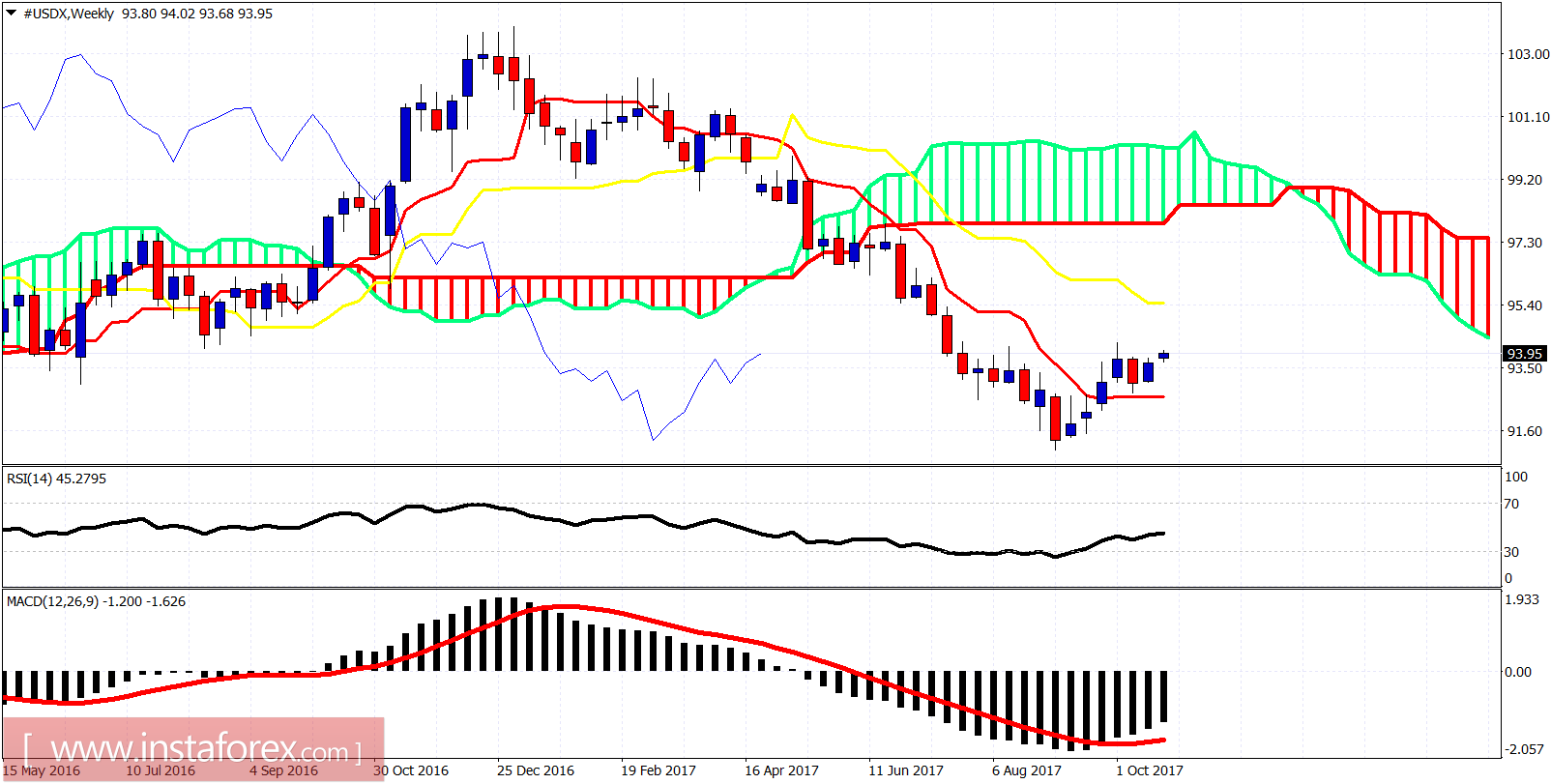

The Dollar index is back near its highs just below 94 but with RSI diverging, I believe we will not break convincingly above 94. I expect at least a short-term pull back towards 93.50 at least. The trend remains bullish.

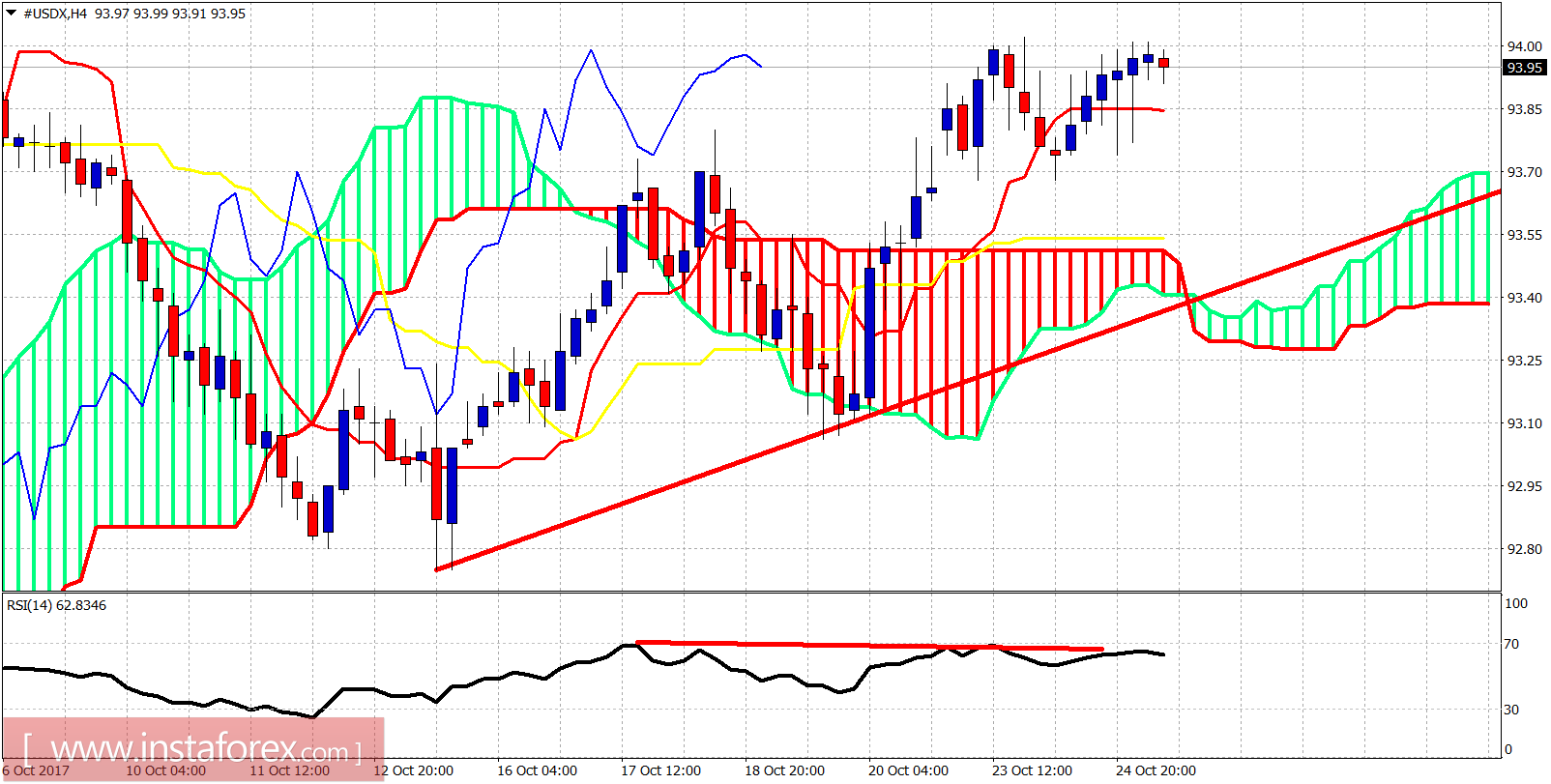

Red trend line -support

The Dollar index is making higher highs and higher lows. Short-term trend is bullish as the price is above the Kumo (cloud) in the 4-hour chart. Support is at 93.55 and next at 93.40. Resistance is at 94.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română