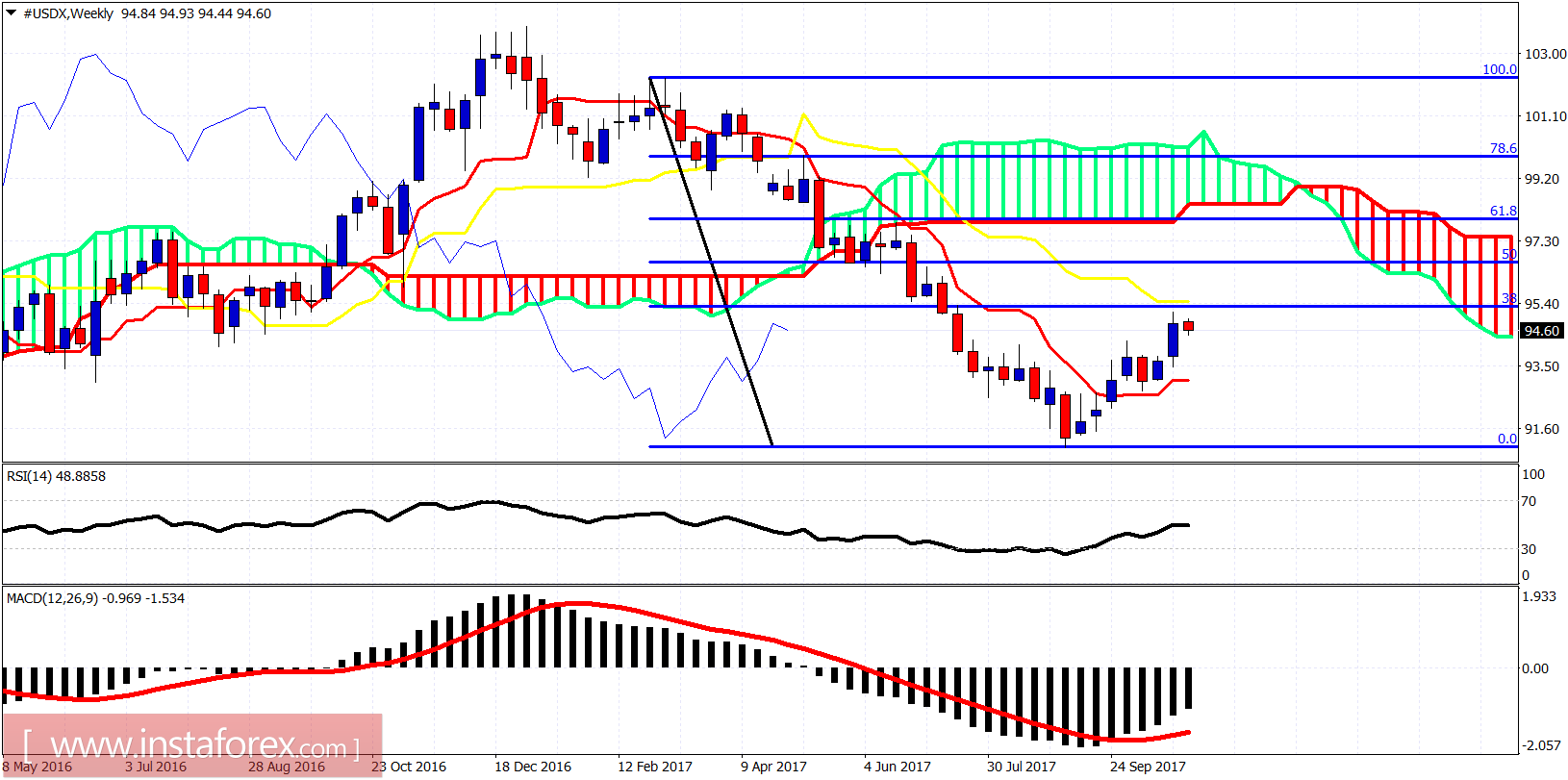

The Dollar index remains in a short-term bullish trend. The price is making higher highs and higher lows and remains inside the bullish short-term channel. The upside target remains at 95.50 as long as we trade above 93.50-94.

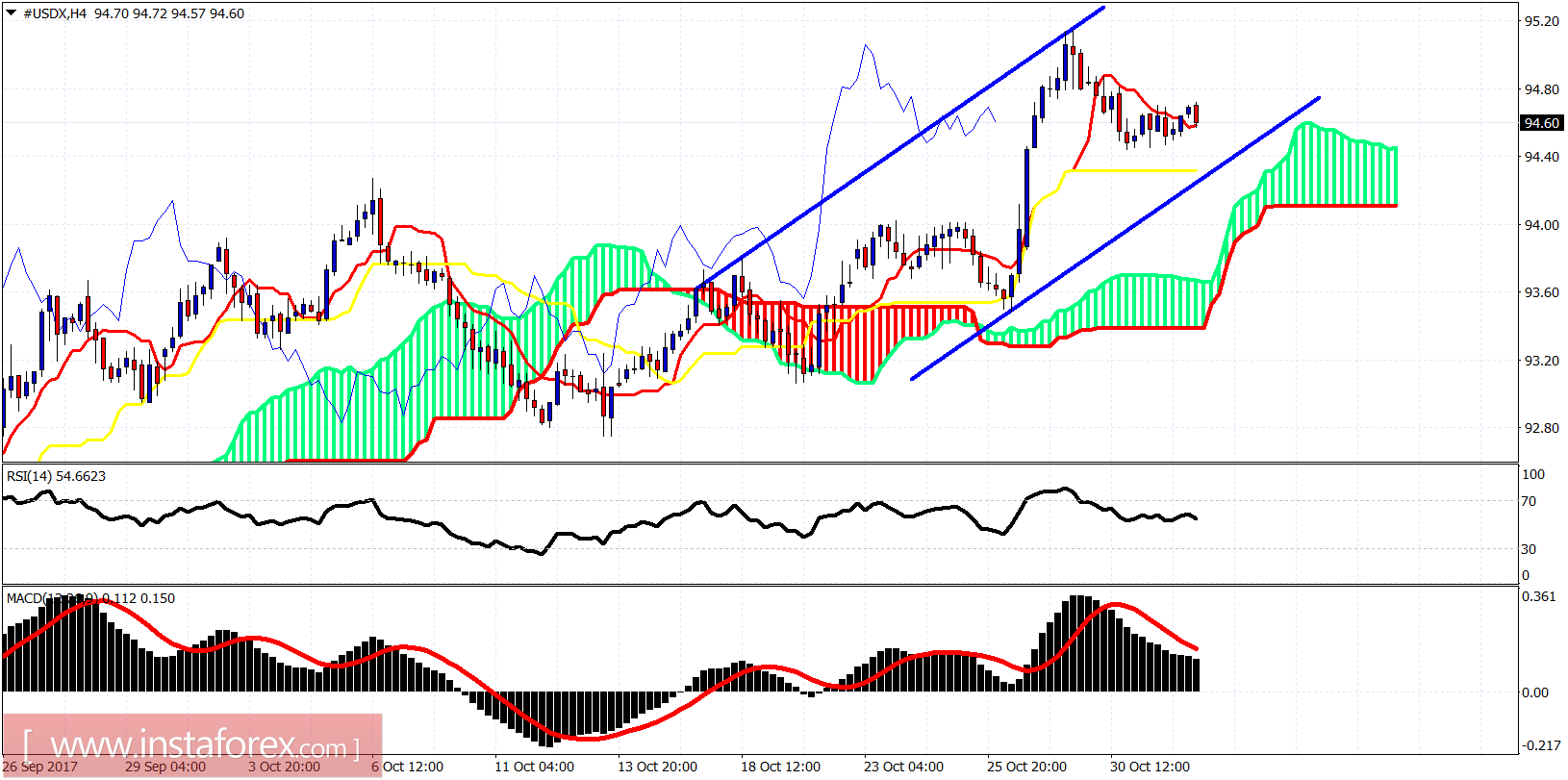

Blue lines - bullish channel

The 4-hour chart shows price above the important indicator kijun-sen (yellow line) and of course above the cloud. The trend is bullish. Support is at 94.40 and next at 94. We could test lower but for a move towards 95.50 to continue, support at 94 must not fail to hold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română