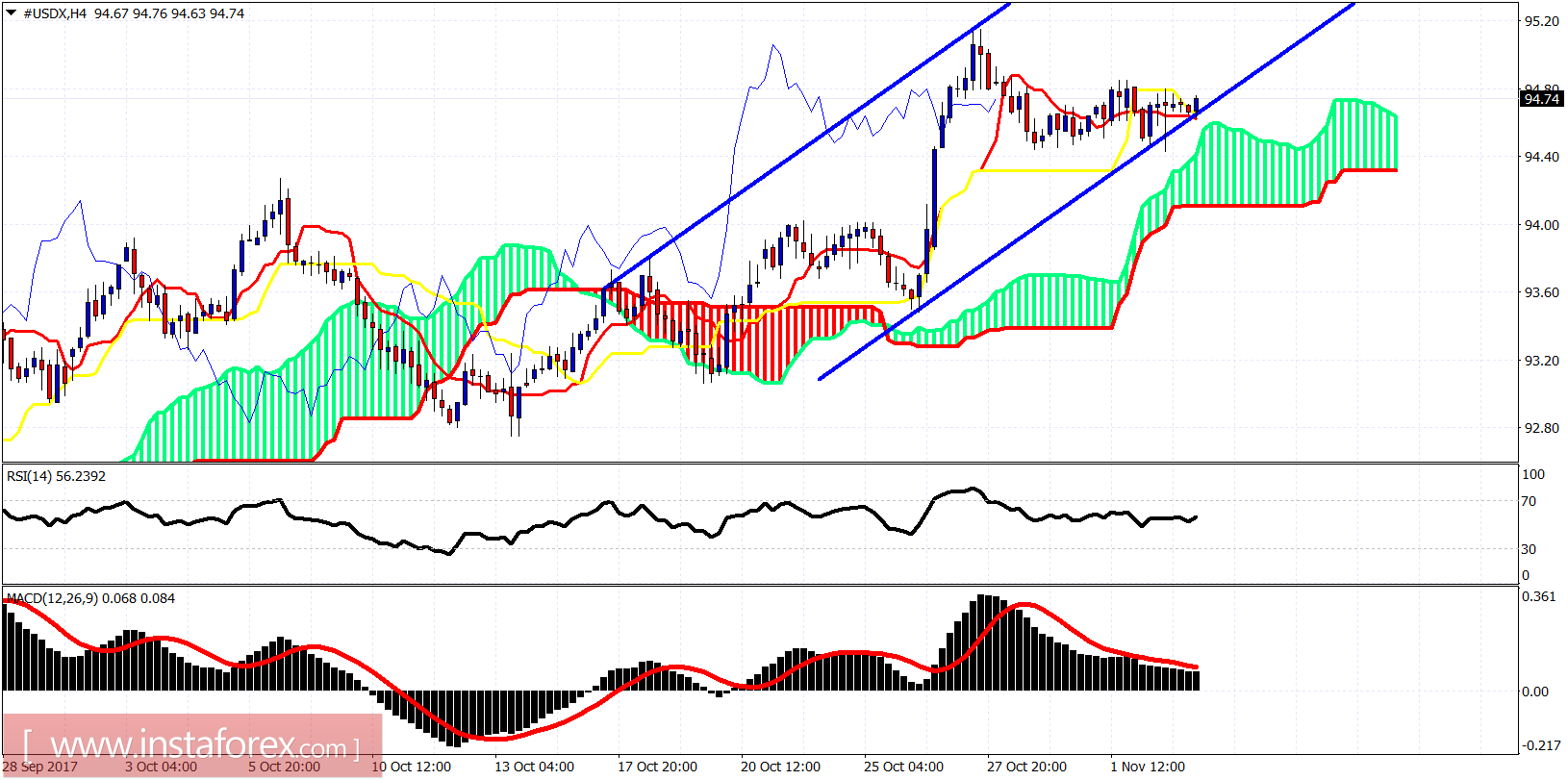

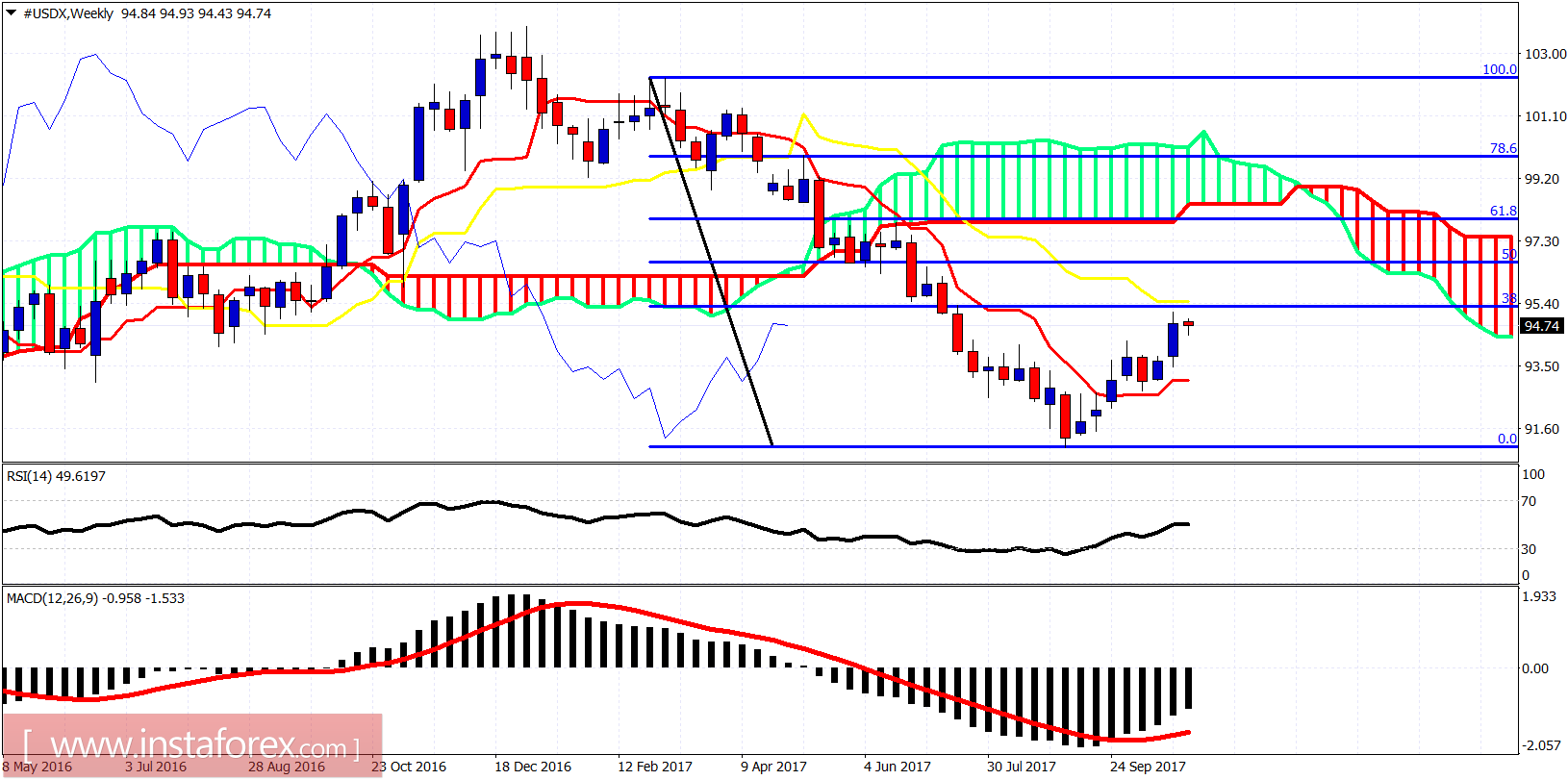

The Dollar index marginally broke below the bullish short-term channel yesterday but sharply came back inside. The announcement of Non-Farm Payrolls today could give a boost for the Dollar for the final new high. Or is this what everyone expects and the market will not deliver?

The Dollar index remains in a bullish trend. Price is breaking above both the tenkan- and kijun-sen indicators prior to the announcement of the NFP later today. Technically as long as we are above yesterday lows we should be heading towards 95-95.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română