 hour Ichimoku cloud as it could not stay above $1,280 last week. Price got rejected at the important short-term resistance and that is why we closed near the lows.

Gold price is trading below the 4 hour Kumo. The trend remains bearish. Price must break above $1,277 and close above it in order for the trend to change to bullish. Gold price continues to hold above the $1,262 low but there are increased chances of breaking below it towards $1,250-45. If the RSI support is broken, we should expect price to move towards $1,250, otherwise a bounce will come towards $1,277.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română