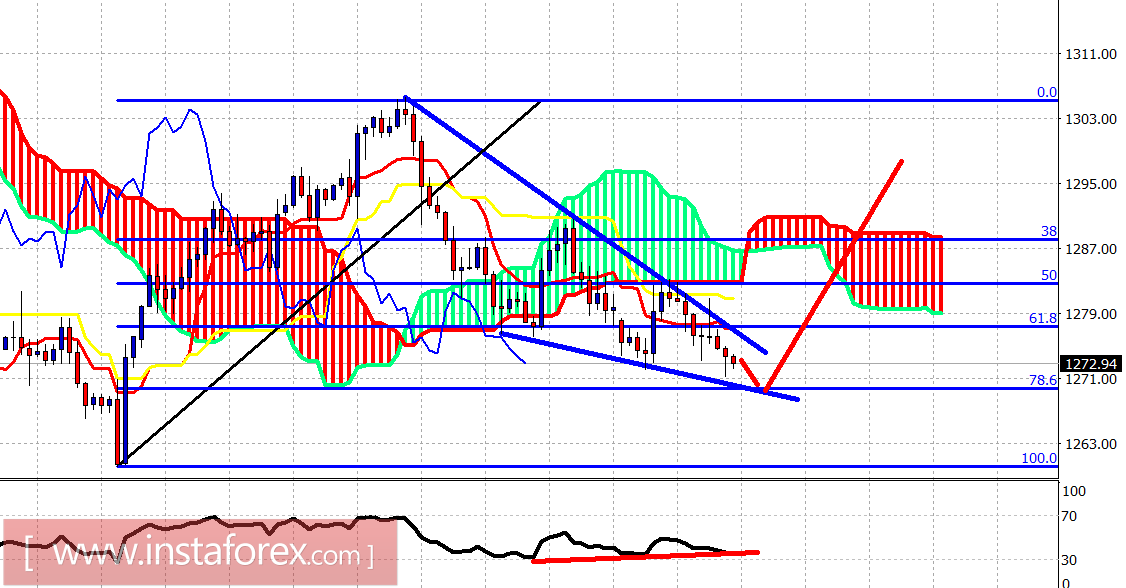

The Gold price has made new lows earlier today but the oscillators are not following to new lows. The trend remains bearish. There is a bullish wedge pattern in play, and a breakout should signal the start of the next upward leg.

Blue lines - downward sloping wedge

Red lines - expected price path

Gold price is heading towards the lower wedge boundary and the 78.6% Fibonacci retracement. Gold price is expected to touch the trend line and reverse higher. The RSI is diverging and we should soon see an upward reversal. Resistance is at $1,283 and next at $1,290. Support is at $1,271 and next at $1,263.

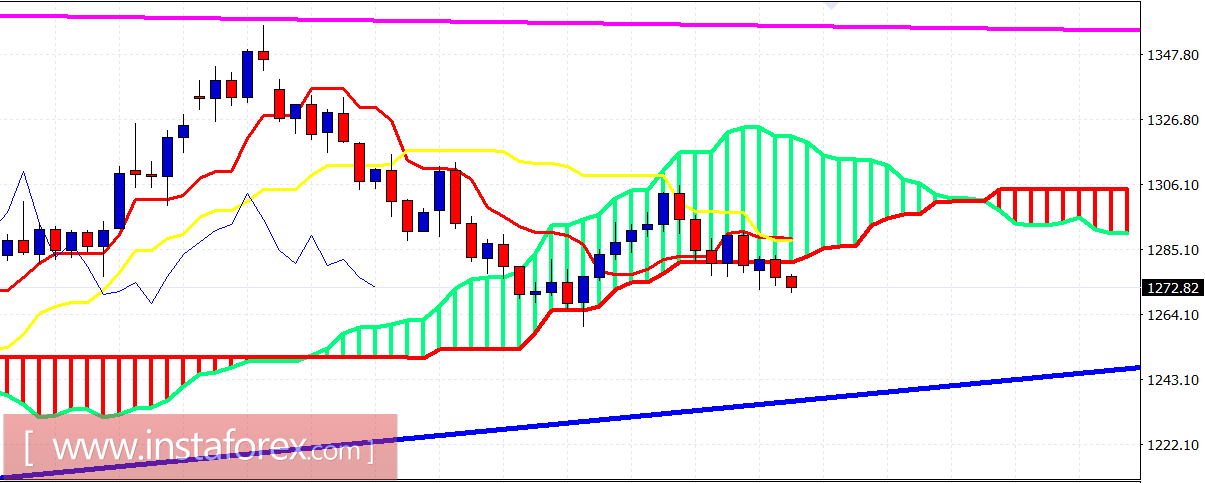

On a daily basis, the trend is now bearish as the price has broken below the Ichimoku cloud. Resistance is at $1,280-85 where the lower boundary of the Kumo is found. Next important resistance is at $1,290. For Gold to be on a bullish trend again, the price must break above the cloud resistance at $1,315. Important longer-term support is found at $1,245-50 where the longer-term blue trend line comes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română