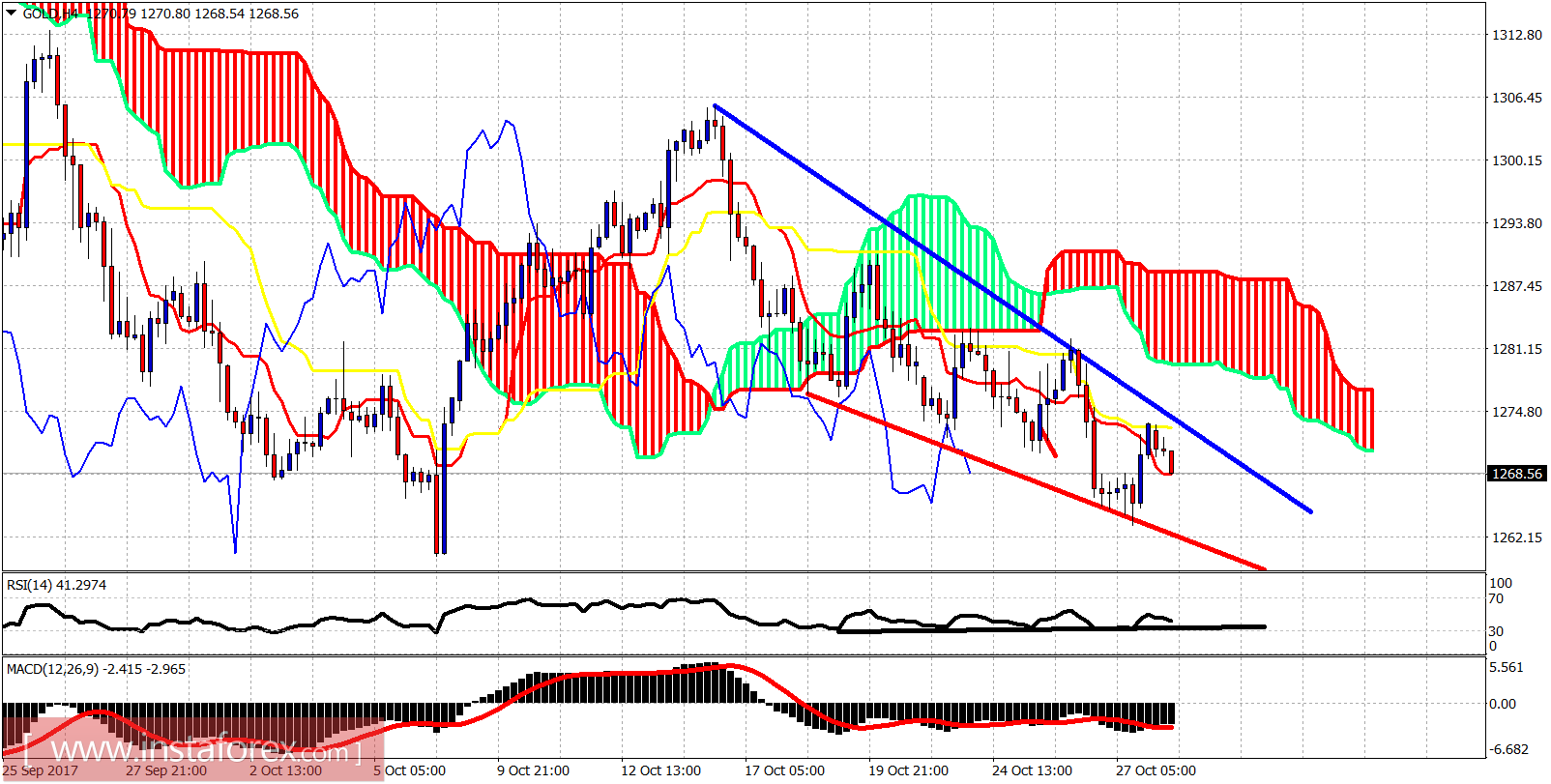

The Gold price remains in a bearish trend at least in the short-term. Price continues to make lower lows and lower highs below the Kumo (cloud). A move towards $1,260-50 is not out of the question as long as we trade below $1,283.

Blue line - resistance

Red line - support

The Gold price is trading below both the tenkan- and kijun-sen indicators inside a downward sloping wedge pattern. Resistance is at $1,275 and next and more important at $1,283. At $1,290 we have the resistance that if broken we have a confirmation of short-term trend change to bullish. Until then the trend is bearish.

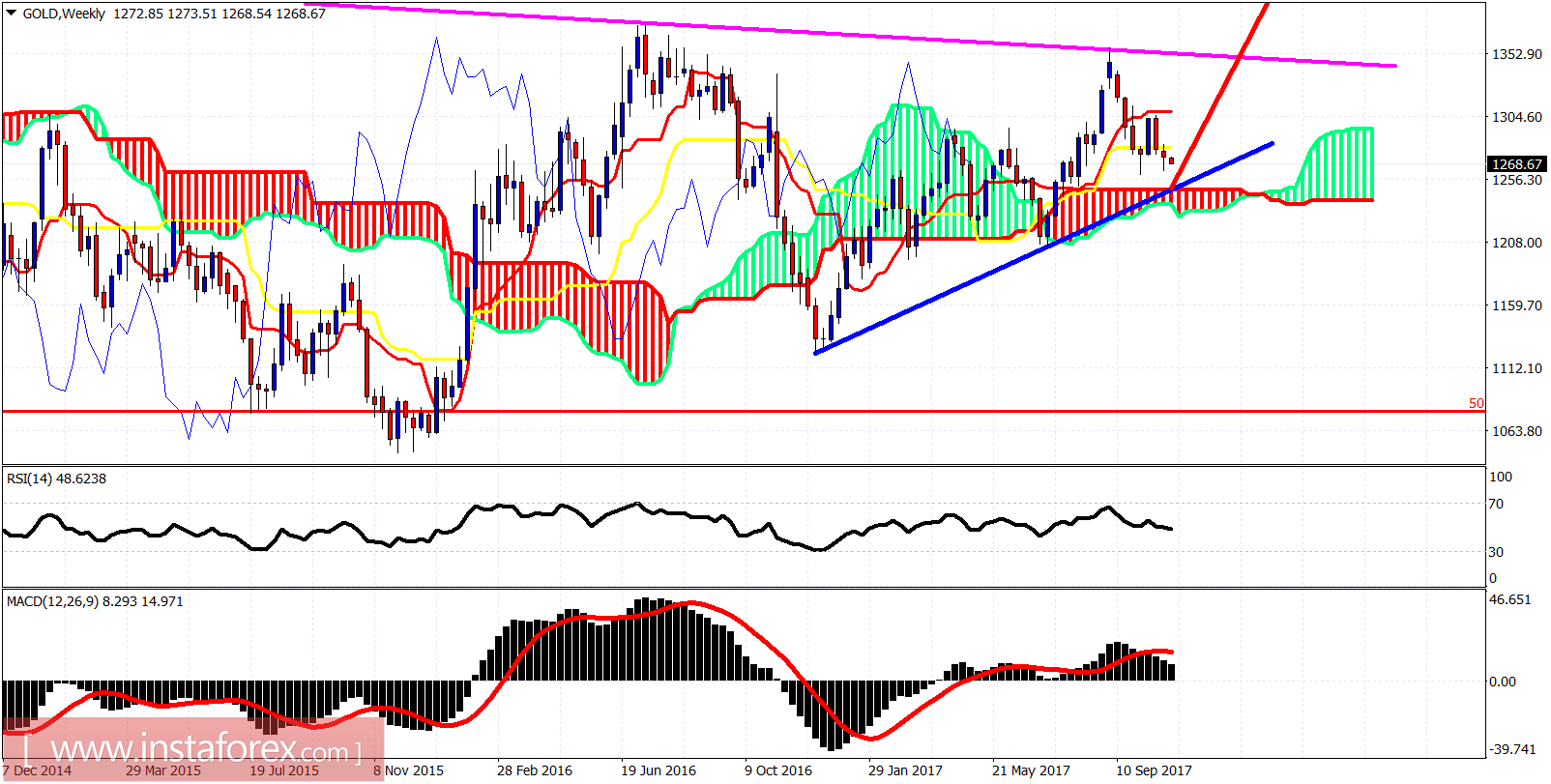

Blue line - long-term support

Magenta line - long-term resistance

Red line - expectation

Gold price is heading towards the weekly Kumo (cloud) and the blue trend line support. There are a lot of chances we go towards that area of support before resuming the uptrend. This scenario is valid as long as we trade below $1,283. If $1,283 is broken upwards then we could say that the decline is most probably over. Only above $1,315, we can be sure that we will not see a lower low.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română