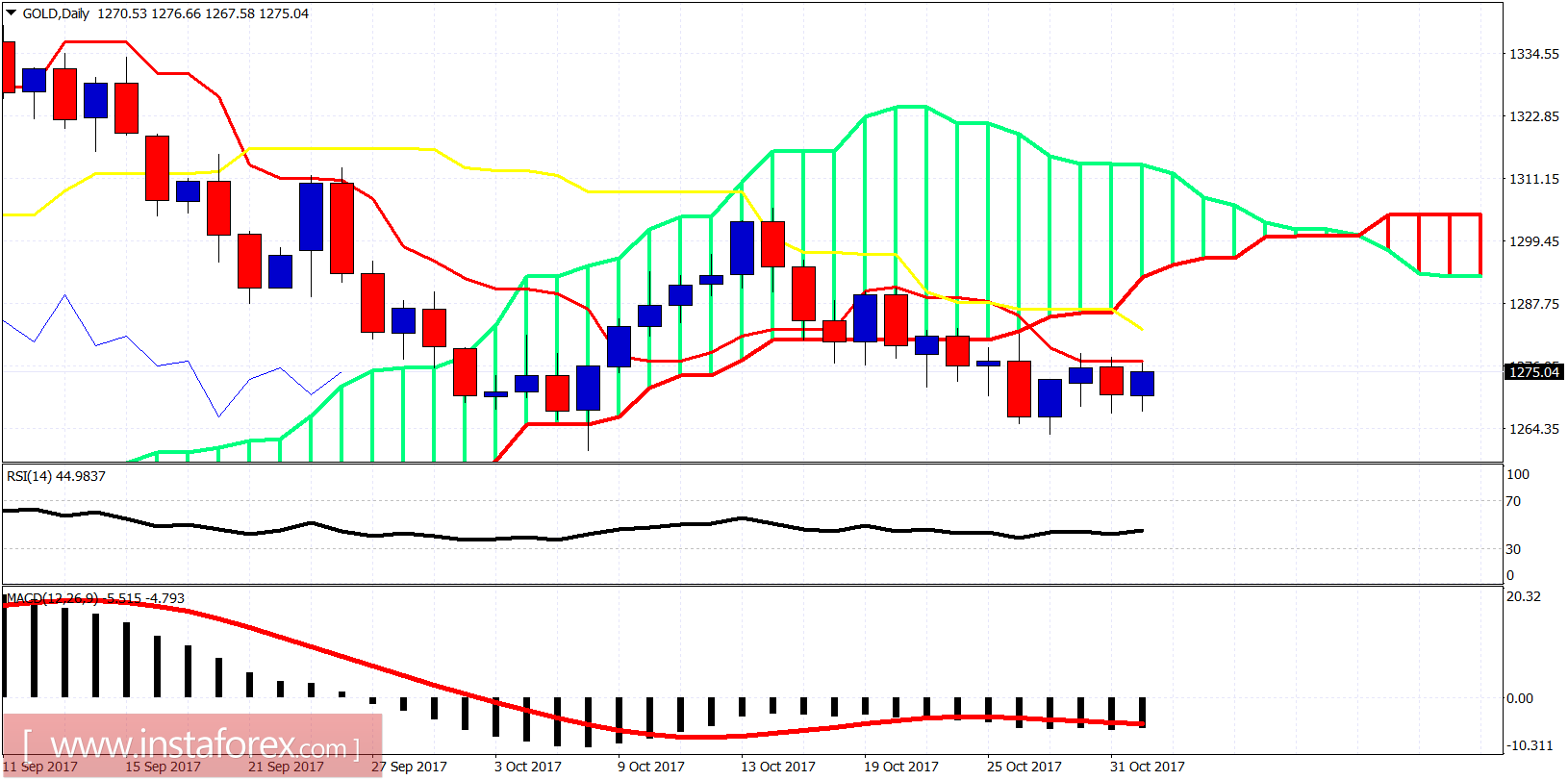

Gold has broken out of the downward sloping wedge pattern and yesterday it pulled back to back test the breakout area. Price made a higher low so far, but the short-term trend remains bearish as long as the price is below the Kumo.

Red line - support

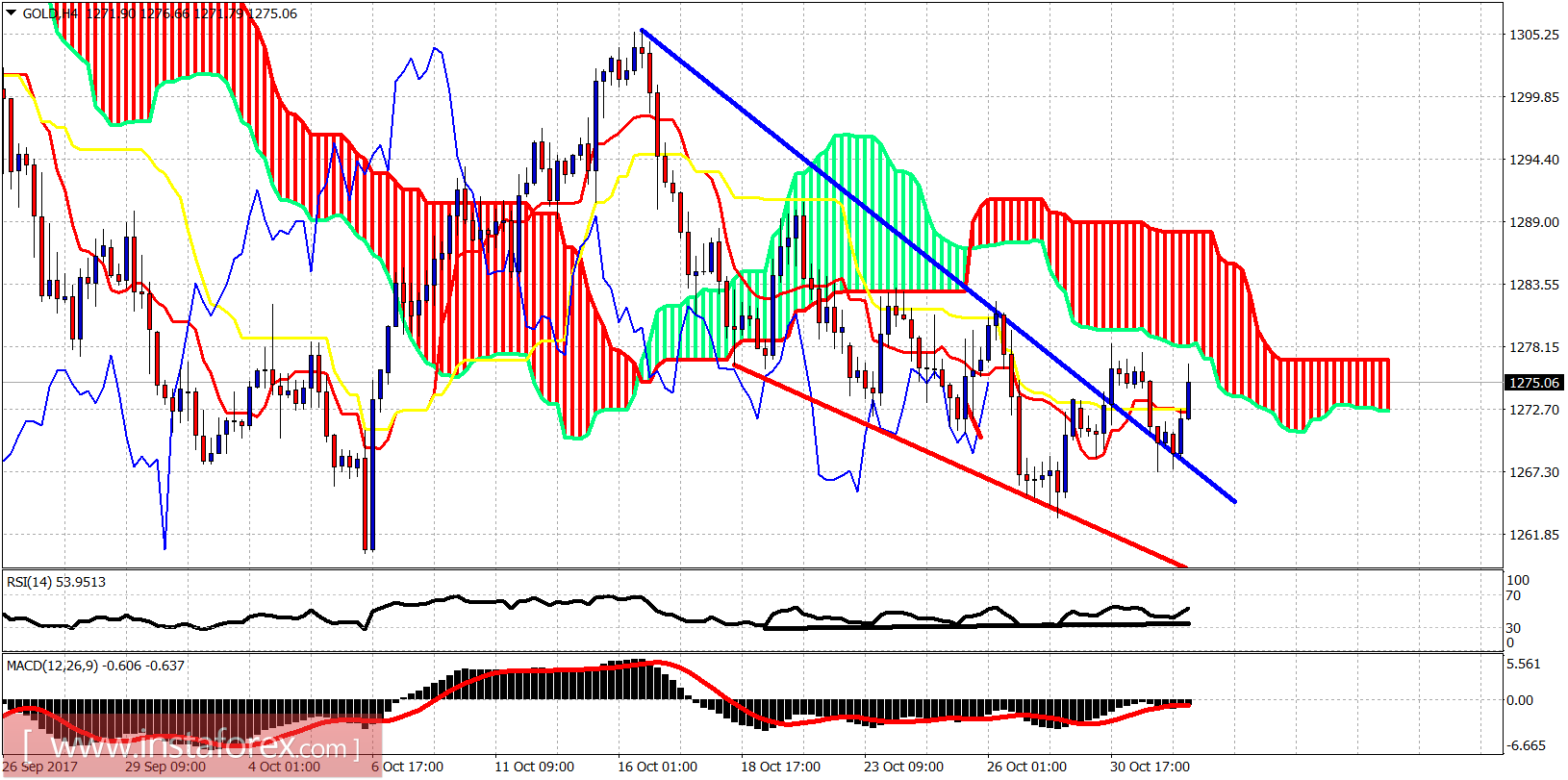

The Gold price is trading below the 4 hour Kumo (cloud) resistance. This resistance is at $1,279-83. Support is at $1,267. Breaking below support will open the way for a move lower towards $1,260 or even lower.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română