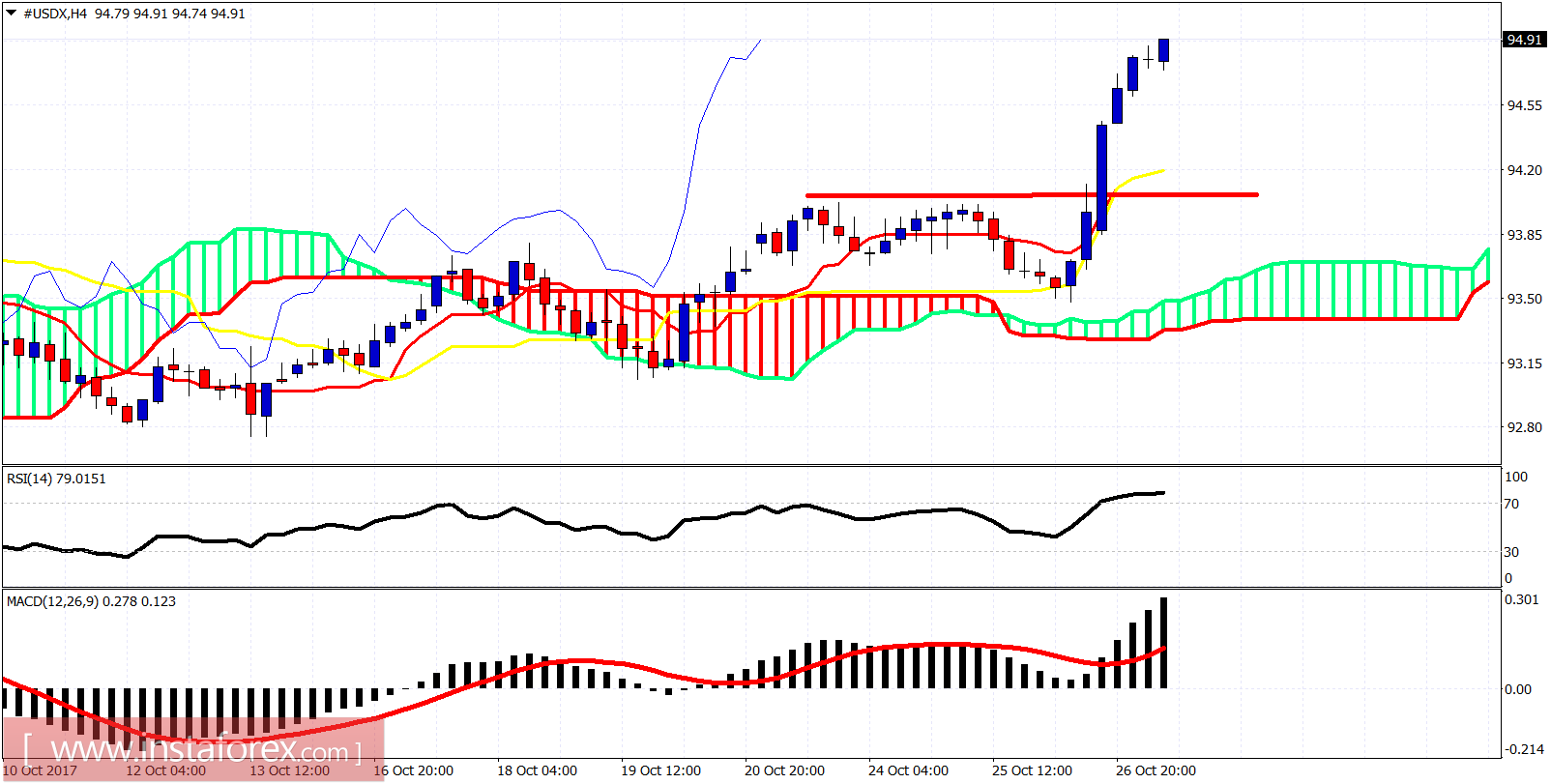

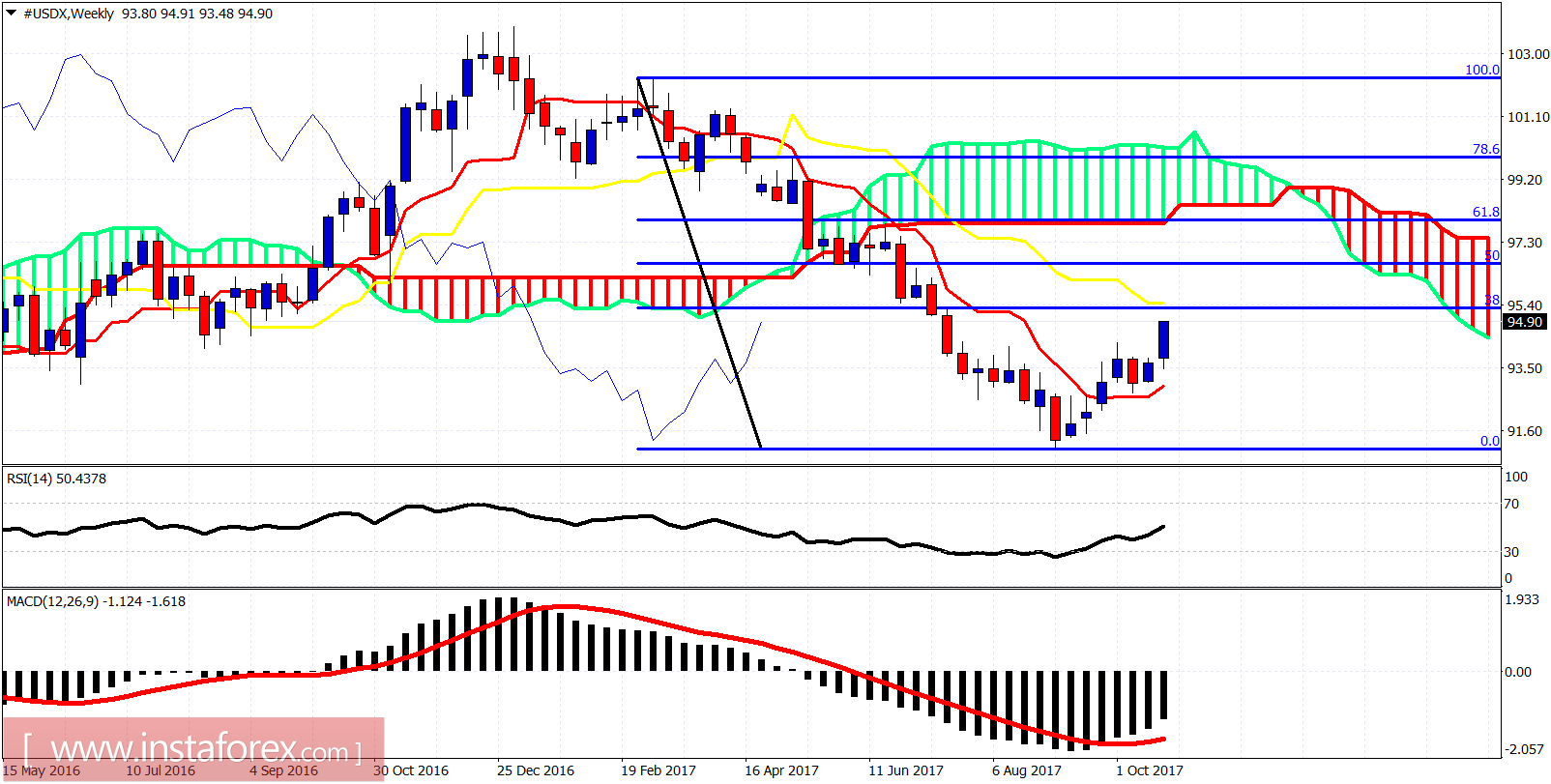

The Dollar index is breaking to new higher highs as it remains in a bullish short-term trend. We might see a pullback but I give little chances that the upward move from 93.50 will end soon.

Red line - resistance

As we said yesterday, a break above recent double top at 94, would be a bullish sign and the index would first move towards 94.50 and next towards 95. The first target has been achieved. We also said yesterday that as long as the price is above 93.50 trend remains bullish in the short-term. Short-term support can also be found now at 94.10-94 area where the previously had our important resistance level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română