The Dollar index as expected has pulled back after the strong breakout to new highs last week. Short-term trend remains bullish as long as the price is above 93.50.

Red line - resistance (broken) now support

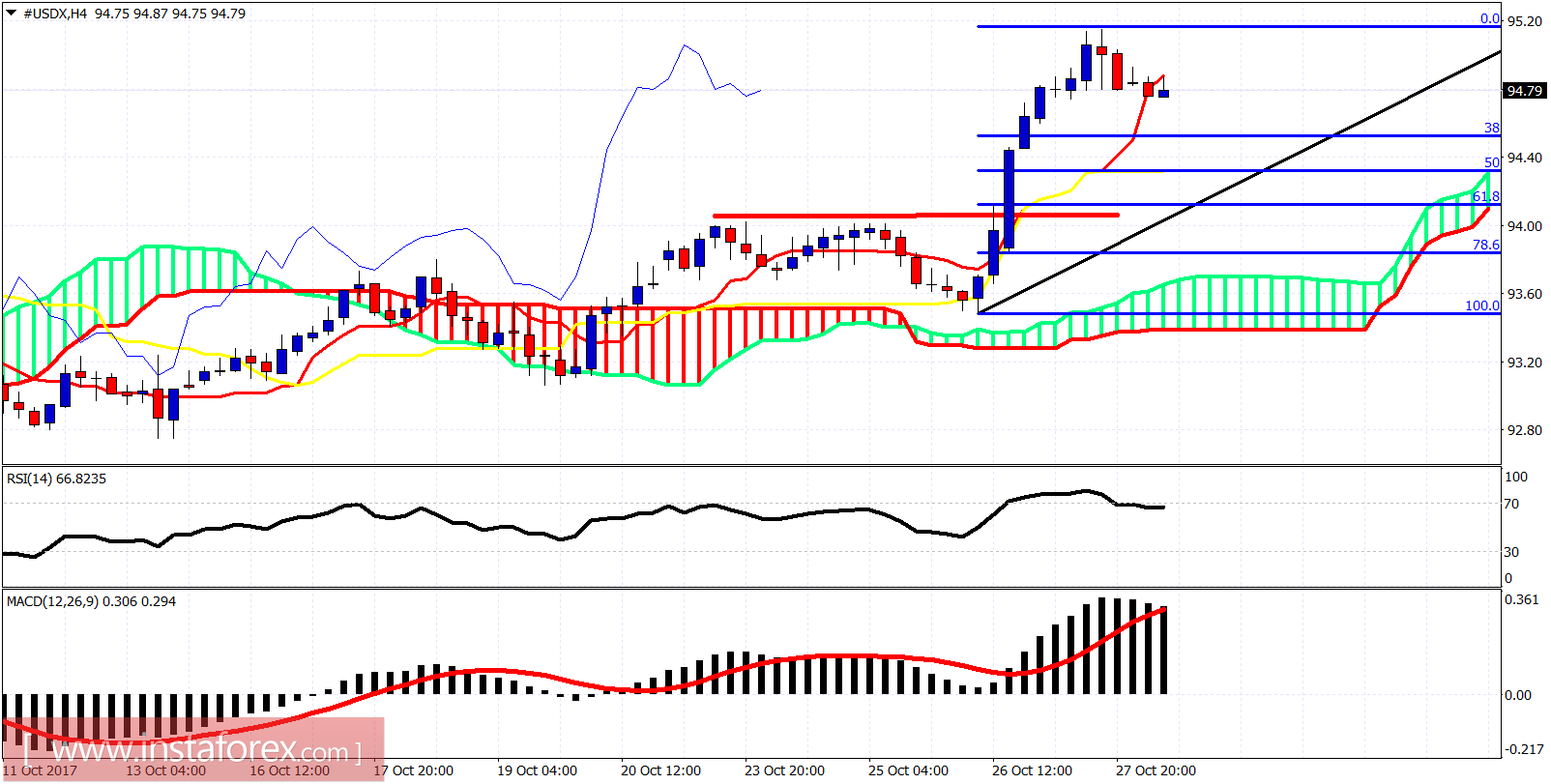

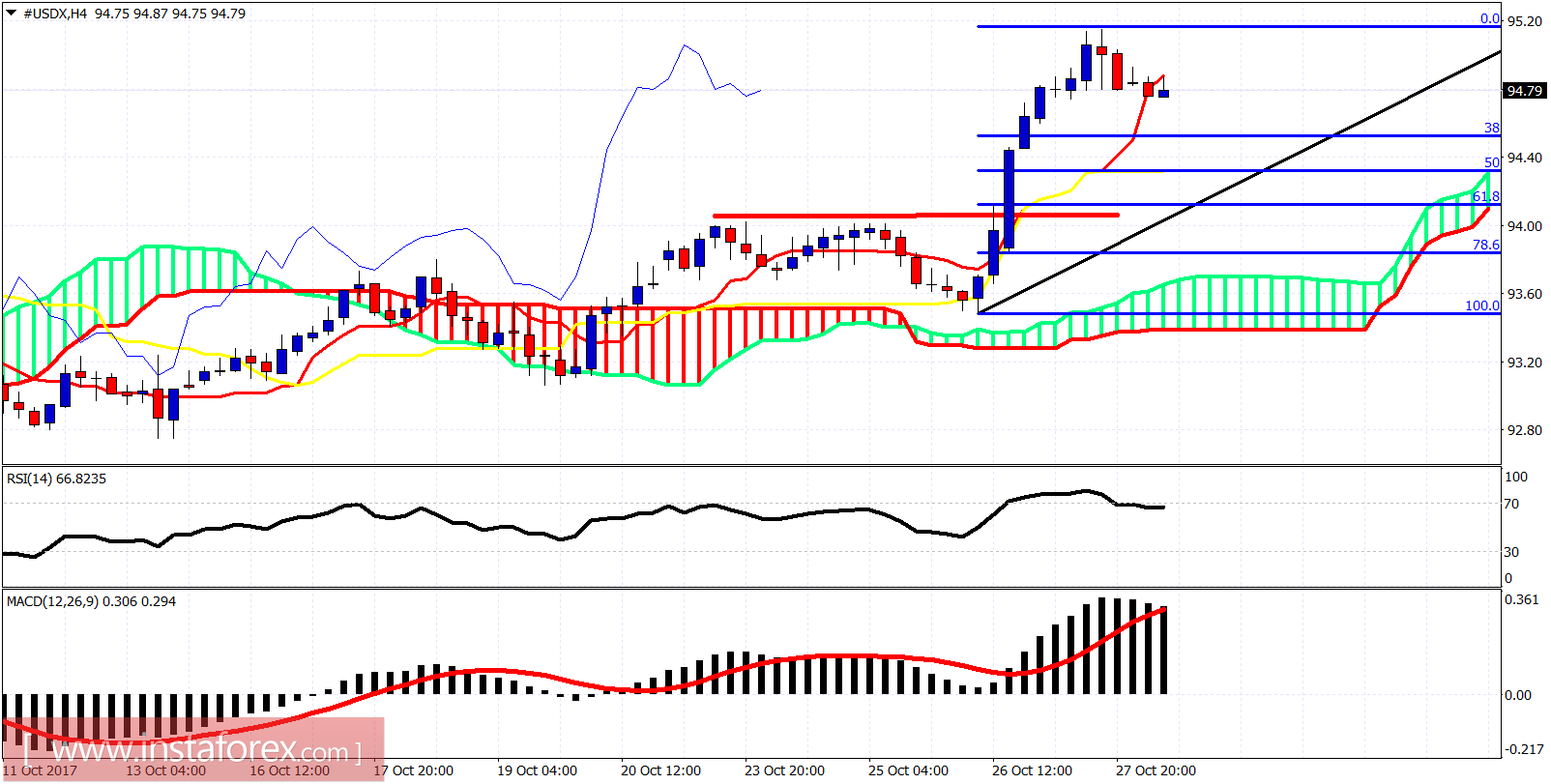

The Dollar index is trading above the 4-hour Kumo (cloud) support. Price has not even pulled back towards the 38% Fibonacci retracement of the latest rise. This confirms the strength of the uptrend. Short-term support is at 94.50 and next at 94.10 the previously broken resistance.

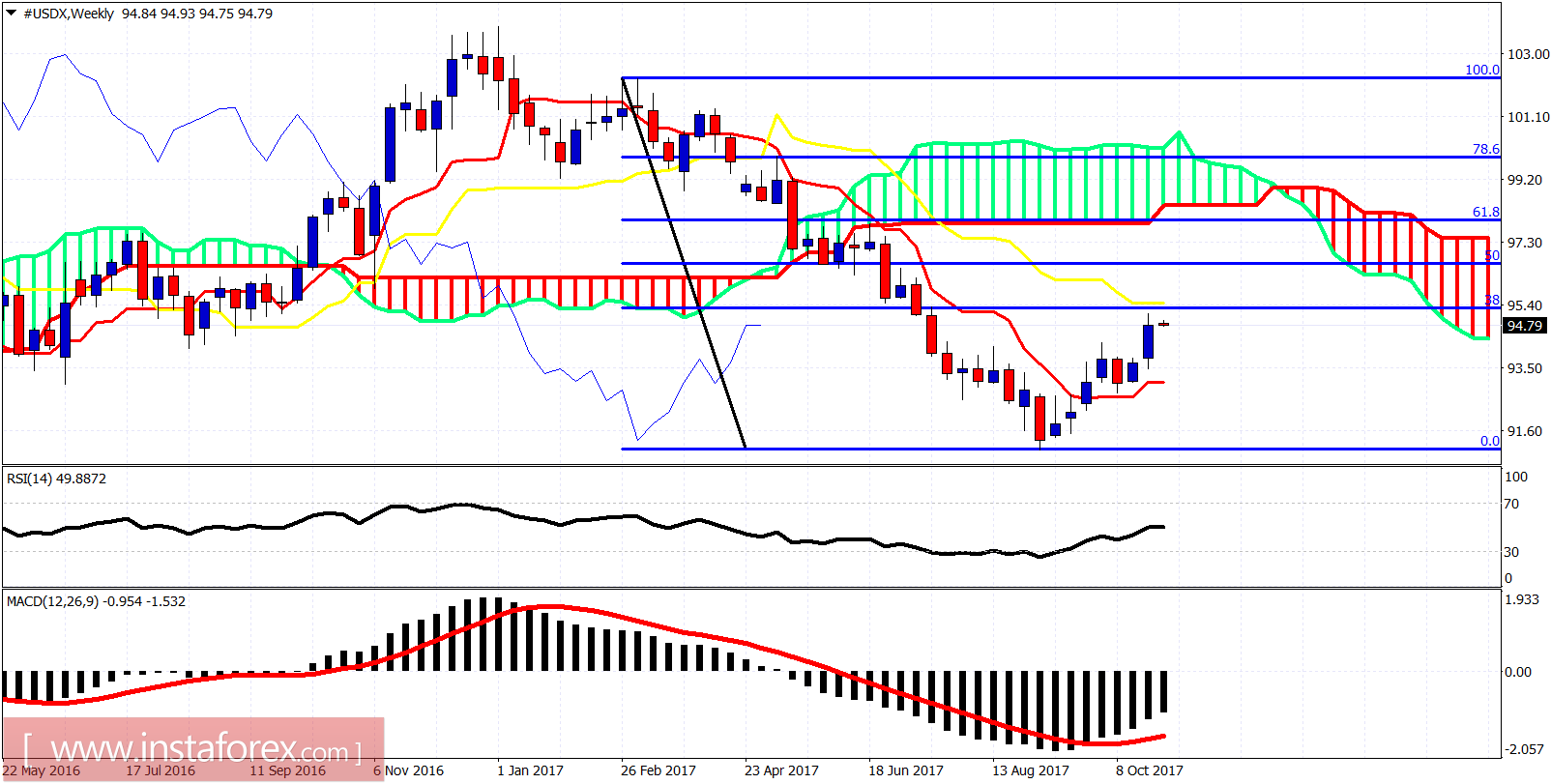

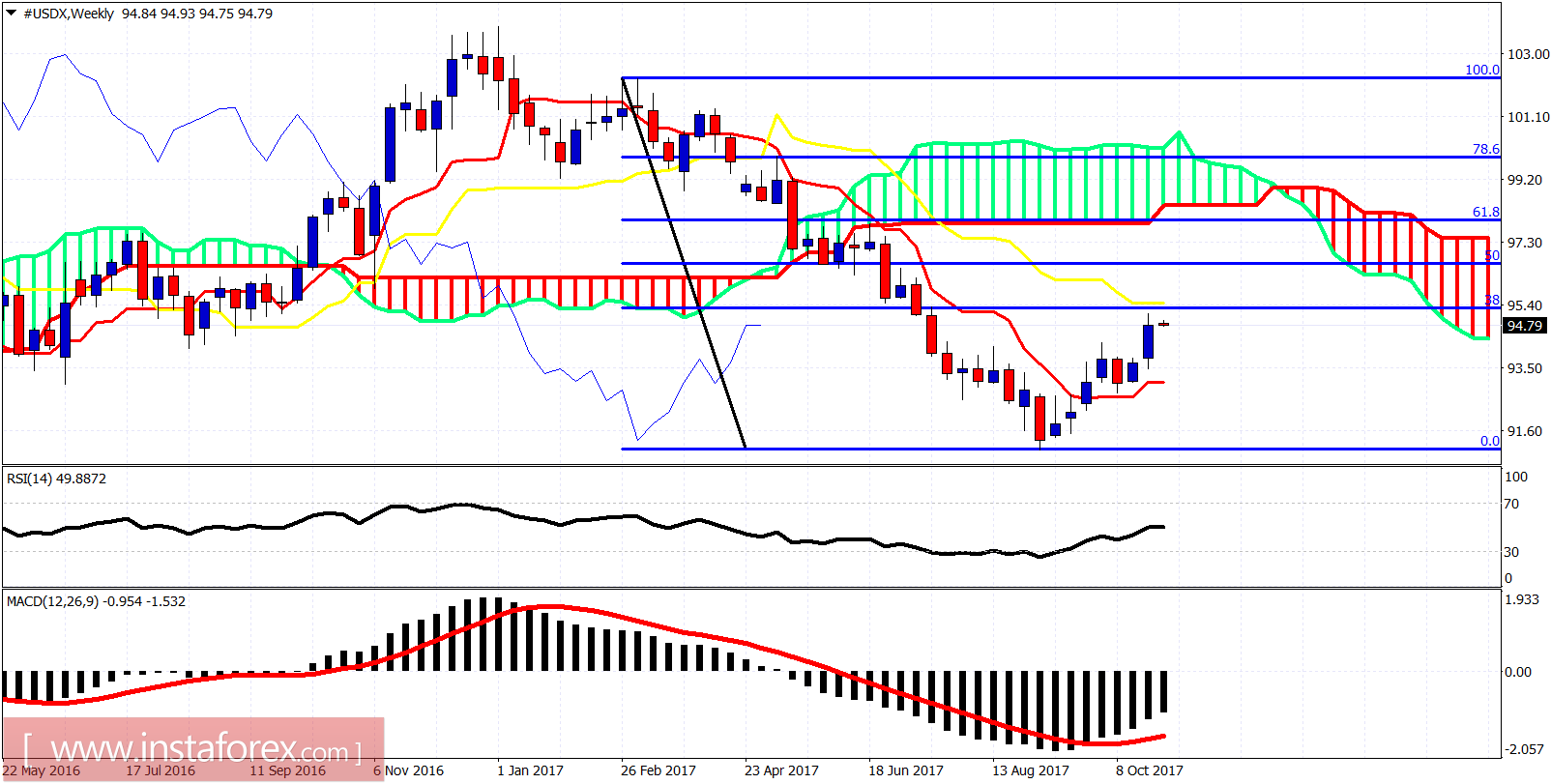

On a weekly basis, the trend remains bearish as the price is below the weekly Kumo (cloud). The kijun-sen (yellow line indicator) resistance is at the same level with the weekly 38% Fibonacci retracement at 95.40. I expect this level to be tested and price to get rejected in order to resume the longer-term downward trend towards 88-90.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română