The Bitcoin (BTC) has been trading downwards. As I expected, the price tested the level of $5.527. Banks such as Barclays and HSBC retain some cryptocurrency business, though reluctantly. Citing money laundering and general criminality, HSBC said it's "monitoring the development of virtual and digital currencies such as bitcoin as well as regulations governing their use," continuing it has a "very limited appetite to bank issuers or dealers in virtual currencies," Financial Times quotes the bank. The intraday technical picture looks bearish.

Trading recommendations:

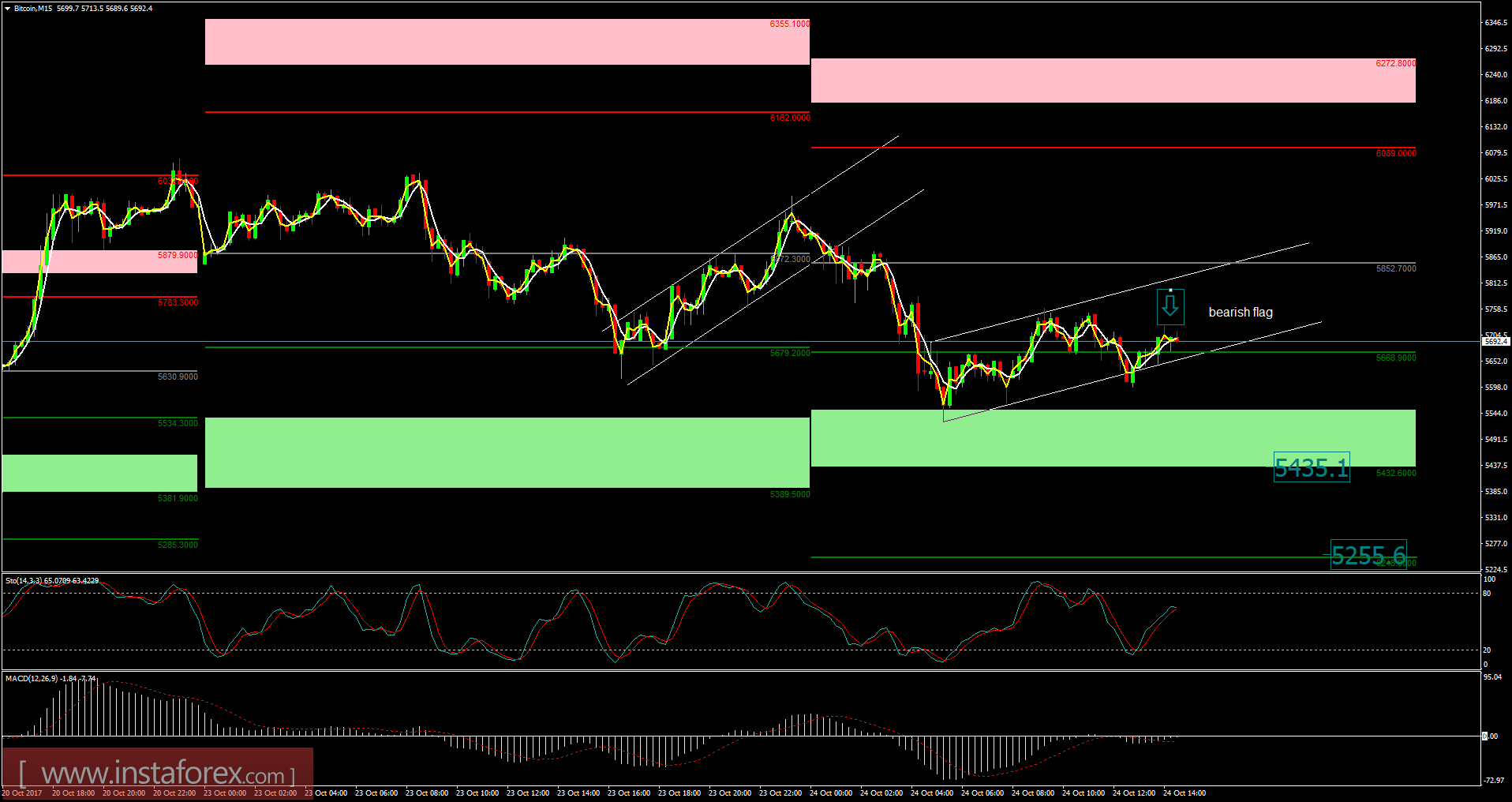

According to the 15M time frame, I found a bearish flag in the creation and broken pivot level at the price of $5.852, which is a sign that buying looks risky. My advice is to watch for a potential breakout of a bearish flag to confirm further downward continuation. Downward targets are set at the price of $5.435 (S2) and $5.255 (S3, extreme intraday target)

Support/Resistance

$5.852 – Intraday pivot level

$6.089 – Intraday pivot resistance 1

$5.435 – Intraday pivot support 2

$5.255 – Intraday pivot support 3

With InstaForex, you can earn on cryptocurrency's movements right now. Just open a deal in your MetaTrader4.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română