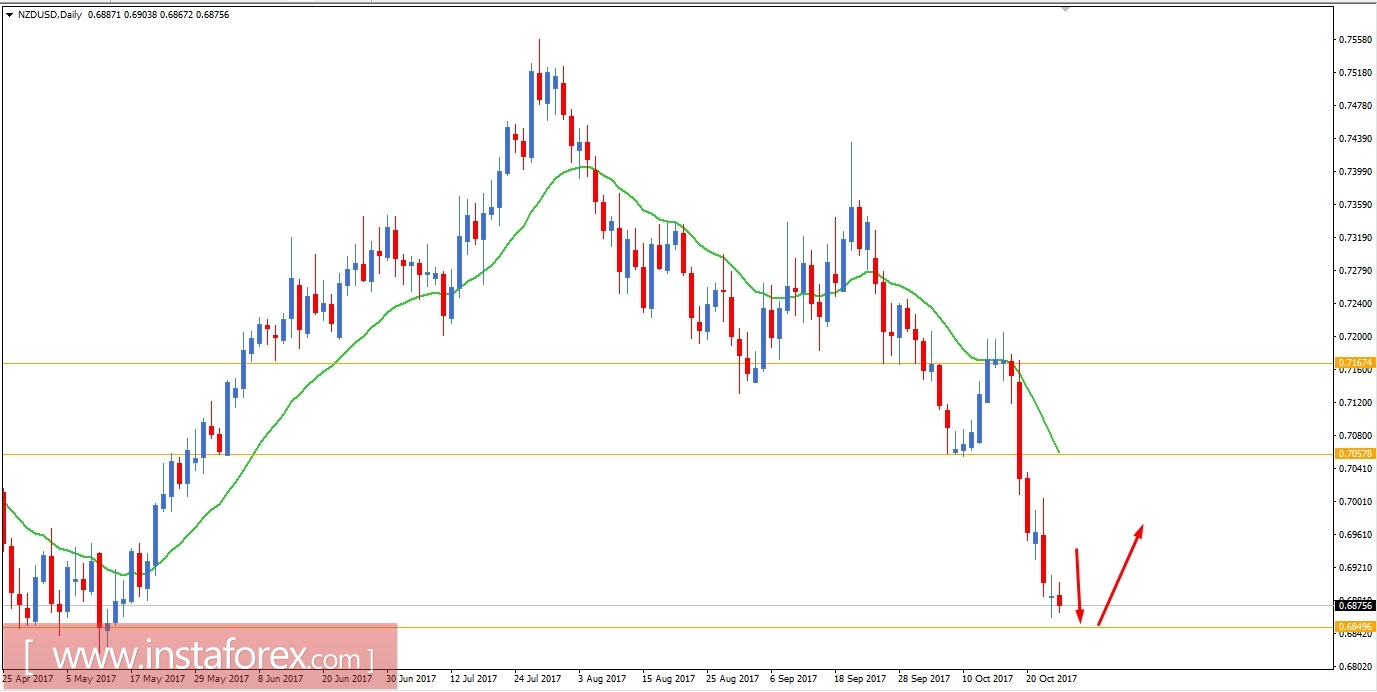

NZD/USD recently rejected 0.7170 resistance area which leads to impulsive bearish pressure in the market taking the price lower towards 0.6850 support area. NZD has been quite negative with the economic reports recently which helped the USD to gain impulsively on the bearish side towards the support area. Yesterday the market was quite indecisive, and some bullish interference was observed in the market. Today NZD Trade Balance report was published with deficit greater than expected at -1143M was expected to be at -900M which previously was at -1179M. The worse report did affect the gain of NZD today and resulted to further bearish pressure in the pair which is expected to fall for a certain point before it shows any bullish intervention in the process. On the USD side, Today Unemployment Claims report is expected to show an increase to 235k from the previous figure of 222k, Goods Trade Balance report is expected to show a greater deficit at -63.8B from the previous figure of -62.9B, Prelim Wholesale Inventories report is expected to decrease to 0.4% from the previous value of 0.9%, Pending Home Sales report is expected to show a positive shift to 0.2% from the previous negative value of -2.6% and Natural Gas Storage report is expected to published wish an increased figure of 61B from the previous figure of 51B. To sum up, NZDUSD is currently residing at the edge of the support area of 0.6850 whereas we might see some correction around the area before price bounces off the level and shows some bullish pressure or else if NZD keeps weakening against USD in the coming days and USD comes up with high impact positive economic reports or events then we might see further bearish pressure in this pair in the future. As of the current scenario, USD is expected to have an upper hand over NZD in the future.

Now let us look at the technical view, price is currently residing just above the support level of 0.6850 whereas the dynamic level of 20 EMA is quite far away from the current price. Currently it is expected that the price will bounce off the 0.6850 support level towards the dynamic level of 20 EMA and if the dynamic level could hold the price downward as resistance then we will be later looking forward to sell in this pair. As the price remains below 0.7050 level and dynamic level of 20 EMA the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română